Before diving into data on specific birth rates, it’s helpful to take an overview of what’s driving the demographic decline. This phenomenon is global. Almost all developed economies have birth rates below the replacement level. Those countries with higher birth rates are seeing those rates decline sharply. There is a global convergence on birth rates below 2.1, even among countries with higher rates today. What’s driving this megatrend?

|

|

The three biggest drivers are urbanisation, education, and women’s emancipation. Let’s take a look at these separately before considering how the interaction of all three has an amplifying effect.

1. How urbanisation reduces birth rates

Urbanisation is a straightforward variable. It arises from the mass migration of poor agrarian workers to cities, where they can find affordable housing and steady work in assembly-style manufacturing. The housing and working conditions may be cramped and onerous, but they represent a material improvement over life in impoverished villages and bare sustenance agriculture.

This migration is most notable in China, where 300 million people have made the trek from village to city in recent decades. But it is also prominent in India, Nigeria, Brazil, and other rapidly urbanising countries.

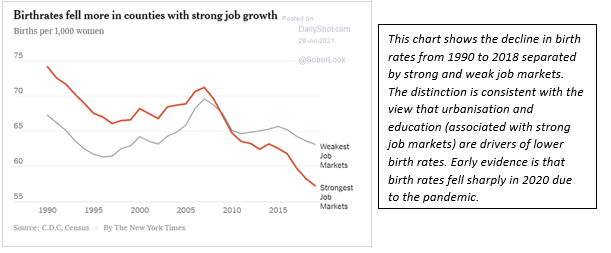

Urbanisation causes lower birth rates for several reasons. The first is that infant mortality is lower, so it is not necessary to have as many children in order to ensure that some survive.

The second is that more children can be a help in agrarian conditions, but they are more of a cost than a help in urban conditions. The third is that opportunities for education, birth control, and possible job promotions are greater in cities than the countryside. Those opportunities influence the decision to have smaller families.

|

|

|

Source: The New York Times |

The impact of urbanisation on birth rates is not limited to developing countries, but is also powerful in rich countries, where increased urbanisation is significant. However, the absolute number of ‘missing’ births is greater in developing economies because the number of migrants and baseline birth rates are both much higher. The result is a convergence of developed and developing economies towards a birth rate below 2.1, even where the initial conditions are highly divergent.

2. How education reduces birth rates

Along with education comes greater knowledge about contraception, family planning, and women’s health generally, which supports decisions about smaller family size. In addition, education opens opportunities for professional careers, job promotions, and entrepreneurship, all of which argue for smaller family sizes (or no children) so the individual can leverage the opportunity without the costs and duties associated with children.

3. How women’s emancipation reduces birth rates

Women’s emancipation from religious, patriarchal, and traditional roles and expectations gives women greater agency in terms of marriage age, spousal selection, and family size. This is particularly true in less-developed Muslim, African, and predominately Catholic countries, where social and familial expectations formerly limited women’s choices.

Obviously, these three factors interact and amplify each other. When individuals move to cities the educational opportunities are greater and the pull of traditional forces is less. This has greater impact on women than men because women were more subject to traditional constraints in the first place.

Urbanisation, along with education and women’s emancipation, are the reasons birth rates are declining so quickly in developing economies and why there is a rapid convergence of developed and developing economy birth rates.

Next week, I look into specific birth rates with national and regional differences and explain the grim realities of demographic decline.

Regards,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

PS: This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.