Betting against Japan is known as the ‘widow maker’ trade.

Given the bulging Japanese debt load (233% of GDP) it looks an obvious play.

And yet, betting on Japan’s demise has bankrupted more hedge funds than any other.

Right now, it looks like we’ve witnessed another failed attempt.

Markets have forgotten about the Japanese carry trade dramas of last week about as fast as the media forgot about the Trump assassination attempt!

It was an amazing turnaround.

After bouncing back hard on Tuesday, the S&P 500 finished just 0.04% lower for the week.

The tech-heavy Nasdaq – which bore the brunt of the selling – finished down a measly 0.18%.

Our own market (ASX 200) fell a bit harder, down 2.08% for the week. It’ll be interesting to see if today follows up on Friday’s 1.4% surge.

So is that it?

Crisis averted?

Look, one thing I’ve learned over the years is that you don’t get the kind of extreme volatility we saw last week unless something’s not right beneath the surface.

Indeed, it was the most volatile things have been since the pandemic outbreak in 2020.

And don’t forget…

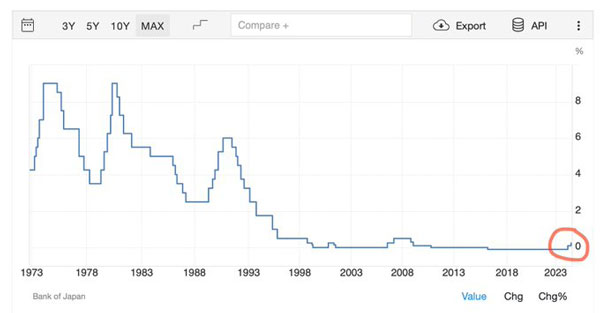

This little blip is what caused all the panic:

| |

| Source: Bank of Japan |

It shows you just how unstable the financial system is.

Today, I want to dive in deeper to show you exactly why you need to keep a close eye on Japan.

You need to understand the mechanisms in play so you don’t get swayed too much by the superficial headlines of the day.

It’s a lot more than just some traders caught on the wrong side of a trade. There’s a huge structural problem that’s been building for decades.

But let me say upfront; this isn’t going to be some doom-monger piece, crying the end is nigh!

Nor will I say to sell your stocks (yet, at least).

Indeed, as I said last Monday:

‘Long story short, things could get volatile this week, but I remain optimistic about the big picture.

In my opinion, any short-term selling pressure will provide buying opportunities in the right stocks.’

That continues to be my base case.

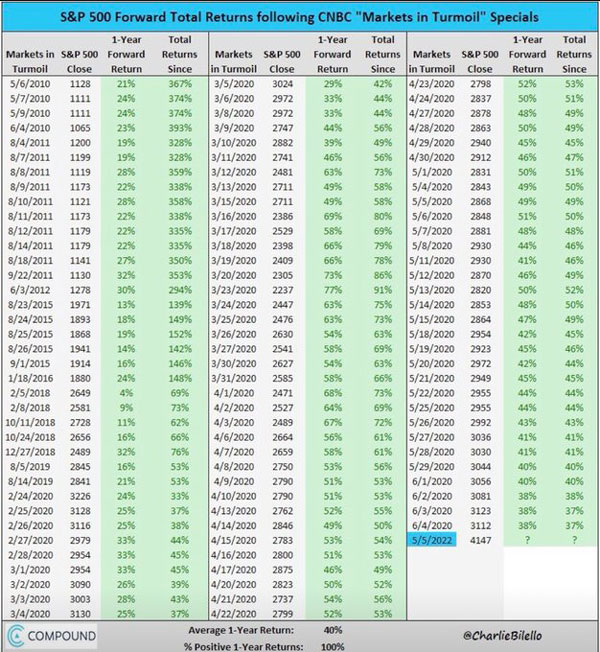

And as this chart shows, buying the fear – on any bad news event – is a pretty good strategy most of the time:

| |

| Source: Charlie Bilello |

This chart shows the returns from buying in when CNBC and the financial media go full alert ‘Markets in Turmoil.’

It’s all green!

The Michael Burry’s of the world – the hedge fund investor who bet against the US housing market in 2007 – are the exception rather than the rule.

But be that as it may, I’m not one to put my money down on blind faith alone.

I prefer to try at least to work out what’s going on.

That’s why I’ve spent the past week trying to understand what’s really happening in Japan.

Could it get worse?

What are the likely reactions from central banks?

Will they be enough?

I think I’ve come up with a good mental framework for how you can invest through this.

Let me explain…

What a Collapse Looks Like

To refresh your memory, a carry trade is when you borrow in a low-rate currency and buy financial assets in another currency that yields a higher rate of return.

You bank the spread between the rate you borrow at and the rate of return you make—as long as the currency rates don’t fluctuate too much!

That’s what happened last week…

On Monday, both interest rates and exchange rates went against the carry trade and saw attempts by investors to unwind their positions.

As I’ll show you shortly, this trade is so big that it caused extreme panic.

This is how the carry trade would collapse in eight steps if no one intervened:

- The Bank of Japan (BOJ) hikes interest rates, increasing the cost of borrowing for the carry trade.

- Traders face rising carry trade loan repayments, driving up demand for JPY.

- A sharp rise in JPY triggers the start of the carry trade unwind.

- Traders face margin calls, leading to forced liquidations.

- Liquidity evaporates, causing severe volatility in foreign exchange markets.

- Widening bid/ask spreads intensify selling pressure.

- Contagion spreads to global markets, sparking a broader sell-off.

- Rapid systemic collapse.

This is clearly a situation policymakers were keen to avoid!

Unsurprisingly then, a BOJ deputy governor came out on Tuesday night to calm markets, saying:

‘We won’t raise rates when financial markets are unstable.’

This was seen by traders as a sign the BOJ had ‘caved’ in to market pressure.

And markets rallied hard with it.

We’ll see if that continues this week, or if they want more concessions from authorities.

But none of that solves a structural issue that’s been building up for almost two decades.

Japan’s whole economy is one big carry trade!

Check it out…

Understanding the Numbers

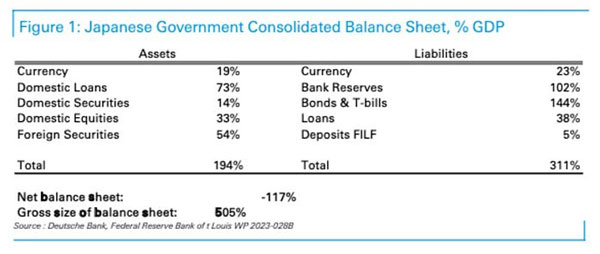

This is Japan’s Consolidated (both public and private companies) balance sheet:

| |

Yes, I know accountancy talk can make one’s eyes glaze over.

But in this case, it’s important to get your head around.

In simple terms, what Japan Inc. – the totality of its economy – owes vastly outnumbers its assets.

They have a net position of -117%.

It’s like owing $1.5M on a home worth $1M.

Those two line items – Bank Reserves and Bonds & T-bills – are the biggies and a lot of that is held on the central bank balance sheet.

This has led to the creation of ever more Yen.

You see, every time they refinance this debt, the BOJ has to create more Yen to do so as no one is willing to lend to the government at 0.25% (inflation is at 2.8%, so it’s a guaranteed loss maker for ‘normal’ bond investors).

They keep interest rates low and print the Yen to buy the excess bonds.

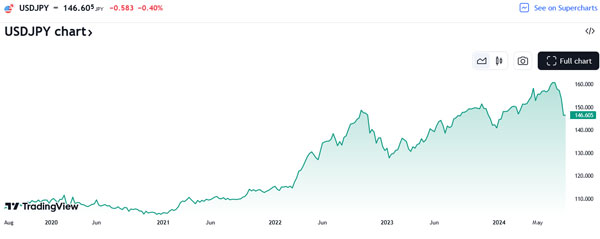

This fact has suppressed the value of the Japanese Yen for years:

| |

| Source: Trading View |

It has also led to an immensely profitable carry trade situation.

As you can see on the asset side, ‘Foreign Securities’ are the second biggest line item.

Japan Inc. loves investing abroad!

Taken as a whole, Japan Inc. uses these loose monetary conditions to earn high returns due to a weakening yen.

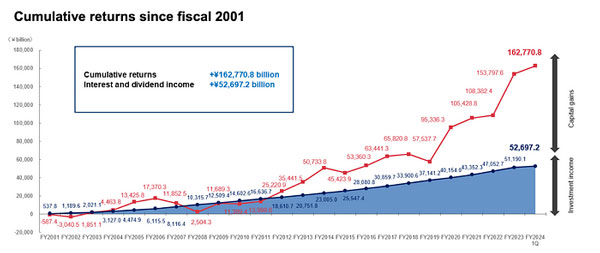

For example, check out this chart of the Japanese pension fund, GPIF:

| |

| Source: GPIF |

It is one of the world’s largest – maybe the largest – pension funds, managing US$1.3 trillion.

It has made a motza by investing abroad and banking the currency gains because of Japan’s extremely loose monetary policy.

As professional trader Arthur Hayes put it:

‘Japan Inc. put this trade on in MASSIVE size. Japan’s GDP is roughly $4tn, with a gross exposure of 505%, and they are running $24tn worth of risk. As Cardi B says, “I want you to park that big Mack truck right in this little garage.”;

It worked for years, but recently, the Yen got too weak, and inflation started to rise.

Japan has one of the slowest rates of wage growth in the developing world, and as our man in Japan, Nick Hubble, recently pointed out, the cost of living is a bigger deal to the general public than stock markets.

Inflation is why the BOJ tried to increase rates.

They wanted to slow down the weakening of the Yen as it would import too much inflation.

But they didn’t bargain on the extreme reaction of the markets caught in the carry trade trap.

Anyway, that’s a very simple overview.

It’s a complex intermingling of inflation, interest rates, exchange rates and trader reactions in an economy that’s sitting on a powder keg of debt.

I don’t think anyone quite knows how Japan extradites itself from this pickle of their own making.

And yet…

The Fix is In

The BOJ and their counterparts in the US are unlikely to let markets fall apart (especially not with a US election so close!).

They have levers they can use.

Like what?

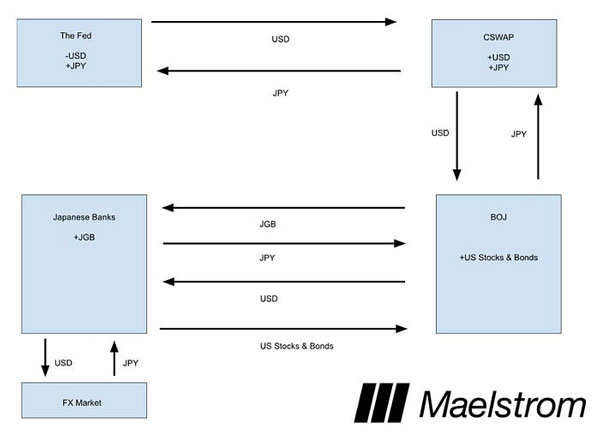

In trading circles the murmurings are that the Fed will probably give the BOJ access to US dollars via something called a Currency Swap.

This is a special facility that lets the BOJ put up Yen-based assets to the Fed as security for US dollars.

The BOJ can then allow Japanese banks, insurance companies, and other finance companies to sell US assets (to them) without affecting the exchange rate.

It’s an exercise in ‘money printing’ from the Fed that allows the BOJ to buy US securities off Japan’s private corporations, helping unwind their carry trade exposure with minimal effect on the exchange rate or stock prices!

The quid pro quo from the BOJ is that they may want the banks to buy some of their huge stockpile of low yielding Japanese government bonds over time.

This is how the flow of assets under this currency swap arrangement might work:

| |

| Source: Maelstrom |

This is a bailout by any other name; an exercise in currency debasement and liability shifting.

But it is what it is!

And it’s bullish for stocks.

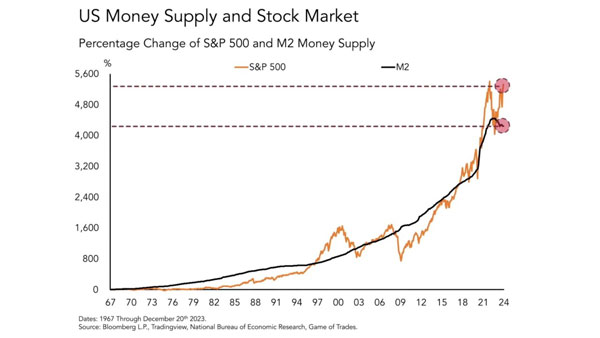

As this chart shows, the US stock market is strongly correlated with the rise in money supply which is what the Currency Swap does:

| |

| Source: Bloomberg |

The BOJ can also afford to sit on a basket of Foreign Securities as long as they need to (unlike private corporations). That will put less selling pressure on the US stock market for now.

I believe some kind of Currency Swap facility will stabilise the system for now—until the next big problem blows up somewhere else in our debt-laden system, at least.

(And in the long term, I think Bitcoin [BTC] and gold are your only escapes from this rigged system of perpetual money printing.)

So, for now, on any panic dips, I’m a stock buyer.

[Editor’s Note: In fact, my tech investing service, Alpha Tech Trader, is putting out two new buy recommendations this week].

As long as the Japanese Yen doesn’t strengthen too much against the dollar in the short term, I think the party will keep going until the end of the year.

But if the Yen unexpectedly strengthens any time soon, then this thesis is probably wrong!

Long story short, keep an eye on the USDJPY exchange rate closely this week…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments