In today’s Money Morning…from cash is trash to a huge cash splash!…the Cantillon effect…the last decade of financial markets has shown us that…and more…

Markets are in a bit of no man’s land right now.

While the charts show most major indices are still within a stone’s throw of all-time highs, rising bond yields have made investors a bit skittish.

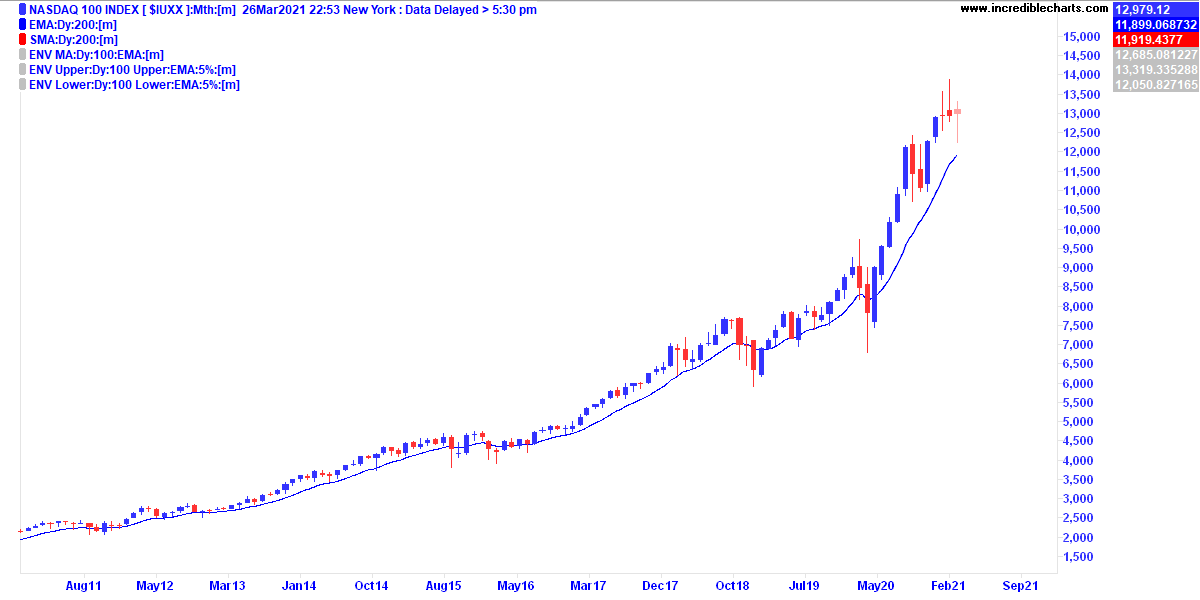

That nervousness has shown up mostly in speculative sectors like the tech-focused NASDAQ Index.

|

|

|

Source: Incredible Charts |

There’s been a sharp pullback over the last two months, though as you can see on this monthly chart, things aren’t as dire as the tech doomsayers are claiming…not yet anyway.

But markets aren’t about what is, they’re about what will be.

And right now, people are speculating — we are all speculators when it comes to the future — that the era of cheap money is coming to an end.

That’s the rising bond yields I mentioned before. This could be bad news for tech stock investors.

For example, my colleague Greg Canavan has argued strongly that the parabolic rise in big tech was mainly due to them being priced as bond substitutes, due to a world of close to zero interest rates.

[Editor’s note: You can read more of Greg’s insights on this in his ‘Life at Zero’ presentation here.]

That is, they’re priced as yield generating assets due to the amount of steady cash they spit out.

If that’s the case and rates keep rising, then they become less attractive compared to the risk-free rate of bonds and might start to fall in value. Or at least be valued on a more fundamental basis.

Anyway, we’ll see I suppose.

But you can see two similar pullbacks in 2018 and early 2020 where tech investors shrugged off short-term falls.

Who’s to say that won’t happen again?

But what about the central premise that ‘the era of cheap money is coming to an end’?

I’d argue that’s not exactly correct either. It’s just where this money is coming from.

And the implications of this are important…

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

From cash is trash to a huge cash splash!

Just last week the Biden administration announced they are considering a $3 trillion stimulus package for the US economy.

This isn’t just ‘cheap’ money, it’s free money!

That’s the power of being able to print out a global reserve currency at will.

So, who gets this cash?

As the Times reported:

‘…The president’s advisors will bring him a plan as soon as this week that would divide the recovery proposal into two planks. One would put money into boosting manufacturing, improving transportation systems, expanding broadband access and reducing carbon emissions, according to the newspaper.

‘The other would focus on reducing economic inequities through investments in paid leave, universal pre-K and community college.’

Great news if you’re one of the recipients, I suppose.

What about if you’re not?

Well, it’ll boost the economy argue the big spenders of other people’s money.

That might be true in the short term, though I’d argue in the long term, such prolific spending leads to an eventual debt calamity.

Here you go grandkids, enjoy the debt!

But even in the short term, there’s a lot on inequality when it comes to new money entering into an economy.

You see, the order of this new money flow does actually matter to each person, comparatively speaking.

Whoever gets the new money first has an advantage over later recipients, even if all benefit to a degree.

In fact, it was an 18th century French banker called Richard Cantillon who noticed this a long time ago…

The Cantillon effect

In Cantillon’s time gold was money so being near a gold mine brought advantages.

As reported by Matt Stoller:

‘Cantillon went on to discuss how money would flow, basically noting that rich people near the mine would spend it on 18th century luxuries like servants and meat pies, prompting a general rise in prices.

‘Eventually the money would get out to the populace, but until it did, working people would have to pay higher prices without access to the new money that mine owners had. So, there would be inflation, with uneven distribution of purchasing power.’

In our system of money today, it’s not gold mines but governments and central bankers that create new money.

And no matter what political stripes they proclaim to wear, the reality is they end up looking after their cronies first.

Right-wing policies of quantitative easing (where money is given to banks first) and ultra-low interest rates show up in the asset values of share markets and property long before they have an effect on economic growth.

The losers here are basic wage earners with less assets (sorry millennials but it’s nothing to do with avocados).

Left-wing direct spending policies — like Biden’s — reward their favourite industries and pet political agendas directly with a cash splash. Jobs for the boys in other words.

Such an environment inevitably results in the corruption of the political class as different groups fight for government largesse.

Or ‘lobbying’ as it’s euphemistically called.

Either way you can see how this fiat money system of ours ends up being warped by vested interests.

It’s always been like this to a degree but the blatant greed of it has gone into hyper-speed since the GFC in 2008.

The financial industry and its various insiders like to laud themselves as independent arbiters of a ‘greater good’.

They cloak themselves in the veneer of respectability that comes with fancy titles, fancy ties, and international travel allowances.

And yet when the sh!t hits the fan, the ‘rules’ are thrown out the window as they bail themselves out first!

The last decade of financial markets has shown us that.

This reality is why I’m such a fan of bitcoin and cryptocurrencies in general.

Are they perfect?

Certainly not.

They’re still works in progress.

But they remove the need for trusted middlemen — who often end up being corruptible insiders anyway — and create a more level playing field.

The supply schedule for new bitcoin for example — there will only ever be 21 million — is programmed into the system.

No bureaucrat or committee of acronyms can change it.

The financialisaton of the current economy is reaching a tipping point. A world where wealth is decreed by your order on the money tree isn’t a fair one.

In my opinion, cryptocurrencies and blockchain technology will bring us back to a free market for money.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

P.S: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.