Jim Rogers is a financial legend.

A poor boy from Alabama that’s now seriously rich thanks to an epic career on Wall Street.

Here’s a quote of his that’s bang on right now:

“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.”

He said this years ago.

What’s it got to do with today?

See this story from the Australian Financial Review…

“NSW Energy Minister Penny Sharpe on Thursday announced grid access rights to 10 huge wind, solar and battery developments in the government’s Central West Orana Renewable Energy Zone…

“Central West Orana will require construction of around 240 kilometres of new poles and wires to connect the projects to the broader electricity grid.

“According to the energy market operator, Australia’s transition to clean sources of power will require around 10,000 kilometres of new transmission lines.

“The Central West Orana zone covers around 20,000 square kilometres around Dubbo and Dunedoo.”

Oh, the beautiful symmetry!

Today, I release my latest report with 4 recommendations.

One of these is likely to win HUGE contracts from this. It’s literally headquartered in Dubbo.

Look at some of those figures. This is a MASSIVE project.

And like Jim Rogers says…

…when the government is throwing money around, all you have to do is go and pick it up.

You may agree or not agree with the renewable rollout. You may or may not like Labor.

Put it all aside.

Frankly, nobody in the market cares what you OR I think on this.

Opinions are like…well…you know the old saying.

All you need to know is that the market loves juicy government contracts, as does everybody else.

You’ve got a buyer who isn’t price sensitive and has an open chequebook.

What’s not to love if you’re on the receiving end of this?

Government money is also good for another reason – certainty.

It’s not going to go broke on you, or leave invoices unpaid. Any company with this kind of customer is one to have in your portfolio, in my book.

We don’t know where Trump is taking the world.

But we do know the Aussie government game plan. It’s simple…

Spend! Spend! Spend!

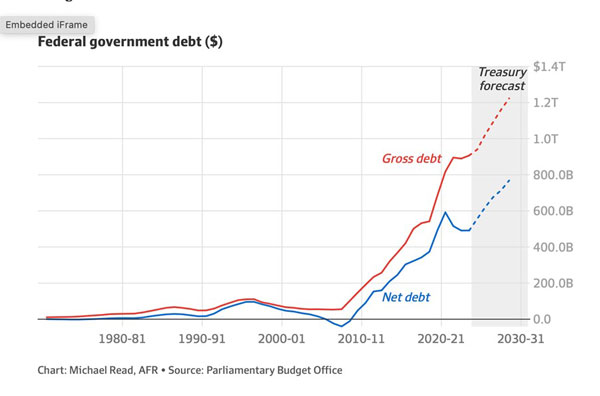

See for yourself…

Yes, it’s our tax dollars going out, no doubt some of it due to be wasted and squandered.

We can’t stop that.

What we can do is own the firm(s) that might be on the receiving end.

And there’s plenty of money coming up.

Already the political types think Labor is a cert for another 6 years.

“Blackout Bowen” has the chequebook…and he’s got a target to hit by 2030.

Not far away, at all.

This is another reason I’m not bearish on the stock market.

This money going out does turn into wages and profits for citizens and businesses out there in the “real” economy.

From the AFR:

“Treasury predicted in March federal government spending would hit 27 per cent of GDP next financial year, which would be a record outside the pandemic.”

Indeed.

Now, I’m no Jim Rogers.

No one is!

But even I can see if the government’s going to spend up big, the smart money will chase where that money is going too.

I’m not saying it’s without risk. They could still mess it up.

That said, to begin…

….all you need to do is read my latest report…and get set for the spendathon about to wash over Australia like a tidal wave.

Then decide for yourself: is Jim’s strategy likely to work…or not?

I say it could be a belter.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day

– US Dollar Index Monthly Chart

| |

| Source: Tradingview |

The US Dollar Index is at a crossroads.

It is testing major support after a serious selloff.

The big question is whether or not support will hold. That’s because a failure below support will give targets much lower than current levels.

So the US Dollar is oversold in the short-term, but the risk of more downside is real.

My analysis of the situation on the monthly chart is that the long-term downtrend has recently been confirmed. So there should be plenty of resistance on the first retest of the long-term moving averages.

There are other strong resistance levels based on the monthly key bar, but that calculation is kept for paying members.

When you combine the various resistance levels you come up with an area around 102.00 to 103.50 which should prove to be stiff resistance.

if the US Dollar Index bounces from the current level around 100.00, I would expect it to struggle in that resistance zone and possibly turn back down again to test the recent lows.

If those levels can’t hold I would expect to see the US Dollar Index cascade down towards 93.00 to 96.00 which is the buy zone of a major uptrend between 2021-2022 (See chart above).

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments