What do you think was the biggest factor to the pre-pandemic bull market?

It’s a question I’ve been asking myself recently.

If you go purely by the stats, then the logical answer has to be the FAANG stocks. This cohort of the US’s biggest tech stocks — Facebook (Meta), Apple, Amazon, Netflix, and Google (Alphabet) — have defined Wall Street’s success since 2009.

You could, of course, include a few more names in that list today, like Microsoft and Tesla, but the point still stands. Big tech has been the big driver of stock market returns.

Does that make them the most important factor for the bull market, though?

I think there’s a strong argument to be made that these tech stocks, as profitable as they are, owe a lot of their success to one common theme: China.

See, this tech boom of the past 15 or so years has relied heavily on China’s relatively cheap and plentiful market for digital devices. I’m talking about things like smart phones, laptops, tablets, smart watches, PCs, and much, much more.

And the reality is, without China’s manufacturing dominance, a lot of this tech would be harder to get a hold of. More than 40% of all digital devices made come from China!

For context, second highest on this list is Mexico — with just an 8.7% market share.

Without China, who knows whether tech would have been as prolific as it is today.

Which begs another question, who will replace them once their growth begins to slow?

A new era requires a new growth engine

The fact of the matter is that the era of ‘peak China’ is looking like it’s coming to an end.

What I mean by this is that the glory days of rampant growth and incredible productivity are likely behind us. That doesn’t mean the Chinese economy or market are going away, just that it has plateaued like any other major economy in modern history.

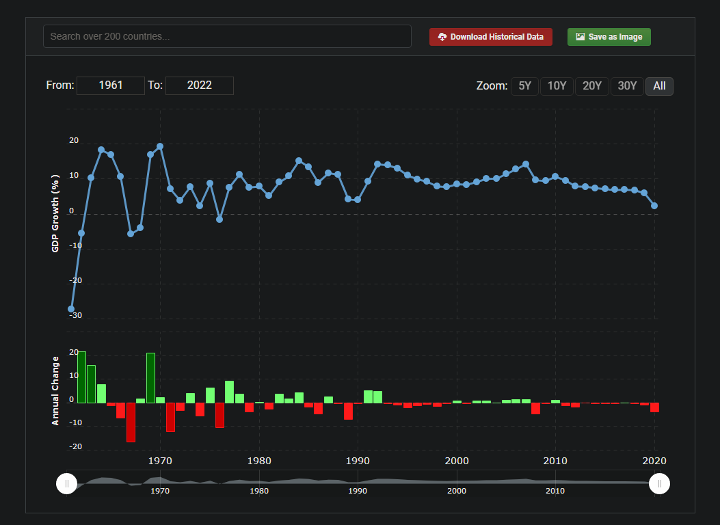

You can see this for yourself in the long-term chart of its GDP growth rate:

|

|

|

Source: Market Watch |

The seemingly limitless growth of recent years is slowing. China’s economy is simply becoming too big to sustain its exceptional past performance.

Because of this, China’s title as the ‘world’s factory’ is now under threat. The need for cheap and efficient labour just isn’t as readily available as it once was.

Trump’s trade war and the pandemic certainly didn’t help alleviate this issue either. The global economy has endured a rocky couple of years as the West’s relationship with China has deteriorated.

For all these reasons and more, the future of global manufacturing is shifting.

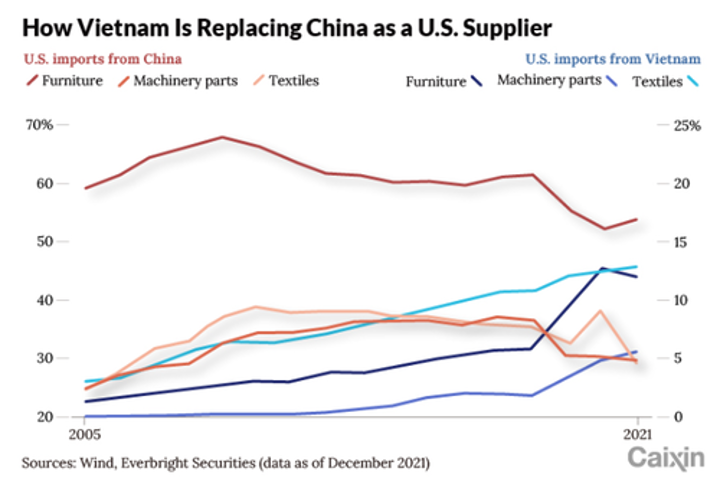

China is slowly being squeezed out by new suppliers to the West. The APAC region, in particular, is quickly emerging as the next big supplier of goods. And nations like Vietnam are leading the way:

|

|

|

Source: Zero Hedge/Caixin |

For investors like yourself, this is one of the biggest trends to keep an eye on.

Over the course of this decade, we’re likely to see a major economic shift to these new Asian powerhouses. Vietnam is already booming as the rest of the world struggles with slowing growth.

GDP recently peaked at 7.72% in the second quarter for Vietnam. That’s the biggest quarterly expansion of their economy in more than 12 years. And I expect it’s just a taste of the even bigger surge that’s likely to come.

We’re witnessing the beginning of an economic boom like that of China in the early 2000s…

How to prepare for the APAC boom

Back in April I covered the big developments shaping up between Australia and India. You can read all about that here, if you’d like.

The point I want to stress right now is that I believe the whole APAC region is likely to thrive. And right now, the biggest winners are looking likely to be Vietnam and India.

For example, a quick look at recent share market performance will tell you all you need to know.

Here are three charts showing the 10-year performance of the Shanghai Composite (China), the VN Ho Chi Minh Index (Vietnam), and the BSE Sensex Index (India) in that order:

|

|

|

Source: TradingView |

|

|

|

Source: TradingView |

|

|

|

Source: TradingView |

The difference in performance between China and the other two since the pandemic sell-off of early 2020 is staggering. And yes, while both Vietnam and India’s markets are far smaller, it’s the general trend of the markets that is important.

Like I was saying, this is a boom that’s just starting to unfold like it did back in the day for China.

For local investors like yourself, this is why you need to be paying attention. Having said that, it’s not like I’m suggesting you need to directly invest in these emerging stock markets. All I want you to do is keep an eye out for local listings with exposure to these economies.

Right now, those potential avenues are few and far between.

But that will change in time. Just like it did with our relationship with China.

And in 10 years’ time, when we look back on the next bull market, we might be able to say we knew the biggest factor for it before it even happened…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: If you’re looking for a more immediate boom, then the battery metal trend is also one to watch. Our resident lithium expert, Callum Newman, has been following this story for a while now, and he’s found a great way to pick potential winners — or, as he likes to call it, identifying ‘Elon’s Chosen Ones’.

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.