Dear Reader,

‘Did you hear about the farmer that gave his farm to his children? He got done for child abuse!’

A Dear Reader

This just in. USA Today:

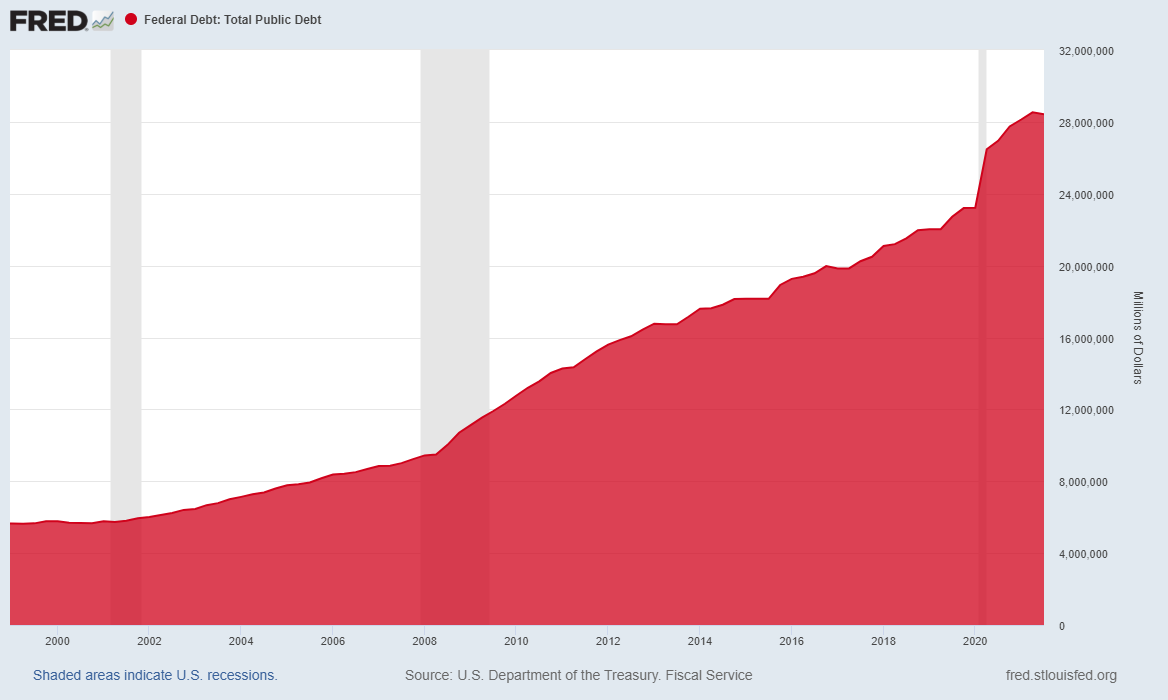

‘Sound the alarm: National debt hits $30 trillion as economists warn of impact for Americans…

‘The national debt surpassed $30 trillion for the first time Tuesday, fueled in part by the coronavirus pandemic and what economists describe as years of unsustainable government spending that could have long-term consequences for every American.

‘The federal government now owes $23.5 trillion in debt to creditors and another $6.5 trillion to itself. Debt to creditors soared by $1.5 trillion over the last year alone, according to the Peter G. Peterson Foundation, a nonpartisan organization focused on addressing the country’s fiscal challenges.

‘“It does not make sense as a society to simply spend more than we take in on a permanent and growing basis,” said Michael A. Peterson, the group’s chief executive officer. “What that essentially does is place the burden onto our future and onto the next generation.”’

Globally, the situation is no better. The borrow-and-spend spree of the 21st century has led to worldwide debt of US$300 trillion — more than three times world GDP.

Yesterday. Today. Tomorrow.

This week we are wondering about the connection. Without yesterday, today wouldn’t be the same. And when we climb onto the bathroom scales tomorrow, is it today’s pudding the needle will detect?

Without two decades of jackass policies, the US wouldn’t be facing US$30 trillion worth of ‘national’ debt. George W Bush’s nonsense ‘War on Terror’ cost some US$8 trillion. Then, when Barack Obama and Ben Bernanke rescued Wall Street’s bonuses in 2008–09, they added another US$8 trillion to the debt. In 2020, along came the COVID crisis. Stocks fell. The feds panicked, and another US$8 trillion in debt was piled on, making the rich richer than ever.

Welcome to Mt Debtmore!

|

|

|

Source: US Department of the Treasury |

Thanks to the Fed’s ultra-low interest rates, they’ve added a total of US$24 trillion to federal debt since 1999. The low rates also made borrowing more attractive to the rest of the economy. So now — in addition to the stinking federal pile — we have a US$56 trillion mountain of household and corporate debt.

A trillion here. A trillion there. Pretty soon, you’ve got a real Everest of trouble.

But what a jolly time it was. Building shining new democracies in Iraq and Afghanistan. Boosting up the stock market to record new highs. Buying back stock. Bidding up jokey cryptos and cool NFTs to millions of dollars. Squeezing the old-timers in meme stocks and watching geezers like Buffett plod along while the whiz kids raced to fast fortunes. Handing out loans that didn’t need to be repaid…and giving out tax credits and stimmie cheques to people who didn’t pay any taxes in the first place. Whee!

And probably the most fun of all — listening to the melancholics warn of ‘bubbles’ and ‘debt’…what were they worried about? The money was free, for Pete’s sake. You could borrow all you wanted — at less than the inflation rate.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Alas, that was yesterday. And today, even The New York Times is beginning to add two plus two:

‘Either the United States can continue to run big deficits and skate along with no harm done or it’s at risk of losing investors’ confidence and having to pay higher interest rates on its debt which would suppress economic growth.’

The ‘either-or’ outlined by the NYT is a fantasy. There’s an ‘or’ but no ‘either’. Skating along while adding more and more debt is not a possibility. Not for long.

Lost in fiscal space

‘My reading of the evidence’, continues Peter Coy in the Old Gray Lady, ‘is that the huge increase in federal debt incurred during and after the past two recessions — those of 2007-09 and 2020 — has used up a lot of the “fiscal space” the United States once had. In other words, the federal government is closer to the tipping point where big increases in debt finally start to become a real problem and interest rates rise.’

Mr Coy had just come from an online annual meeting of the Allied Social Science Associations, which includes the American Economic Association as well as the American Finance Association.

The question on the table was roughly ‘when do we have so much debt that the system breaks down?’.

The answer, paraphrasing Mr Coy’s summary of the proceedings, is ‘probably tomorrow’.

Causes have effects. Actions have consequences. Borrow too much today, and your credit score goes down tomorrow. Then, if you can borrow at all, you’ll have to pay a higher interest rate. And with US$86 trillion outstanding, even very small increases in interest rates (carrying costs) can be devastating.

A real ‘normal’ interest rate is, say, 3%. With consumer prices rising at a 6% rate, that would mean a nominal rate of 9%. If the entire debt had to be refinanced at 9%, it would cost about a third of annual GDP. Obviously, normal is not going to happen. (On Monday, we’ll look at what is likely to happen.)

‘Fiscal space’ is another way of describing how much rope a country needs to hang itself. When the borrowing capacity of the government — the ‘fiscal space’ — is exhausted, the borrowing must stop, or the consequence is bankruptcy. ‘Debt doyenne’ Carmen Reinhart, who, along with Ken Rogoff, studied 800 years of public debt history, puts it like this:

Adverse debt dynamics sooner or later come back to bite you.

Actions always smile. But consequences have teeth.

Tune in on Monday for more.

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.