In today’s Money Morning…it’s not just the price falls punching you in the face…a fairer way…this is where bitcoin comes in…and more…

Mike Tyson famously said that everyone has a plan until they get punched in the face.

Which is probably how a lot of cryptocurrency investors feel right now.

After a year of ‘easy money’, the bottom fell out the market last week as everyone’s greed and optimism suddenly turned into fear and doubt.

Even worse, in crypto when the worm turns, it’s not just the price falls punching you in the face, but an army of naysayers sticking the boot in too.

I’ve read huge crypto pile-ons from the mainstream press, crypto-Twitter traders have turned angry (or pretending like they always knew it was about to plummet), and generally a whole lot of ‘I told you so’s’ have come out of the woodwork.

Even Nobel prize-winning economist, Paul Krugman, had a go.

He sarcastically tweeted this about Bitcoin’s [BTC] value:

|

|

| Source: Twitter @paulkrugman |

Never mind that bitcoin is already the best-performing asset of the past decade — heck, it’s even gone up 10 times in just the past year, despite the pullback of late.

Krugman may be a clever man (though he’s probably just a typical economist who’s good at sounding smart), but I’m not sure I’d take valuation advice given his track record here.

In 1998 Krugman famously had this to say about the internet’s value:

‘The growth of the Internet will slow drastically, as the flaw in “Metcalfe’s law” — which states that the number of potential connections in a network is proportional to the square of the number of participants — becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.’

Look, we all make wrong calls in the markets, I suppose, though not usually as Biblically wrong as that one!

But Krugman has a big incentive to talk down the value of bitcoin.

Economists like Krugman base their career on the premise that they know best when it comes to managing the economy.

For them money is a tool of control. To be wielded by them.

But they live in a fantasy world of economic privilege, insulated from the real-life havoc their wanton manipulation of money has on folks out in the real economy.

So, it’s no wonder they don’t see — or don’t want to see — the value in something like bitcoin that would literally take away this power.

Which brings me to bitcoin’s value…

A fairer way

Let’s think about what money is supposed to be.

In a normal free market economy, money is the reward for labour, endeavour, or enterprise.

You’re rewarded for creating something that is of value to others, whether that’s your time, your skills, or your invention.

Investors are rewarded for allocating their capital to those who are good at this too, in the interest of generating future cash flows.

The rules are simple…

If you’re good at any of this, you get more money, if not you get less.

And I think we can all live with this situation if we feel it’s a level playing field of sorts.

Of course, there’s room for social safety nets and some sort of shared goals in the interest of society as a whole. That’s why you pay taxes after all.

But when it comes to the pecking order, a free market system of money should reward those who create value over those who don’t.

Now here’s the problem with the status quo…

Central banks have the power to distort this equilibrium through the power of unlimited money creation.

The creator of bitcoin, Satoshi Nakamoto, pointed to this fact in the original bitcoin white paper, saying:

‘The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

‘Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

‘We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.’

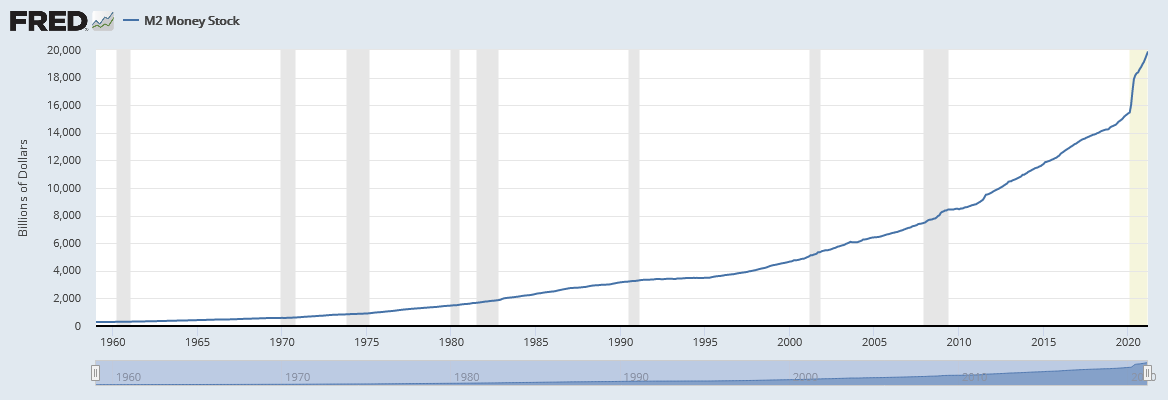

Look what they’re doing with that trust right now:

|

|

| Source: St Louis Fed |

You can see the supply of money has been ramping up since 2008. But look at the vertical lift-off in 2020.

That was of course in response to the COVID crisis and global shutdowns.

Isn’t that good that they’re supporting the economy, you might think?

I’m sorry to break it to you, but they’re not supporting the economy, at least not for yours or my sake.

Over the past year the gap between rich and poor — even within developed nations — has never been greater.

The truth is fiat debasement — money printing — inflates the assets of the already wealthy at the expense of the poor.

This is where bitcoin comes in

Bitcoin takes away this power and instead creates fixed rules over money supply that cannot be gamed by a chosen few.

By holding bitcoin, you’re able to store your wealth in something that cannot be debased by centralised powers.

It brings us closer to the concept of free markets for money, where we’re all on a level playing field, at least in terms of opportunity.

Can this idea succeed?

There’s no doubt, the powers that be are stacked against it.

They’re thriving in the current crypto volatility, proclaiming their temporary victory, and trying to talk it down.

My advice right now?

Take the opportunity — especially while the hype has died away — to learn more about this new world of money.

Maybe you’ll decide to invest, maybe you won’t.

But I can guarantee you there’s a lot more to this than many know, and I think, if you look under the hood, you’ll start to see it too.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: This recent interview with Ross Stevens, CEO of NYDIG, is a must-see for anyone who wants to understand why corporate America is looking very closely at bitcoin right now.