We’ve all been amazed by the path of markets since the COVID crisis hit.

A mind-bending crash and then a relentless rally after the US Fed rode to the rescue once again.

The Nasdaq is now 15% above the all-time high set in February 2020 — having rallied 69% from the low.

Silver has spiked from US$12 to nearly US$30 in a matter of months. Gold has run from US$1,450 to over US$2,000, setting a new all-time high in the process.

The news last night that Warren Buffett — the gold hater — has taken a position in Barrick Gold saw precious metals spike. If you’re keen to get involved but don’t know where to start, check out our Strategic Intelligence Australia service.

Other commodities are getting in on the act. Copper, nickel, zinc, rare earths, uranium, iron ore, and even cobalt have bolted since the lows reached during the crash.

Bitcoin is up almost 200% from the US$4,000 low set in March this year.

Wow.

What the hell is going on!?!

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

The whiff of inflation

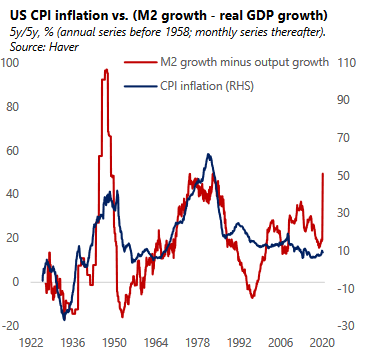

Let’s have a look at a chart that I saw in an article called ‘The Great Monetary Inflation’ by one of the most famous hedge fund managers of the past few decades, Paul Tudor Jones:

|

|

| Source: The Great Monetary Inflation |

The chart shows you that over the past 100 years, when M2 is growing faster than real GDP growth, there is a high correlation with resultant CPI inflation.

What on Earth is M2 I hear you ask?

Good question. M2 is a calculation of the money supply that includes all elements of M1 as well as ‘near money’. M1 includes cash and checking deposits, while near money refers to savings deposits, money market securities, mutual funds, and other time deposits.

After the crash in 2008 we saw a spike in M2 growth, which didn’t result in a spike in inflation, and the article explains this by saying:

‘The bank-centric GFC induced a one-time paradigm shift in banks’ preference for liquidity, later enforced through regulatory changes. As a result, only a small share of the Fed’s massive injection of high-powered money was re-lent in the banking system: M2 never grew by more than 10% a year even after subsequent rounds of large-scale asset purchases by the Fed.

‘Effectively, banks’ preference for liquidity and the need to rebuild their capital cushions quashed the money multiplier. While the multiplier has recently started to fall—in a crisis, banks are wary to lend to potentially insolvent borrowers and, in fact, start building provisions for loan losses—this time banks entered the crisis in a stronger footing and policy is more squarely aimed at putting liquidity directly in the hands of businesses and households shielding, to some extent, banks from losses.

‘As such, the chance of a large fall in the multiplier as seen in the aftermath of the GFC is now smaller. Plus, the Fed’s elimination of the reserve requirement means that the theoretical money multiplier is now infinite (the multiplier is the inverse of the reserve requirement).’

In other words, the huge lift in M2 growth as a result of the COVID crisis will probably have a larger effect on inflation down the track.

CPI inflation will still be weak for the foreseeable future and could even fall due to the large supply gap that has resulted from the government-decreed recession to fight off the virus.

But the moves we are seeing in markets currently are screaming to all who will listen that big investors are starting to position themselves for an inflationary future.

And yet, when you look at the most important benchmark for assets around the world — the US 10-year bond yield — it is trading near its lowest levels in history.

The US Fed isn’t raising rates anytime soon

The US 10-year bond yield is currently at 0.7%. Inflation-protected securities aren’t showing any signs of a coming inflation either, and you would expect TIPS as they are called to ring alarm bells first.

The US Fed isn’t buying as many bonds with printed money as they were during the height of the crisis. But they are still buying billions worth a month.

I think the threat of yield curve control is keeping the bonds well bid, but there have been some signs below the surface that is making me think US bonds will be under pressure before long.

Last week a 30-year bond auction didn’t go so well. The dealers ended up being stuck with 28% of the whole issue.

Bonds sold off quite aggressively with yields rising from 0.5% to 0.72%. That confirmed a weekly sell pivot and until I see a weekly buy pivot, I am short-term bearish on US bonds (a pivot is a reversal signal on the charts when prices close below the low of the bar that created the highest price in the move).

The mad rally that we have seen across the board in many markets since the low in the crash can be traced to the US yield curve that is low and flat. The US Fed has telegraphed that it isn’t even thinking about raising rates.

If rates are going to be extremely low for many years the net present value of a dividend stream goes up. If you were happy with a 2% yield on a stock and shift your preference to a 1% yield, that stock price can double.

Hence the flood of money chasing a home in Tesla and Facebook at any price.

Investors may think they are well diversified if they buy Apple Inc and gold, but the fact is they are all morphing into the same trade. The flat yield curve, inflation trade.

So, the state of the US bond market is now all important. Any signs of weakness can kneecap this rally.

If Paul Tudor Jones is right and we are staring down the barrel of a lift in inflation over the next few years, US bonds should sell-off to compensate for rising inflation expectations.

But if the US Fed starts yield curve control and basically price fixes the most important asset in the world, price discovery for bonds will be dead.

As inflation rises, real yields will turn steeply negative and there is a high inverse correlation between negative real yields and gold.

The US Fed loves to use a crisis as cover to start their next market saving ideas. Yield curve control is the next cab off the rank, and they won’t use it until they have to. That means we will need to see a sharp rise in US bond yields before they will bring the hammer down.

If US bonds do start selling off from here, the markets that are rallying strongly will take a hit. But that will be reversed when the Fed rides in on a white horse again.

You want to be prepared for it when it comes.

Regards,

|

Murray Dawes,

For, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments