Today, we’re talking breakout trading…

Everyone loves this type. Me too!

When it works, it’s ripping fun. It can be one of the fastest ways to make money in the markets.

What am I talking about?

A ‘breakout’ is when a stock bursts above a certain level…and keeps rising on very strong momentum.

I’m going to share with you the best sectors to find this type of trade too.

There’s a certain type of stock that really suits breakout trades.

Maybe you’ve already guessed: commodity shares!

Step back a moment and think about why this might be.

The share market is, stripped to essentials, about who is making money.

Yet there are all sorts of businesses on the ASX…

There are retailers, real estate investment trusts, travel firms and insurance writers and banks and builders…and more!

Here’s what defines most of these businesses.

They can only change the amount of money they make relatively slowly.

Granted, over years a company can go from making $10 million in profit to $25 or $50 or $100 million.

These are the growing businesses that long term investors like Warren Buffett love to hold for years, if not decades.

But not everyone in the market is like Buffett.

Some want to make a buck today, or this week, or this month.

They need something that can move fast…and they’re willing to risk higher volatility, and potentially a quick loss as well, to find it.

They’re the breakout traders.

That brings us back to commodity shares.

You see…

Generally speaking, commodity shares make poor investments.

For example, they have no control over the price of their product. There is little competitive advantage of what they sell.

They need a lot of capital investment to get up and running. They are at the whim of Mother Nature if they don’t dig or drill what they expect.

And they always know for every ounce or tonne or barrel they extract, that’s one less they have in the future.

They’ll need to find more eventually…or go out of the natural resource business.

Why do traders love commodity shares then?

They have one ace up their sleeve, and it’s a big one.

When commodity prices soar unexpectedly, it increases the earning power of the related miners as fast as lightning. This can send certain shares skyrocketing.

We can see this happening on the market right now…

You might have heard that copper is trading at a two year high. Copper is up 20% in about two months.

The investment banks are upgrading their forecasts and projections to account for the rapid shift.

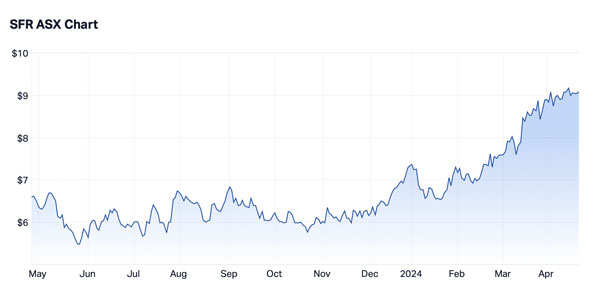

Now take a look at copper producer Sandfire Resources [ASX:SFR]…

| |

| Source: Market Index |

Sandfire broke out into a new high in February…and has kept on going alongside the copper price.

But this dynamic is not unique to copper.

Manganese is a metal nobody spends much time thinking about.

There’s been some supply issues recently. It’s sent manganese miner Jupiter Mines [ASX:JMS] roaring up lately …

| |

| Source: Market Index |

And, of course, we can’t forget gold. It’s been ripping up since last year.

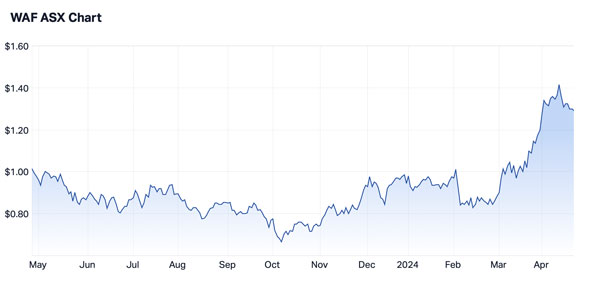

Take a look at miner West African Resources [ASX:WAF] break out above its recent range around $1 per share…

| |

| Source: Imdex |

This doesn’t happen all the time. And not every stock will perform like this.

And commodities can melt down in price as fast as they rise. Commodity stocks can often disappoint in their production updates, and cause the stock to drop. The risks are many.

Sometimes a stock looks set to break out, and then the price action fizzles out, or can even go backwards.

There are no sure things in the market.

But every trader is always watching commodity stocks for the breakout potential of natural resources.

A gold miner might make $500 per ounce margin at $2,000 gold. That could double at $2,500 gold.

You can’t say that about, say, a shoe retailer. The average selling price of sneakers is about $150 per pair.

The odds of the average going to $300 next week or next month is non existent. So their shares can’t move like a gold miner can.

You have to decide whether trading or investing in commodity stocks is for you.

What I can tell you is that mining shares a rumbling on the ASX.

My colleage, geologist James Cooper, can help you take advantage of it.

See what he’s saying now by clicking here.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments