Well, that didn’t take long.

On 6 December 2022, my Daily Reckoning Australia article made the not-so-bold prediction of:

‘The absence of new money coming into the pyramid scheme, all-but assures us of more front-page news stories on the “unexpected” collapse of the crypto holdouts like Binance, Tether and a few others.’

This past week, the opaque practices of the cryptoverse have been once more in the news.

One of the few others I referred to is…Grayscale Bitcoin Trust.

On 6 December 2022, US hedge fund Fir Tree Capital commenced legal proceedings against Grayscale Bitcoin Trust (part of the Digital Currency Group) in the Delaware Courts.

If you are so inclined, you can access the 41-page filing here.

|

|

|

Source: Protos |

What’s prompted the US$4 billion hedge fund to launch this action?

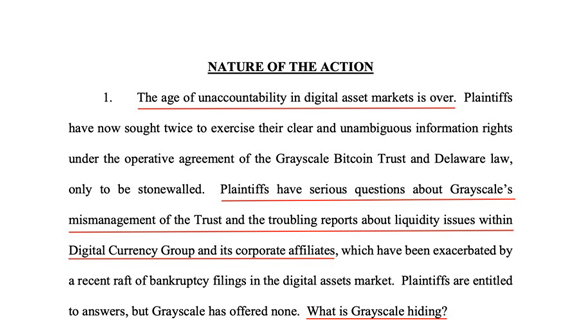

Fir Tree Capital’s Verified Complaint grievance is made evident in the first paragraph of the court filing (the red underlined emphasis added):

|

|

|

Source: Protos |

Lack of transparency. Reports of liquidity issues. Stonewalling.

Seems like these are all standard business practices in the mysterious world of cryptos.

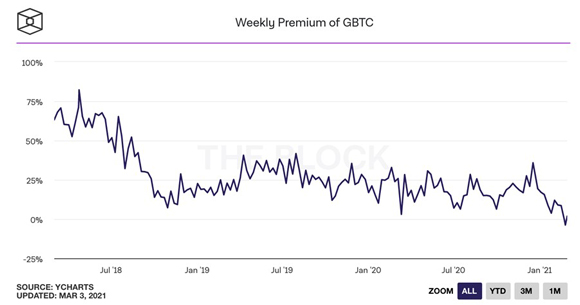

The issues now facing Grayscale investors were flagged as potential concerns in the March 2021 issue of The Gowdie Letter:

‘On 1 March 2021, Block Crypto published this article…

|

|

|

Source: Block Crypto |

‘What’s GBTC?

‘From Yahoo! Finance (emphasis added):

“The Grayscale Bitcoin Trust (GBTC) is the world’s largest bitcoin fund and the first investment vehicle of its kind to report financials regularly to the U.S. Securities and Exchange Commission (SEC).

“GBTC shares are part of a range of traditional financial products that track cryptocurrency prices offered by Grayscale Investments; the world’s biggest digital asset management firm and part of the Digital Currency Group (DCG) led by founder and CEO, Barry Silbert. DCG is also the parent company of Coindesk.”

‘GBTC provides investors the opportunity to invest (or speculate) in bitcoin, without buying it directly.

‘Therefore, the investor avoids the hassle of organising safe storage from hackers and having to remember the password.

‘The Grayscale Bitcoin Trust has proved popular with institutions…

“…nearly 20 institutions already filed paperwork with the U.S. Securities and Exchange Commission last quarter, showing they invested in the Grayscale Bitcoin Trust (GBTC)…”

Forbes, 6 August 2020

‘Apparently, institutions favour GBTC over holding bitcoin directly due to the transparency in the chain of custody…it makes it easier for auditors to verify the institution is actually holding what it says it’s holding.

‘This product feature is why GBTC was Wall Street’s preferred option for bitcoin exposure…and why the fund traded at a premium to its net asset value.

‘What’s the big deal about the GBTC premium collapsing from 25 to 30 percent down to zero?

|

|

|

Source: Block Crypto |

‘Glad you asked.

‘GBTC will issue new shares to institutional investors for “more or less” par value with one restriction…the shares must be held for a minimum of six months.

‘Over the course of the past two years, an institution could buy a US$1 share, that, on average, could be sold for $1.25 six months later.

‘Money for jam…so why not borrow to get some of this “all-but” guaranteed action?

‘With the evaporation of the GBTC premium…some institutions might start to face margin calls…which could bring more downward pressure on the price.

‘We’ll have to wait and see.’

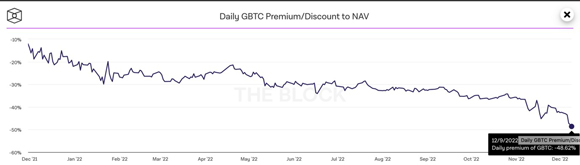

Here’s the latest on the Grayscale Bitcoin Trust (or should that be ‘lack of trust’?).

GBTC is trading at a DISCOUNT of almost 50% to its ‘supposed’ Net Asset Value (NAV).

|

|

|

Source: Block Crypto |

Why the hefty discount?

Grayscale report having 643,572 Bitcoins [BTC]’s worth more than US$10 billion (NAV).

But without a verified audit to confirm this, the market thinks it smells a rat…and is erring on the side of caution.

Fir Tree Capital have resorted to legal recourse to get answers.

Does Grayscale have the bitcoins or not?

Or has there been some funny business within the Digital Currency Group…just like Sam Bankman-Fried’s web of corporate deceit?

What happened to the money before and after 11:59pm?

Fir Tree Capital is also a little sceptical about Tether’s UNAUDITED claim its stablecoin is backed US$1 for US$1.

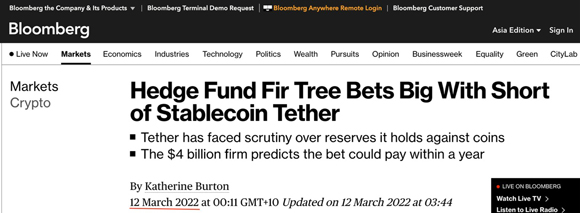

On 12 March 2022, Bloomberg reported:

|

|

|

Source: Bloomberg |

To quote from the article (emphasis added):

‘Fir Tree Capital Management is making a substantial short wager on Tether, the stablecoin that’s under intense scrutiny from regulators.

‘The $4 billion hedge fund, founded by Jeff Tannenbaum, constructed a way to short Tether in an asymmetric trade, meaning the downside risk is small and potential to make money is great, according to clients of the firm.’

Tether also has an aversion to being fully audited.

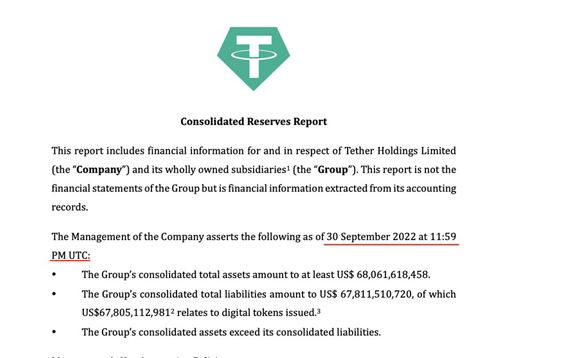

Every quarter, Tether posts a ‘Letter of Attestation’ from an accountancy group (at present, Tether has engaged BDO in Milan) that comes with one very critical caveat…underlined in red.

What happened to the funds five minutes before or after 11:59pm on 30 September 2022, is an unknown.

|

|

|

Source: Tether |

Tether’s resistance to undertaking and publishing a complete audit of its holdings is why Fir Tree Capital and others are betting against Tether surviving the coming crypto winter.

Personally, I think it’s a good bet.

When an audit is not really an audit

On 10 December 2022, The Wall Street Journal (WSJ) headline shone the spotlight on Binance’s lack of transparency:

|

|

|

Source: WSJ |

To quote (emphasis added):

‘Binance recently made a commitment to transparency, but it has a long way to go before it discloses enough meaningful information to give investors’ confidence in its future, accounting and financial specialists say.’

In an attempt to calm investor nerves, Binance engaged the services of mid-tier global accounting firm, Mazars, to conduct an ‘audit’ of its books.

This is why accounting and financial specialists are a little dubious about Binance’s attempt at transparency.

According to The Wall Street Journal article:

‘Mazars said it performed its work using “agreed-upon procedures” requested by Binance and that “we make no representation regarding the appropriateness” of the procedures.’

Binance has not yet realised the days of treating crypto investors like mushrooms is over.

Binance’s request for a blinkered view of its financial position falls just a little (make that a lot) short of accepted International Standards.

This sham audit only served to create even greater doubt over the solvency of Binance.

Can you imagine the Commonwealth Bank instructing its auditor to use only ‘agreed-upon procedures’ for the bank’s Annual Report? The CBA share price would plunge like a stone…bit like the Grayscale Bitcoin (lack of) Trust.

What happens in crypto, won’t stay in crypto

Vegas and cryptos have one thing in common…both are gambling haunts. But, unlike Vegas, what happens in cryptos won’t stay there.

As the truth slowly exposes the lies, deceit, and fakery behind crypto’s higher profile ‘pump and dump’ schemes, there will be spillover into US corporate debt markets.

There is never just one roach in a multi-asset bubble hotel.

Greed and speculation on the magnitude witnessed during the everything bubble, was not isolated to cryptos alone.

Corporates of lesser and dubious quality are certain to be adversely impacted by the coming collapse of the crypto pyramid.

Those default ripples will flow through the bond markets…starting with junk and then working its way up to BBB’s and so on it goes.

Yields blow out.

The value of bonds fall (due to the inverse relationship between higher interest rates and lower capital values).

Pension funds loaded up with higher yielding debt start to sink further into underfunded territory.

And we haven’t even mentioned what falling values in public and private equity holdings will do to the solvency of these receptacles of retirement capital.

Even though the real downside action is yet get underway, the bailout of pension funds has already started:

|

|

|

Source: The Washington Free Beacon |

What happens in cryptos will not stay in cryptos.

The first half of 2023 is promising to deliver the long overdue reckoning on what is destined to be referred to as…‘the greatest episode of mass delusion and speculation in market history’.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia