After soaring on Tuesday, Bubs Australia Ltd’s [ASX:BUB] share price is currently down 7% today as the market assesses China’s child policy.

BUB shares jumped over 20% to 41 cents on Tuesday, prompting an explanation from the ASX.

In response, the infant formula company pointed to news that the Chinese government will replace its two-child policy with a three-child policy.

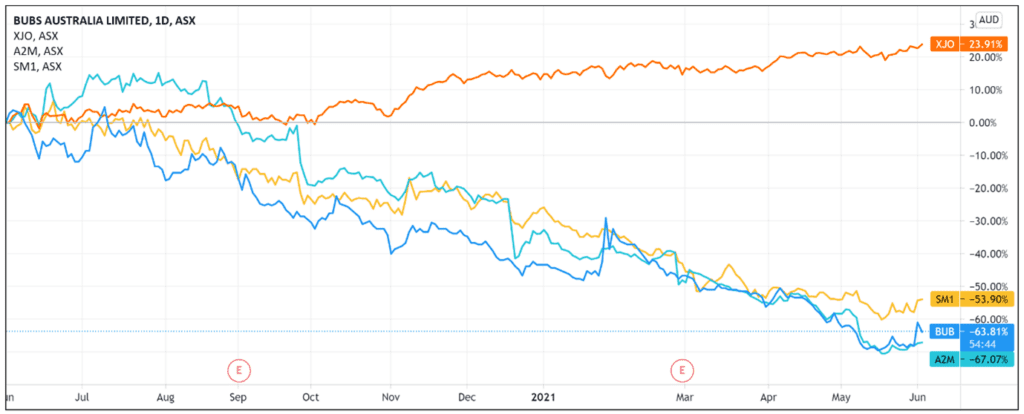

Despite yesterday’s gains, the BUB stock is still down 35% year-to-date and has underperformed the ASX 200 benchmark by 85%. Source: TradingView.com

Source: TradingView.com

BUB and demand for infant formula in China

When prompted by the ASX to explain BUB’s recent share price action, the company offered this explanation:

‘The Company is aware, via publicly reported news articles, that the Chinese government today announced it is scrapping a policy limiting couples to two children, and will now permit families to have three children without financial penalty with the formal introduction of a third-child policy.

‘The Company is aware that the policy announcement has been widely reported, both internationally and in Australia, including across the Australian Financial Review and ABC News.’

The market reacted positively to this development, as Bubs has a big exposure to the Chinese market.

The idea is that if the policy leads to a rising birth rate, it could lead to a rising demand for infant nutrition products.

As a2 Milk Company Ltd [ASX:A2M] itself admitted in its interim report for the six months ended 31 December:

‘Volume growth for the overall infant nutrition market in China was broadly flat in CY20, impacted by pantry destocking, COVID-19 disruption and a lower birth rate.’

However, while the policy is an admission by the Chinese government that the country’s birth rate is declining, it’s no guarantee the policy will be significantly adopted.

Will China’s new policy work?

As The New York Times reported overnight, while China’s state news media hailed the government’s announcement, the reaction across much of the country was indignation.

‘Women worried that the move would only exacerbate discrimination from employers.

‘Young people, who have barely been able to afford homes and necessities for themselves, were fuming.

‘Working-class couples said it would be impossible.

‘On Weibo, users complained of mounting education expenses, sky-high housing prices and unforgiving work hours, and pointed out a shortage of childcare options.

‘Some millennials are choosing a kid-free lifestyle, and many men are having vasectomies to ensure they remain childless.’

So while the market was initially buoyed by China’s announcement last night, BUB shares retracing today suggests that some investors are sobering up to the possibility that the three-child policy may not have a material medium-term effect on infant formula demand.

If you’re looking for how to navigate this wild and low-interest rate environment or are smarting from going long on Bubs shares, I recommend watching Greg Canavan’s ‘Life at Zero’ presentation.

There are plenty of great insights and he also shares his favourite stock for 2021.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here