Three things I’m thinking about today…

1. The recent US GDP number is misleading you, me and everyone else…

You might’ve seen a bit of chit chat about how US GDP fell in the first quarter. Yes? No? You can see it visually on this chart:

| |

| Source: Charlie Bilello |

This is a “worry” for some.

If the second quarter comes out negative too, then the USA would be in a “technical” recession. That’s two quarters of negative GDP.

Yawn!

Here are two reasons why this kind of thing can be misleading when it comes to the share market.

The first reason? The recent drop in net exports – because of the mad rush to import before the tariffs – distorted the headline number.

The second point is that there’s something called “core GDP.” This just measures consumer spending and private investment. This came in super strong.

The headline number obscures this.

Let’s be honest. GDP chat is as boring as bat shit.

However…

If you’re wondering why the US stock market is bouncing so hard since the big dip, this is a big reason why.

However… *again*

Trump’s tariffs are now eroding this US economic strength.

The market is saying that the current stand off can’t last, and assumes a deal happens. Don’t let uncertainty around this stop you from acting now.

Consider…

2. Tariffs: a win for Aussie beef farmers

Old Trumpy might be popular in Queensland right now.

Aussie beef prices are back up at 2 year highs thanks to Chinese buyers coming into the market. US beef is being displaced.

However, it’s not all about tariffs. Good rain is important too.

That reminds me of an Australian Financial Review story that appeared in early 2024. Have a read of this…

“Melbourne hedge fund Farrer Capital is betting that Australian cattle prices will soar next year.

“Adam Davis says the return of the La Nina weather pattern in the months ahead will boost domestic cattle prices by 50 per cent as major cattle producing countries such as Brazil, the United States and Australia rebuild their herds, setting up a bullish environment (puns aside) for beef markets.”

I’m not sure if the price is quite as high now as this gent thought it might be, back then. But he’s certainly got the weather and the general trend right.

Certainly, Queensland is the place to invest right now.

I mentioned fund manager Matthew Kidman yesterday.

One of the points he made is that, by contrast, business in Victoria is a major weak spot for the country right now.

Do make sure to check if any share you own has a heavy weighting down here. Plenty of retail chains have a good chunk of their stores in Victoria, for example.

Firms weighted toward WA and Queensland are a better bet.

3. By the way, check this out…

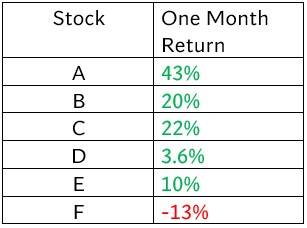

On April 9 I told readers of my advisory, Australian Small Cap Investigator, to “hold their nose and buy”. I gave several suggestions.

Here’s how they’ve done over the last month…

| |

It’s never easy stepping in during times like last month. Charlie Bilello makes this point this week.

“The index has advanced 18% from the April lows, illustrating once again that the biggest rallies tend to occur after the biggest short-term declines.”

One to remember for the next time.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

PS. Make sure you tune in tomorrow for my latest report on the shares I suggest scooping up for the rest of the year…and beyond.

Murray’s Chart of the Day

– Gold Weekly Chart

| |

| Source: Tradingview |

We are seeing some wild swings in the price of gold at the moment.

Last night saw a US$100 rally turn into a US$70 fall in the blink of an eye after news came out that the US and China will meet in Switzerland to kick off trade talks.

After the first weekly sell pivot since late 2024 was confirmed last week, the odds were increasing that a correction may be coming soon.

But a sharp rally over the last few days threw that idea up in the air.

Where gold finishes this week will be important for short term direction. If the price closes above US$3,353 it will confirm a weekly buy pivot and the rally can continue.

But if we see further weakness into the end of the week and a close below US$3,353, the weekly sell pivot form last week will remain live. Hence, the probability of further downside in the immediate future will increase.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments