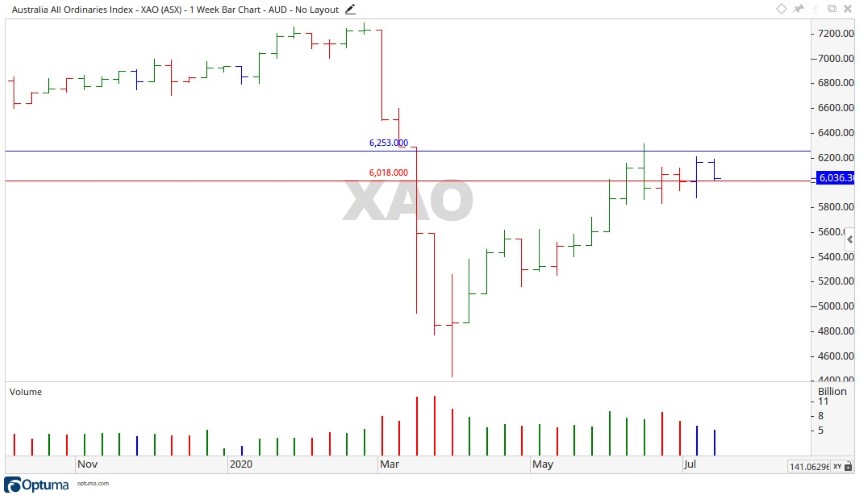

Last week saw the All Ordinaries [XAO] pull back as it struggles to break through the level of 6,253 points. Closing out the week on 6,036 points and on decreasing volume, and with all trading days moving down last week, the move up may be in danger.

Source: Optuma

The week ahead for the All Ordinaries

This week coming the All Ords is starting to look like it may have run out of steam. The level of 6,253 points is showing itself as a tough nut to crack, with the price moving sideways just under this level for the last four weeks.

The close last week was at the lower end of the trading range for the week, so I suspect a move down may be afoot.

If [XAO] moves down below 6,018 points, the next level on the horizon to be aware of is 5,853 points.

Source: Optuma

A closer look at the winners and losers on the All Ords

It was somewhat of a mixed bag last week, the sector winners were Information Technology and Communication Services, moving up 1.90% and 0.87% respectively.

On the losing end, Real Estate pulled back 5.42%, along with Industrials and Health Care, down 4.59% and 4.46% respectively.

As for winning stocks, St Barbara Ltd [ASX:SBM] shot up 10%, with Fortescue Metals Group Ltd [ASX:FMG] and Mineral Resources Ltd [ASX:MIN] also up 6.07% and 4.27%.

On the downside, Lendlease Group [ASX:LLC] pulled back 10.13%, as did Cimic Group Ltd [ASX:CIM] and Aristocrat Leisure Ltd [ASX:ALL], falling 8.57% and 9.49%.

Outlook for ASX this week

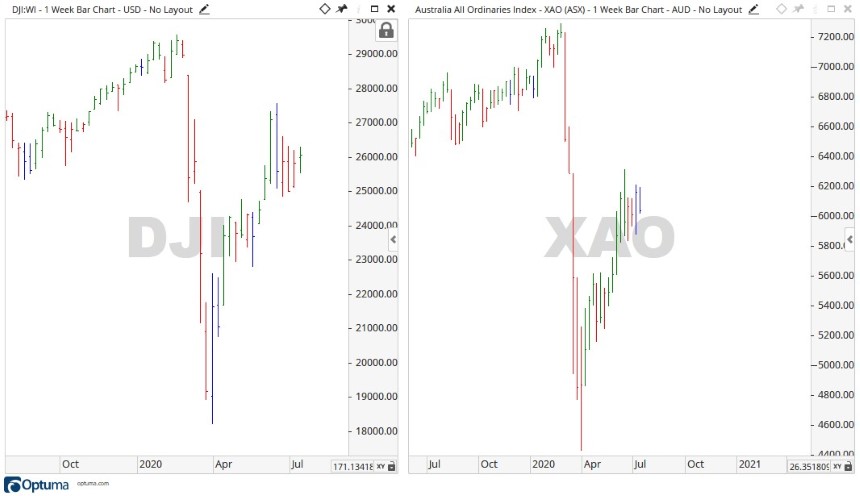

In my opinion things are looking a bit crazy. The Dow Jones Industrial [DJI] keeps pushing up as does the Australian market, all while a second wave plays out.

Here in Australia, Victoria is now into another six-week lockdown, more cases are appearing in New South Wales, and in the US the country is hitting grim records with over 60,000 new cases a day.

At some point, the rally may unwind.

Source: Optuma

As can be seen above, [DJI] and [XAO] trace a similar path as the ASX is typically highly correlated to the US stock market (Dow Jones or S&P 500), with the opening level of the ASX often determined by what the US markets did the previous night.

With this correlation in mind and considering the havoc COVID-19 is causing both here at home and abroad. The question must become, how far can the markets run up?

We’ve discussed the disconnect between economies and markets before.

When will the two catch up to each other? Well, we will see in the coming week and beyond.

Regards,

Carl Wittkopp,

For Money Morning