Self-proclaimed successful and established Australian gold producer, Westgold Resources [ASX:WGX] today announced that it has hit a new production record for mine production at the Bluebird Gold Mine — a record of 49,000 tonnes at 4.0 grams per tonne of gold in the month of May.

Interestingly, the WGX share price had begun the day by rising nearly 4% in share price, but after lunchtime, the gold stock had fallen by around the same.

In the early afternoon, WGX shares were trading for $1.44 each with a 65% increase so far in 2023:

Source: TradingView

Bluebird delivers another record of gold production for May

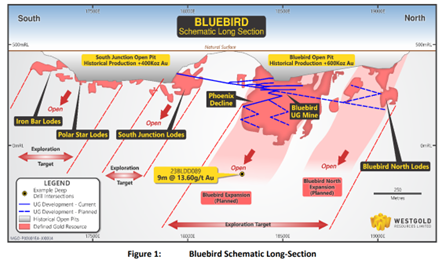

The Australian gold miner sought to update its investors on the latest progress it has made at its Bluebird Gold Mine at Meekatharra.

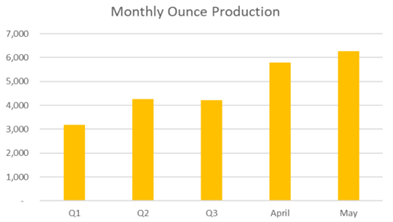

Westgold reported it had hit a new record in production at Bluebird. The group reached 49,000 tonnes at 4.0 grams per tonne of gold churned for 6300 ounces in the month of May — an 8% increase on April’s 48,000 tonnes at 3.7 grams per tonne for 5800 ounces.

The gold miner also revealed that it has found a new high-grade intercept at nine meters at 13.6 grams a tonne of gold from 638.4 meters returned in drill hole 23BLDD089, which was reportedly found outside the current Mineral Resource footprint.

Westgold has three drill rigs operating — and a third South Junction hole which is currently still in progress — and the surface diamond drill holes are now well underway. Westgold says these will assist with gaining a broad scale understanding of what will be used as a mineralised system of support for extending the mine plan.

The gold miner says these initial holes will also be helpful in forming a comprehensive drilling program to be undertaken from underground once drill platforms become available.

Source: WGX

Managing Director of Westgold, Wayne Bramwell commented:

‘The excitement around our Bluebird underground operation continues to grow. Following a massive rain event late in April, the Bluebird team has smashed another production record in May with 49kt, delivering 6.3koz at above the scheduled mine grade. Improving month-on-month output reflects increasing understanding of the geological controls and improved operational execution.

‘Time will tell how big this system can be. Westgold has doubled the output from this mine in the last 12 months and our drilling has not yet defined the vertical or lateral limits of this system.’

Westgold says that it has seen some momentum building at its Bluebird operation. The main ore sources feed into production stemming from its Paddy’s Flat underground mines, reportedly 1.6 to 1.8 million metric tonnes per year for its processing plant at Meekatharra.

The 8% growth in month-on-month production rates was said to have reflected the improved understanding of the project’s geological system, with better mine scheduling and operational delivery.

Below is a graph representing the average monthly ounce output so far in fiscal 2023:

Source: WGX

The red draught and what to do with it

Stopping climate change will require trillions and a global supply of critical minerals — one special metal from this range is copper.

This means that we’re going to need a lot of red metal, and more exploration will be required to restock supplies.

If you subscribe to Fat Tail Commodities, you will have access to the most recent insider report on the subject from our resources expert, James Cooper — all for free.

James will give you instant tips on stock picks for the copper industry. He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about making money from the red draught and click here today.

Regards,

Fat Tail Commodities

Comments