Up, down, up, down. The ASX 200 has been a nightmare since the big low on 20 June for anyone trying to place a directional bet on the market.

She’s choppy waters. And no wonder. The news around the world, outside job numbers, is largely grim.

There’s the war in Ukraine, Chinese property woes, and wild uncertainty where interest rates and inflation end up.

The ASX’s source of strength in recent times — resources — is now getting it between the legs.

Iron ore is flirting below US$100 a tonne. Copper is dropping like a stone. Oil has the wobbles.

There’s a book just out called The Anxious Investor. It’s a study of human behavioural traits in the context of the stock market.

You should read it. Our brains tend to go haywire when markets start falling. There are two glitches that come to light especially.

One is that we tend to focus on what’s recent and memorable…like a war, for example. The second is our thoughts around time frames shrink.

Instead of focusing on where a business might be in 2024 or 2025, we start to obsess about what’s happening right now.

That’s part of why we have the habit of pulling our money out of the market right when things look terrible…and often just before the market starts rising again because it’s discounted all the bad news.

You can counter this emotion with logic and facts, or at least try to.

Can we agree, for example, that decarbonisation will require more investment, rather than less?

Yes, I think that’s a fair assumption.

But is that investment currently forthcoming?

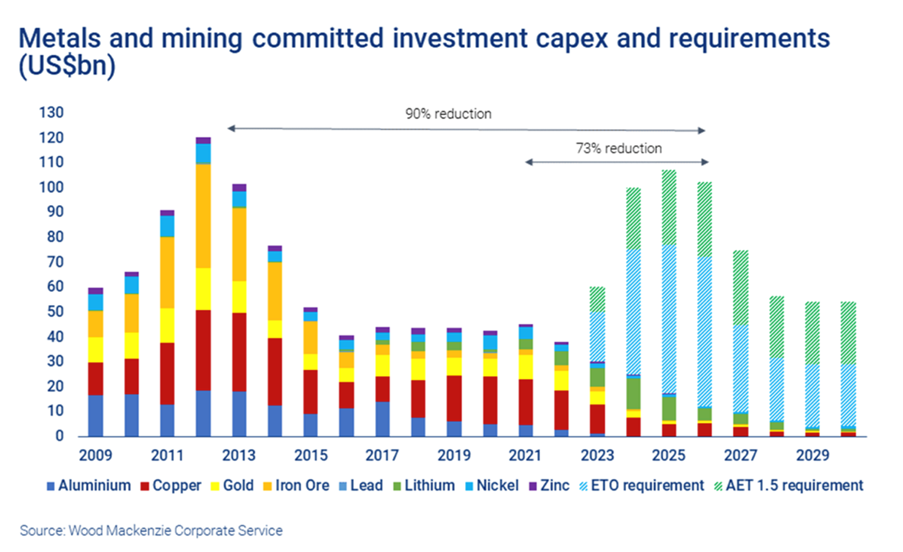

In the context of the mining industry, the chart below would suggest not.

Check it out:

|

|

|

Source: Market Index |

The writers at Market Index say:

‘The above chart shows committed capital expenditure (capex) into metals and mining projects is only 33% of what it was at its peak in 2012…

‘Excluding lithium, 2026 capex will be at 6% of 2012’s levels.’

Hello! The inner-city latte sippers can crap on about their reusable string bags for their weekly shopping all they want.

The markets are going to have to fund an extraordinary level of mining to generate the future copper, nickel, tin, etc., the world needs.

The longer the lag, the better the profits will be for producers already in action.

You only have to look at the coal industry right now to see the gargantuan cash flows that can come from extended underinvestment in a sector.

I’d expect something similar to show up in copper and nickel in a few years’ time. That’s why any project getting the ball rolling now should see massive upside by 2025.

The lead times in mining are enormous. Yes, we’re in a bear market today.

But the good times will come again. History teaches no clearer lesson.

Which nickel company is primed to soar in future years? I’ve made my bet. You can check it out in this recent report I put together.

2) As above, perhaps you’re too nervous to enter the market?

Let me share with you a few thoughts and insights on that…

Where to look?

My suggestion, right now, as a first port of call, is Peter Bakker’s First-Mover Algo Alert.

This is Fat Tail Investment Research’s algo service that uses hundreds of data points to advise whether to be in shares, bonds, cash — or a mix.

The algo — I like to call it Johnny five — has been out of the stock market since at least the start of the year.

The ASX 200 is down 13% for 2022 so far.

Johnny five could’ve saved you a lot of stress and worry…and the only thing you had to do was nothing.

What did Peter say in his most recent update?

Let’s check in:

‘I postulate that we are again in a bear market bounce, and will continue to go down as the damage due to demand destruction becomes clear: lower earnings, lower multiples, more redundancies, etc.

‘We haven’t seen a capitulation event yet, and most bear markets end with a capitulation event and a period of stabilisation from which we start to go up again.’

That was on 22 June.

I asked Peter, who just returned from Europe, for the latest from Johnny five.

One of the inputs for the algo is the copper-gold ratio. Peter told me this has deteriorated further since June, and signals recession is near.

He added:

‘Stress, however, is subdued, which is odd. Worse part of the decline seems done, although there’s still significant risk another leg down as the skew in the option market is showing lots of professional hedging.’

What I like about this service right now is that Johnny five will likely pick up a turn in the market — to the upside — when the news around us will be terrible.

Johnny five never gets anxious, greedy, or scared.

I believe that Peter’s service is an indispensable tool in this current environment. My earnest desire is for you to use it.

Peter’s algo will help protect your capital and, just as importantly, give you the confidence to go shopping for cheap stocks — when it gives a signal change — when everyone else will likely be still running scared. Check it out here.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia