Westgold Resources [ASX:WGX] scored a new production record at its Bluebird Gold Mine, leading the miner to believe its expansion plan is on the right track.

The latest of its drilling also delivered high-grade results, supporting the installation of three operation rigs with plans to accelerate operations.

WGX saw its share price drop by more than 1% in the early afternoon. A WGX share was worth $1.70, its longer-term stock pricing having been healthier lately, with a 94.5% gain so far in 2023 and 15% higher in the past month:

Source: TradingView

Drilling and expansions at Westgold’s Bluebird

Reporting from Perth, Australian gold miner Westgold appeared eager to share an update on its intended expansion for the Bluebird Mine, located at Meekatharra.

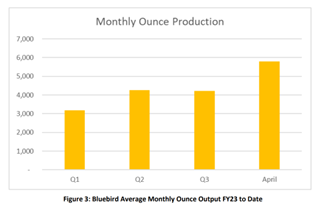

Westgold has produced a new production record only last month, reaching 48,000 tonnes at 3.7 grams per tonne, for 5,800 ounces of precious resources.

Westgold says this production rate confirms its expansion plan is on the right track.

The miner posted the following high-grade results, outside of mine footprint, for April:

-

‘94m at 7.32g/t Au from 195.04m in 22BLDD247;

-

‘72m at 8.53 g/t Au from 140.72m in 22BLDD278; and

-

‘59m at 3.94 g/t Au from 139.75m in 23BLDD026.’

Source: WGX

the company also states it now has three operational rigs. A second surface diamond drilling rig is now being prepared at the site in order to accelerate testing of the greater Bluebird resource (the group’s South Junction opportunity).

Westgold’s Managing Director, Wayne Bramwell, commented:

‘Westgold’s operational team has nearly doubled the monthly mining rate from this asset in the last 12 months with the production record achieved in April a credit to their efforts‘

‘With success in our latest drilling, we now turn our attention to areas outside of the current Bluebird mine footprint. The next target is to lift outputs well above current levels with the South Junction lodes providing the opportunity to expand towards 60-80kt per month at > 3.5g/t Au.

‘Our confidence in this system continues to build and with three drill rigs extending mine life and defining the South Junction opportunity, Westgold is now accelerating the next stage of expansion for this asset.’

Source: WGX

WGX says that it can attribute the increased output at Bluebird at steady increases in ongoing resource drilling.

There is also to be development of a second decline to open more work areas. Ongoing improved geological analysis has provided much support to the miner’s progress.

Growth in ‘operational efficiencies’ was also marked as a contributor to the higher results in April.

Along with increased physical output from the mine, there has been a consistent stream of high-grade drill results at and beyond the boundaries of the current Life of Mine plan, indicating strong mineralisation at current sites.

With these results in mind, the company will soon be adding another drill rig for both surface and underground activities.

The Bluebird underground mine and the Paddy’s Flat underground mine are the two primary ore sources feeding the 1.6-1.8Mtpa (million metric tonnes a year) Bluebird processing plant.

As more surface, infill and diamond drilling continues, the miner will take the data and accelerate continued ramp up of mining rates towards the 50,000-tonnes-per-month target.

The data will also support the next stage of the expansion planning and help to inform future decisions for scale of mining in a high-grade system.

How to buy and store gold in 2023

In a world where people are feeling more financial pressure than ever, this makes it even more important to find ways to build and protect wealth.

How are you meant to do this with the increasing interest rates, sky high energy bills and general dismal high cost of living environment?

Fat Tail’s gold bug Brian Chu, editor of Gold Stock Pro and host of the Bullion and Bordeaux Hour, has advice for those worried about the rapidly changing environment…and why gold just might be the answer.

Click here for Brian’s latest gold report.

Regards,

Fat Tail Commodities

Comments