Will doomers get it right for a change?

Is everything about to head down the drain?

It does appear that the developments over the past month are pointing to that possibility.

The Federal Reserve raised rates by another 0.75% last Wednesday. And the markets tumbled further on the news.

Most stock markets are now approaching the lows we saw back in June this year, when the world woke up to the fact that inflation is now roaring hard and that there would be tough times ahead.

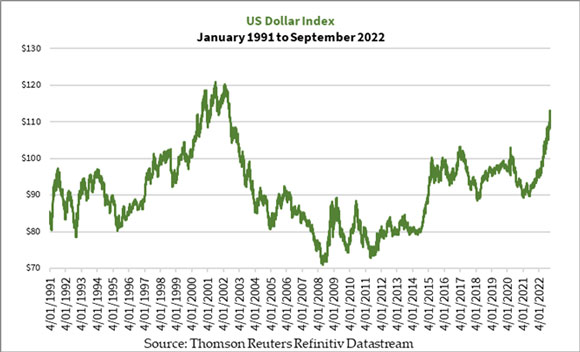

The US Dollar Index [DXY], a proxy for how much the US dollar is worth by comparing it against other major world currencies, is now rising further. It’s at the same levels as it was in 2002, as you can see in the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

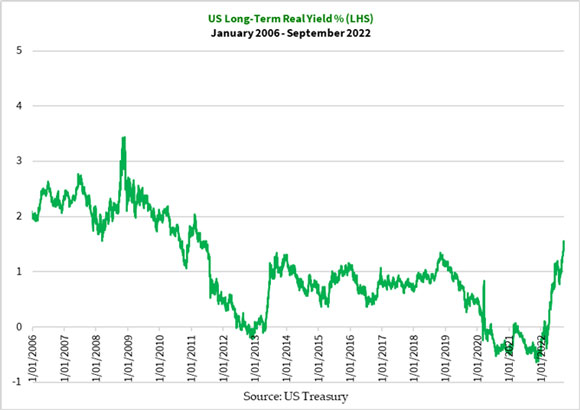

And the long-term real yield for US Treasury bonds sits at 1.55%, as of last Friday. This hasn’t been seen since 2011. You can have a look below:

|

|

| Source: US Treasury |

Notice how sharply things have turned around since late last year when the market took seriously the central bankers’ warning that inflation will linger for longer and that they’re finally ready to act? It was only at 1.2% three months ago, and the Federal Reserve tried to ease the market in the July meeting by tempering its language.

Even my preferred asset of protection against the financial and economic storm, gold, has had a rough ride.

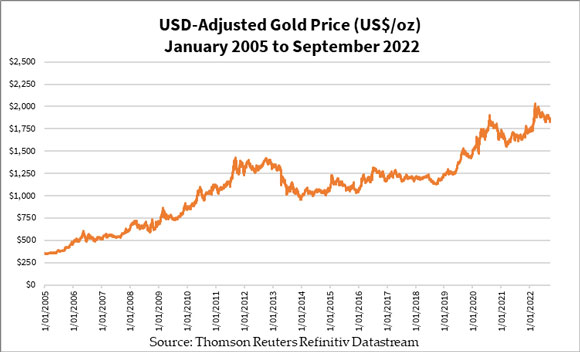

Going by what they report in the news, gold is down even more as it closed last Friday at US$1,644 an ounce. The last time it traded this low was in April 2020, as you can see here:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

It looks like even gold can’t face the irresistible onslaught of the central bankers’ monetary policy hammer.

I have a feeling they’re about to really put the pedal to the floor…

Another storm…but how bad will this get?

Doomers haven’t had it good the last decade.

They’ve called for an economic collapse for a long time. The closest they got was back in March 2020, and then again just over three months ago.

They’re used to people mocking them for getting it wrong. After all, isn’t it true that ‘a broken clock is correct twice a day’ or ‘eventually they’ll get it right if they don’t change their view’?

Bagging out a doomer is like a sport now.

The irony is that those participating in this may be smug about it, but they fail to realise that the only reason doomers have been wrong for so long is that the illusion has simply rolled into a bigger and bigger snowball.

How big can a lie get before it blows up?

That’s the part that’s stumped the doomers yet also lured in many who are happy to ride along with the central bankers.

After all, it seems like each market collapse in recent memory has resulted in a bigger rally thereafter. It looks like someone is playing backstop and keeping things going just that much longer.

That’s if you only focus on the market indices, the economic figures the government and media tell you about, and you’ve been happy-go-lucky with your job and investments.

But when the governments and central banks are warning about costs continuing to rise and to expect tough times ahead, maybe it’s time to step back and wonder if they’ve now run out of tricks to keep this illusion going.

Or if you are like me, you’re wondering if this is the time when they enact the second part of their plan, which is to blow up the markets so they can rebuild it for their benefit.

Things are very challenging right now. And it might get worse.

The crippled supply chain has caused inflation to hit hard on households trying to make ends meet, as well as businesses seeking to operate profitably.

Higher interest rates are slowing down business activity, placing pressure on households weighed down by debt, and causing asset prices to fall.

The crude oil price has recently eased off and may provide short-term relief to the economy.

Or will it?

After all, the cause of this is due to the Biden Administration depleting the Strategic Petroleum Reserve (SPR) to create the illusion that oil supply has increased after closing many oil and gas fields or cancelling leases. Another is that many cities in China faced lockdowns and hence industrial demand slowed down.

This illusion could dissipate after the 20th Chinese Communist Party Plenary Summit (scheduled on 26 October) and the US mid-term elections (8 November).

So expect a rising crude oil price to return with a vengeance by year-end. The Biden Administration has announced that it could start to refill the SPR soon given that crude oil is now less than US$80 a barrel.

If you ask me, the game of keeping crude oil prices down is more political than economic. Much like the facemask and vaccine mandates to control the spread of the virus.

And should the Biden Administration actually follow through with its plan, things are going to get just that more chaotic given the Northern Hemisphere is heading into winter. Demand could overwhelm supply and not only will we see the price go crazy, but expect that to hit the actual physical supply around the world.

A reliable cover for this upcoming storm

So all is lost now, isn’t it?

Central banks appear to have the upper hand.

The global supply chain is in tatters, and the fools who run the system are going to screw people further when the price of crude oil resumes its rally by year-end.

And markets are going to tumble.

But you know me well. I believe, amidst the doom and gloom, there are opportunities and places to take refuge.

The official story on gold is only half told.

Let me tell you the other half.

Check out how the intrinsic value of gold has fared in the figure below, taking into account the rising US dollar in recent times:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

You won’t hear it from the news as they won’t report this, but you can see how gold is holding its ground solidly.

Gold is clearly gaining favour in the current markets, especially outside of the Western world.

I hear rumours that Russia and China are further gaining speed on taking a more dominant position in the global gold market.

This is a good time to get ahead of the crowd, so why not consider buying some physical bullion?

A sail is just what you need right now as the storm winds gather once more!

Regards,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments