Editor’s note: Last week, our Editorial Director Greg Canavan wrote to our paid subscribers in The Insider after a plunge in the Aussie dollar’s value. There is a myriad of effects that this creates for the Aussie economy, and it’s important that Aussie investors are aware of them — which is why we want to share this insight with you today. There are downsides to a lagging Aussie dollar, no doubt, but there are also benefits. If we plan accordingly, there’s a way to prepare our investments to be primed to rise when the bull market returns. Enjoy…

Dear reader,

As I write this on Wednesday morning, the Aussie dollar is trading at around 62.8 US cents.

It’s the lowest it’s traded since April 2020, during the COVID panic. Before that, you have to go back to the dark days of the GFC in November 2008. And before that to the early 2000s, with the rise of China and globalisation.

You can see this in the long-term chart below:

|

|

|

Source: Optuma |

The Aussie dollar is a great barometer of global economic growth. When it’s as weak as it is now, that tells you something is wrong in global commerce.

That ‘something wrong’ is rising interest rates worldwide. As evidenced by the sharp fall in the Aussie dollar over the past few weeks, those rate rises are now starting to bite.

As I mentioned in Monday’s Insider, monetary policy acts with a lag. And we don’t know how long that lag is. In his 1969 book The Optimum Quantity of Money, Milton Friedman said that monetary policy acts with ‘long and variable lags’.

He, therefore, argued for rule-based rather than discretionary monetary policy. Given the hole that central bankers have dug for us over the past few decades, it’s hard to argue that Friedman had it wrong.

Anyway, the point is the same one I’ve been making for a while now: The Fed continues to tighten while looking for evidence of its effect in lagging indicators.

The sharp decline in the Aussie dollar is just another example of the rapid slowdown in global growth occurring right under the Fed’s nose.

But it’s more than just that.

Flexible exchange rates mean currencies act as shock absorbers. What made the Great Depression so bad in the 1930s (aside from easy money in the lead up) was the rigidity of the currency system at the time.

Most major currencies were on a type of gold standard. So in the Great Depression, labour took a hit, as well as capital. The US dollar stood strong.

It was only in April 1933 that Roosevelt devalued the dollar against gold, nearly four years after the Depression began.

By that time, unemployment was around 25%, the banking system had collapsed, and the Dow Jones Index had already plunged 80% from top to bottom.

These days, currencies move relative to other currencies, so as not to inflict such harsh outcomes on labour and capital. Everyone is impacted in some way by currency movements. Some benefit, some lose. But the idea is that pain is spread in a broad manner rather than narrowly.

For example, a weaker Aussie dollar means imported goods cost more. It’s the market’s way of trying to discourage consumption and encourage production. But this can also feed into the inflation pressures Australia is already dealing with, putting pressure on the RBA to raise rates further.

On the other hand, the weaker dollar makes our exports cheaper in the eyes of foreign buyers. This is good for our food producers and other commodity exporters. But if they need to invest in imported plants and equipment to build new mines and/or production capacity, it increases the cost of this initial investment.

Another area that will likely benefit from a weaker Aussie dollar is high-end real estate. If you’re a cashed-up US investor and see that the Aussie dollar is down nearly 20% against the greenback in six months, a falling real estate market here all of a sudden looks very attractive.

You can see the other impact of currency movements in the stock market. With the Fed raising rates and the US dollar the world’s reserve currency, the greenback is the only game in town. It’s by far the strongest-performing currency this year.

That’s part of the reason why US markets are down heavily this year while the Aussie market has done much better. For example, the S&P 500 is down around 25% from its peak. Meanwhile, the ASX 200 is only down around 12.5% from its peak.

However, if I denominate the ASX 200 in US dollars, as you can see below, it’s down more than 27% from its high:

|

|

|

Source: Optuma |

So adjusting for currency movements, the Aussie market is on par with the US.

Can you see now how floating rate currencies can cushion the effects of global capital flows and economic currents?

But it can only absorb so much before other factors come into play — like imported inflation forcing the RBA to raise rates even further. There are many examples in history (especially in developing markets) where central banks have to raise rates to defend their currency.

If history is any guide, it’s probably getting close to a bottom for the Aussie dollar here. But in the short term, with the Fed pushing the US into recession, you can’t rule out more downside.

Much will depend on this week’s (lagging) inflation figures, due out on Thursday in the US. A better-than-expected number for September should see markets — and the Aussie dollar — rally sharply. But if it remains higher than forecast, all hell could break loose.

There’s one other currency impact I want to point out. It relates to commodities and what our producers receive for their goods. You see, when the Aussie dollar falls, and the US dollar price of a commodity remains stable, the Aussie dollar price rises.

That’s been happening lately, especially with gold and oil. In the last few weeks, the Aussie dollar gold price has jumped by around $150/ounce to $2,650. Brent crude, priced in Aussie dollars, has gone from $130/bbl to $150/bbl.

Not all companies benefit uniformly from this rise. Some have US dollar contracts, and in the case of the big energy companies, they report in US dollars anyway.

But overall, the rise in price is beneficial to Aussie-based producers. In the case of gold, the miners’ share prices just aren’t responding. I’ve shown the chart below before. The gap between the Aussie-dollar gold price and the ASX Gold Index just keeps getting wider:

|

|

|

Source: Optuma |

That just shows you how deep a bear market gold stocks are in right now. But when the turn comes, the gains will be substantial, in my view.

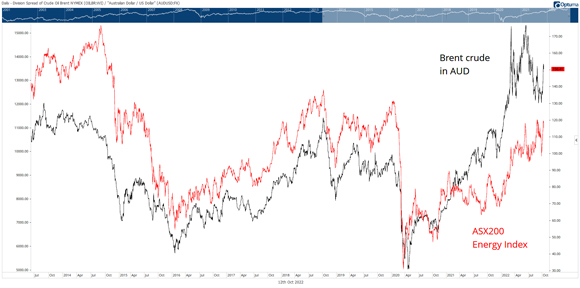

The ‘discount’ on energy stocks isn’t as great. The chart below shows Brent crude in Aussie dollars versus the ASX 200 Energy Index. Energy stocks have been in a bull market, unlike gold stocks:

|

|

|

Source: Optuma |

But there’s still a discount there. It’s like the energy stocks aren’t convinced that high oil prices will remain. Maybe with the Fed on an inflation war path, oil prices will succumb to demand destruction in the short term.

As I’ve pointed out before, even with the dollar so strong and Biden depleting the Strategic Petroleum Reserve to its lowest levels since the early 1980s, oil prices remain strong.

And thanks to the weak Aussie dollar, prices in the local currency aren’t far off the all-time highs reached just a few months ago.

That’s why you’re still getting smashed at the petrol bower.

This brings me back to inflation. A reader recently asked how I can be both bullish on oil and think inflation is heading lower.

I’ve run out of time and space today, but I’ll answer that question in an upcoming essay.

Regards,

|

Greg Canavan,

Editor, The Daily Reckoning Australia

PS: To see that upcoming essay, you’ll need to become one of our paying subscribers. If you’re interested in Greg Canavan’s insights, you can sign up for his service, Fat Tail Investment Advisory, here.