What a week it was on the tech front last week!

A slew of good results from big-name tech companies saw investors pile in on Friday.

The most notable company reporting was Apple Inc. [NASDAQ:AAPL].

More on this shortly…

A weaker-than-expected April jobs report on Friday also helped the positive sentiment in tech.

The market thought this ‘bad news’ was ‘good’ for the possibility of interest rate cuts sooner rather than later.

The tech sector is particularly sensitive to interest rates as they feed into analyst models of future cash flows.

It’s a concept known as ‘present value’.

In short, any fall in interest rates makes future cash more valuable in today’s money.

Anyway, the tech-focused Nasdaq Index looks set for an attack on new all-time highs this week.

But beyond the index, several key areas are worth paying particular attention to.

Let’s dig in…

Are Apple’s best days behind it?

On Thursday, Apple announced their latest results.

The headline grabber was a whopping US$110 billion stock buyback. A stock buyback is when a company uses its own cash to buy back its own stock.

Prior to the 1980s, these buybacks were deemed illegal stock manipulation as they inflate a company’s share price and boost its earnings per share.

But investors generally like that as it can support or even drive up the stock price.

And that news seemed to take the edge off poor iPhone sales, which dropped 10% in revenue terms.

Apple ripped 6% higher on the day.

However, I wonder if this buyback is a sign that Apple’s best days are behind it.

Buying your own stock isn’t the same as investing in productive assets or new technologies.

It’s dead money.

And there’s an AI arms race on right now, so you’d think Apple wouldn’t be short of places to invest.

In saying that, CEO Tim Cook teased out the potential of incoming developments on the AI front on an analyst call, so perhaps they feel they can do both.

One notable seller last quarter was Warren Buffet, selling 13% of his position.

Though Apple still makes up almost one-third of Berkshire Hathaway’s US$364 billion portfolio, so this could simply be a bit of risk management.

Still, I’ll be eagerly awaiting news on Apple’s latest innovations — after all, it’s what Steve Jobs made the company famous for…not financial engineering.

Staying on the AI front…

On Wednesday, Microsoft CEO Satya Nadella pledged a US$2.2 billion investment to build digital infrastructure in Malaysia.

It’s part of a broader push into the fast-growing economies of Southeast Asia, which are investing heavily in an AI-led future.

There seems to be news about new data centre builds almost every week right now.

Which brings me to energy.

Bloomberg had an interesting story on the intersection of energy and AI.

The article noted that single data centres will need as much power as ‘several nuclear reactors’ because of AI.

Bullish on uranium!

Away from AI and onto another highly disruptive asset class…

Blackrock sees ‘influx of demand’

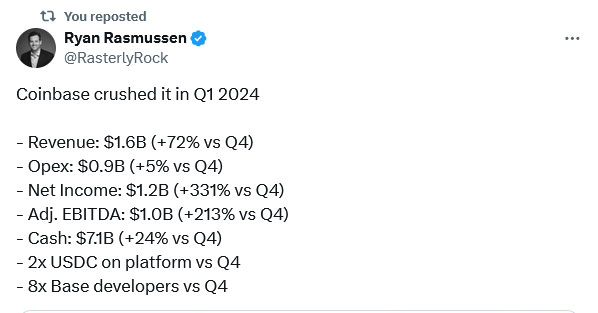

Crypto company Coinbase Global Inc. [NASDAQ:COIN] absolutely smashed analyst expectations over the first quarter.

As this tweet noted:

| |

| Source: X.com |

And some people think crypto is dead!

These numbers will certainly make Wall Street sit up and take notice.

Staying on the crypto theme…

Jack Dorsey’s Block Inc. (formerly Square) announced they will contribute 10% of gross profits from their Bitcoin operations into Bitcoin as a long-term Treasury asset on a regular basis.

This copying of the highly successful MicroStrategy playbook could be the start of a wave of corporate interest in Bitcoin.

As MicroStrategy’s CEO Michael Saylor put it:

‘It takes 2–10 companies to act and you kick off a roaring bull run’

Maybe that’s wishful thinking from the well-known die-hard Bitcoin bull.

But here’s the thing…

He wasn’t alone in voicing such opinions last week.

Despite the recent pullback in the price of Bitcoin, huge money manager Blackrock put out a note saying they were seeing an uptick in interest from traditional investors:

The coming months could see financial institutions such as sovereign wealth funds, pension funds and endowments start to trade in the spot ETFs, Mitchnick said in an interview.

The firm is seeing “a re-initiation of the discussion around bitcoin,” which turns on the topic of allocating to bitcoin (BTC) and how to think about it from a portfolio construction perspective.’

You’ve always got to be ready for risk and stiff price volatility — and a lot of drama — in Bitcoin and crypto.

But when you look under the hood, it’s clear this tech trend is gathering steam.

Indeed, in a strange twist of fate, some serious people think Bitcoin could be the native currency for AI.

Ex-Facebook executive, and former PayPal President David Marcus said this at the Bitcoin for Corporations event in Las Vegas (yes Bitcoin sceptics, I get the irony of this location!) last week.

As reported:

He argued that BTC could eliminate the inefficiencies and “friction” inherent in fiat currencies, predicting that AI agents will adopt this “digitally native” medium for value exchange.

Marcus claimed that Europeans won’t accept the American version of this theoretical medium for AI agents to exchange value or vice versa. “And what is the most neutral form of digitally native, internet money? It’s bitcoin,” Marcus insisted.

‘He noted that if BTC can meet the speed of AI it’s “basically going to be the native currency of AI.”’

This is a trend that I think will slowly sneak up on the world.

Paying attention now could pay dividends later.

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments