Westpac Banking [ASX:WBC] rose on Monday, bucking the trend, as the ASX 200 fell 1.25% in afternoon trade.

Westpac shares were up 2.9% in afternoon trade as the Big Four bank reported $3.1 billion in first-half cash earnings.

Source: Tradingview.com

Westpac’s half-year results

On Monday, Westpac announced its half-year results.

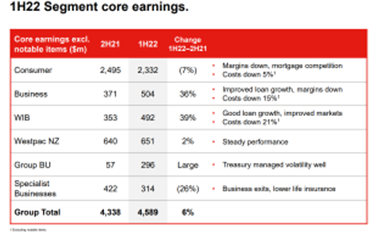

First half 2022 statutory net profit came in at $3.28 billion. This was up 63% compared to the second half of 2021 but down 5% on the first half of 2021.

In a similar pattern, cash earnings for the half reached $3.1 billion, up 71% on the second half of 2021 but down 12% on the first half of 2021.

However, revenue was down on both comparable halves.

2022 half-year revenue was down 3% on 2021’s second half and down 8% on 2021’s first half.

While revenue was down, Westpac’s costs managed to shrink at a faster rate.

WBC managed to cut costs by 10% compared to 2021’s first half and by 27% compared to 2021’s second half.

The improved cost reduction follows Westpac’s goal to achieve an $8 billion cost base by FY24.

The big bank was able to cut costs due to a ‘reduction in headcount of more than 4,000, lower occupancy costs and a reduction in spending on suppliers.’

Regarding lending, Westpac reported that lending rose 1% over the prior half, as the net interest margin declined by 14 basis points.

Westpac attributed the net interest margin reduction to competition:

‘The decline in net interest margin was due to competition across mortgages and business lending and from a shift in the mix of our portfolio to lower spread products, particularly fixed rate mortgages.’

WBC’s deposit-to-lending ratio rose to 83.5% as lending increased to $8.8 billion and total deposits also rose $20.6 billion over the period.

Source: Westpac

WBC share price outlook

WBC CEO Peter King said the bank was making ‘steady progress’ towards its goals as it manages a low-rate environment.

Westpac was able to maintain its return on equity (ROE) during the half, reporting a ROE of 8.7%.

That said, the ROE figure excluded ‘notable’ items like ‘provisions for estimated customer refunds and payments, associated costs and litigation costs; the write-down of assets, including goodwill and capitalised software; and the impact of asset sales and revaluations.’

The recent interest rate hike by the Reserve Bank of Australia is likely to ease pressure on the bank’s slim NIM (net interest margin), which could help improve ROE.

Despite the turbulent macroeconomic environment, the Westpac CEO remains upbeat about Australia’s economy, calling it ‘robust’.

Westpac then offered the following macro-outlook:

‘We expect the Australian economy to expand by 4.5% in 2022 but slow to 2.5% in 2023. Credit growth is forecast to be a strong 5.7% in 2022 slowing to 4.3% in 2023.

‘Demand for housing has already shown some signs of easing and rising interest rates are expected to contribute to a moderation in house prices next year.

‘As the economy moves into the rising rate cycle, it’s important to remember that rates are moving from a very low base and we already assess loan applications on higher rates, consistent with regulatory requirements.’

Source: WBC

All this uncertainty creates a volatile market.

But it’s precisely when others start losing their nerve that opportunities can present themselves.

Recently, our small-cap expert Callum Newman discussed three stocks that could defy the current interest rate hysteria.

If you want to check out Callum’s ideas on stocks trading at ‘crazy cheap’ valuations, go here now.

Regards,

Kiryll Prakapenka,

For Money Morning