Following another downgrade, A2 Milk Company Ltd [ASX:A2M] share price continued their recent fall, with major brokers revising their price targets.

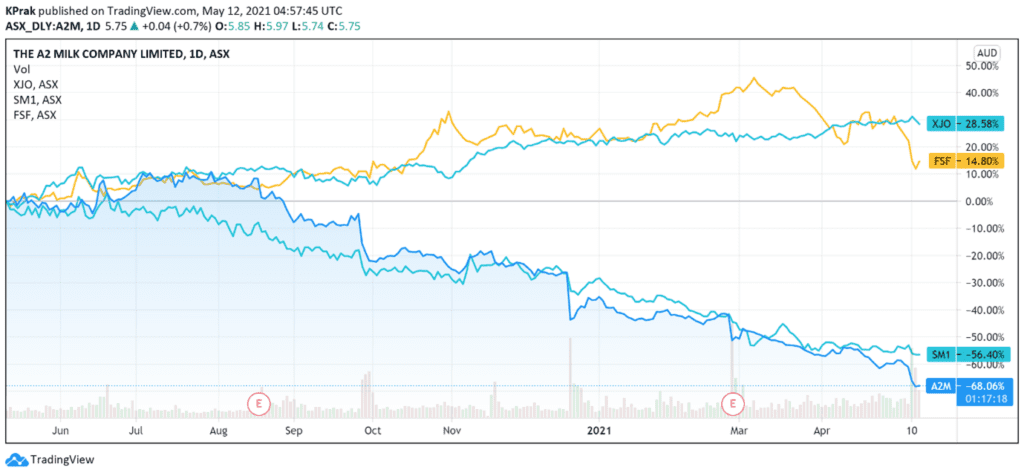

The A2M share price is currently trading 70% below its 52-week peak.

From the $20 highs in July 2020, the former ASX darling is now exchanging hands for $5.76 per share.

This represents a 49% year-to-date decline. Over the last 12 months, the dairy producer underperformed the ASX 200 benchmark by 97%.

But is this year’s sell-off harsh or is A2M’s share price indicative of its intrinsic value?

Morgans cuts target but retains Hold rating

Morgans slashed its price target for A2M to $6.65 from $8.34.

While A2M’s latest downgrade wasn’t a surprise for the broker given its research into A2M’s channels, the extent of the downgrade did.

Morgans commented that:

‘While we expect earnings growth to resume at A2M from FY22 onwards, we forecast it to be much less than in the past reflecting regulatory changes and border restrictions impacting the daigou, China’s declining birth rate and increased competition from Chinese companies (government has a 60% self-sufficiency target).’

Based on its forecasts, it estimates that its shares are trading at 26 times FY 2022 earnings.

Citi retains Sell recommendation

The investment bank set a price target of $5.85 on A2M.

Citi commented:

‘We retain our Sell recommendation as we see downside risk to medium-to-long term margins given a2 appears likely to increase its focus on the China offline channel, where it will need to increase investment in order to attempt to compete against larger domestic and foreign players.’

Macquarie rates A2M as an Underperform

Macquarie rated the dairy producer stock as an Underperform, setting a price target of $6.10.

The investment bank thought that ‘what started as an isolated daigou issue has now grown to affecting all channels and rising competition compounds this (and impacts recovery prospects).’

Macquarie concluded that A2M’s earnings are yet to find a base.

UBS reiterated bullish Buy rating

Unlike its bearish peers, UBS stuck to its Buy rating on A2M, even in the wake of the downgrade.

The investment bank explained that its Buy rating is ‘underpinned by our expectation of a meaningful recovery in daigou infant formula (IF) sales in the next 3 years, plus substantial medium-term China IF share gains through its offline rollout and free trade zone expansion driving CBEC activity.’

As a result, UBS placed a price target of NZ$13.50 on A2M shares.

A2M’s valuation correction

As I’ve covered recently, A2M was valued so highly at one point that it looked more like a tech stock than a staples company.

Its price-to-earnings ratio of 38 in late 2019 eclipsed the PE ratio of tech giant Alibaba, which traded on a PE of 32.

Today, however, A2M’s valuation multiples are closer to its food business peers than tech firms.

It currently has a trailing PE of 14 and a trailing 12 months (ttm) price-to-sales ratio (PS) of 2.66.

Fonterra has a trailing PE of 12 and a PS (ttm) of 0.33.

What the broker ratings suggest is that the macroeconomic environment is not the only thing contributing to A2M’s share price slide.

It could also suggest that the company is undergoing a more general correction in its valuation, with its current price possibly better reflecting its position as a food company.

As we’ve discussed earlier, A2M went from the best-performing stock globally in a decade to one of the worst performing stocks on the ASX in 2021.

That kind of turnaround could make one uneasy about entering the stock market. Doubly so with inflation fears swirling around.

However, I do think I have an illuminating resource for you.

If you are looking for how to navigate this wild and low interest rate environment or are smarting from going long on A2M shares, I recommend watching Greg Canavan’s ‘Life at Zero’ presentation.

There are plenty of great insights there and he also shares his favourite stock for 2021.

Regards,

Lachlann Tierney,

For Money Morning

Comments