The late Chinese leader Deng Xiaoping once said ‘a cat that catches mice is a good cat, regardless of whether it is white or black’.

I want to take that statement and play around with it.

‘A good banker stabilises the economy and brings confidence to the markets, regardless of whether they raise or lower interest rates.’

It’s funny that there are more good cats than good bankers!

In the first week of May, central banks frantically rose rates in a vain pursuit to control inflation.

The Reserve Bank of Australia announced on Tuesday that it would raise the 24-hour cash rate by 0.25%. The market expected a 0.15% hike. So now the official level sits at 0.35%.

In an unscheduled meeting, the Reserve Bank of India also raised rates by 0.4% on Wednesday, bringing up their official rate to 4.4%. It cited this surprise move as recognition of inflation, highlighting its view to begin winding down its balance sheet.

The most awaited move was, of course, the US Federal Reserve. The markets had braced themselves for a possible shock rate hike of 0.75%, which explains the heavy selling wave in the broader markets over the past fortnight.

To the relief of market investors, the Federal Reserve raised rates by 0.5%, in line with the market’s initial expectations. The Federal Open Market Committee (FOMC) also announced it would begin to reduce its balance sheet on 1 June by selling treasury notes and mortgage-backed securities at a rate of US$47.5 billion a month. This will increase to US$95 billion a month over the three months thereafter.

These moves — particularly the balance sheet reduction — sound quite daunting. But they seem as timely as cleaning up the kitchen after the cockroaches and mice have had their feed.

What’s more interesting is the market’s response in the hours after the Fed announced its stance.

The Federal Reserve raises rates, the market laughs it off again

Those who took a bearish position lost big on their bet regarding the Federal Reserve and how the markets would react afterwards.

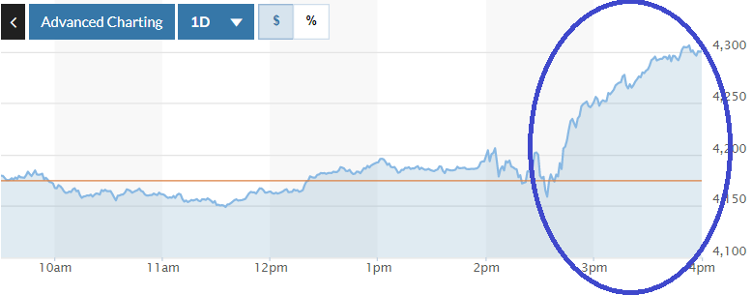

The S&P 500 Index rallied almost 3% and experienced its biggest surge on a day that the Fed raised rates since 1978!

|

|

|

Source: MarketWatch |

The Nasdaq Index, which had been on a bearish run, gained more than 3%:

|

|

|

Source: MarketWatch |

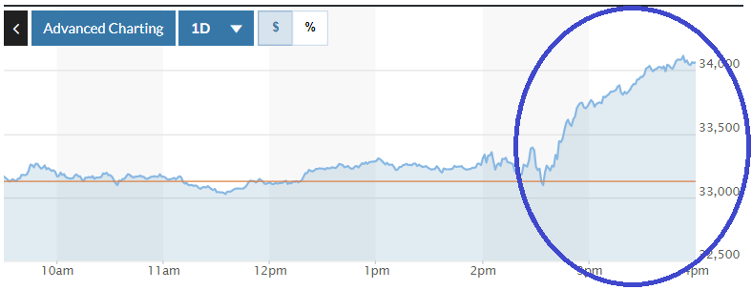

The Dow Jones Index rose more than 900 points, or 2.81%, at market close:

|

|

|

Source: MarketWatch |

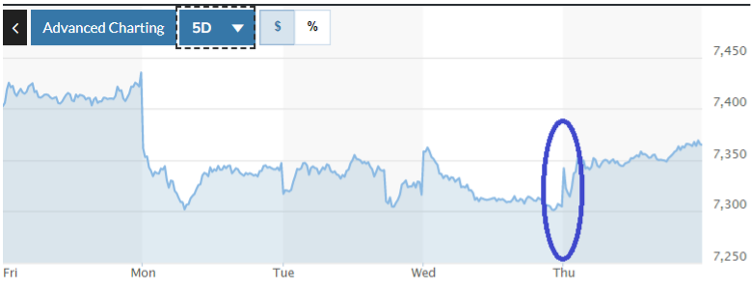

Meanwhile in Australia, the ASX 200 Index gained almost 1%:

|

|

|

Source: MarketWatch |

Let’s just say that the Federal Reserve undershot with their ‘aggressive’ rate hike.

The markets laughed off the 0.25% rate hike in mid-March. The same thing happened this time.

Better luck next time, bankers!

Will the illusion of the central bankers prolong or bring forth the inevitable?

Markets may be staging a strong relief rally on the back of the Federal Reserve missing the mark on their objectives to rein in inflation.

However, I’m wary of what’s been developing, and I think you should be too.

Avoiding the conspiratorial part of this being a plan to collapse the market and bring upon the World Economic Forum’s ‘The Great Reset’ agenda, it seems like there’s cause to believe that the Fed isn’t accidental in what it says it’ll do and the pace at which it achieves it.

My guess is that the Federal Reserve is talking in a hawkish manner to prime the market into getting used to the upcoming tightening cycle. And it will follow through with action that’s more dovish.

This type of psychological conditioning is delicate. However, it only works for a short time. And it’s less likely to work when the one to use this technique has very little credibility and/or competence.

On credibility and competence, it’s safe to say that the Fed (and central banks for that matter) lacks both. I’m not being harsh in saying this.

Look at its track record.

The Fed has been raising rates when inflation takes off rather than maintaining its own mandate in controlling inflation. Furthermore, the persistently low interest rate environment has lingered for more than a decade…since the subprime crisis. The solution that the FOMC presents is the possibility of negative interest rates!

The only reason it’s raising rates is because there’s no way to put the inflation genie back in the bottle, and the weight of debt in this dysfunctional financial system threatens to smother society.

As you know, low interest rates beget more borrowing. More borrowing can increase the chance of malinvestment, where resources are allocated to unprofitable ventures. The failure of such ventures leads to wasted resources, which causes productivity to fall below the growth of currency spanning from these business loans. It is a vicious spiral.

Central banks are now facing the beast it raised and fed. And the approach they propose is to feed the beast some more.

It’s possible that central banks could accelerate their tightening in the subsequent months to get over the tipping point. Think of the possibility of a 0.75% or 1% rate rise that causes the Federal Funds Rate to rise above 2%, or more than that.

The tipping point may not be known or apparent now. One thing for certain is that it’ll be much lower than the past, owing to the sheer amount of hot money and speculative capital that flows around the system.

Remember that no one rings the bell at the top.

And central bankers are now bent on achieving their objectives. It doesn’t help when the markets are trading as if they are taunting them every step of the way in each rate decision.

I’ll pound the table again to remind everyone how gold is clearly a safe haven.

Do you have some for the chaos that’s coming?

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia