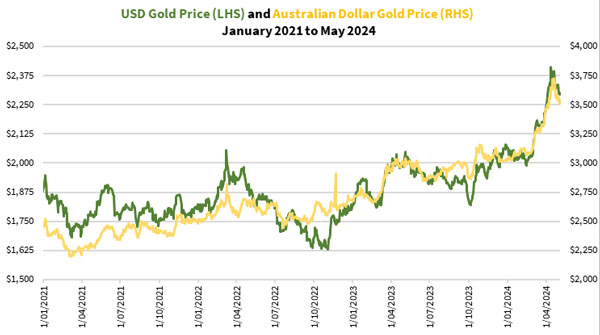

Gold has rallied strongly in the last few weeks, going parabolic since mid-March.

Recently, this rally took a break as tensions in the Middle East temporarily de-escalated. Have a look below:

| |

| Source: Refinitiv Eikon |

Now, this is not the end of gold’s ascent… I believe it’s having a brief pause.

But why hasn’t this year’s outstanding rally captured the public’s attention?

The exceptional move should have sparked a much broader interest in gold. But that hasn’t happened yet.

It wasn’t long ago that lithium or uranium was a hot commodity. The media was brimming with articles touting both metals, spurring the public to pay attention.

However, gold hasn’t received the same reception. In fact, rather than buying more, some investors are selling!

According to Investor Daily, gold consumption among Australian investors fell in the past year to the lowest on record. This trend went against the trend of the Asian markets.

The article also noted a fall in the amount of gold held by global exchange-traded funds (ETF) over the last two years, even as the price of gold rallied.

Where did the gold go?

The answer is that central banks and Asian buyers have bought up more gold over this period. And only recently did the US funds shift towards buying more gold.

With Australian investors behaving this way, it begs the question how can we make gold great again?

The silent disintegration of fiat currencies

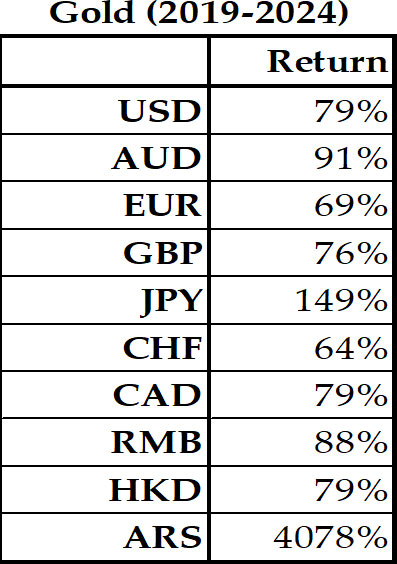

Let me show you how the price of gold has changed since 2019 for some of the major currencies in this table below:

| |

| Source: Refinitiv Eikon |

Did you expect gold to deliver such an astounding return over these five years?

In case you’re wondering what ARS stands for, it’s the Argentinian Peso.

While various stock market indices rose similarly over the same period, it was a rougher ride.

I’ll let you in on something while we’re at it.

Gold hasn’t become more valuable over the years. It’s the currencies that are losing purchasing power.

This is what you’re receiving in return for your labour and brainpower. Gone are the days when you could rely on your paycheque and save to build wealth.

Let that sink in!

Gold: Misunderstood and vilified by design

We know gold has been money for several thousand years. It’s a tale as old as time.

However, the advent of central banking and technology has turned gold into an antiquated asset.

Central bankers, investment legends such as Warren Buffett, the mainstream media, and academics have publicly criticised gold.

They’ve called it a ‘barbarous relic’ and ‘pet rock’ and used the argument that ‘you can’t eat gold’ to explain why gold isn’t worth your attention.

In response to the argument ‘you can’t eat gold’, here’s my rebuttal:

‘With respect, do you eat bank notes, coins and numbers in your bank account statement?’

Snarky comments aside, I believe every man or woman should take gold seriously.

Especially when gold has stealthily increased in price against all the world’s currencies over time. You’ve seen how it’s moved at an alarming pace over the last five years.

If you’ve read my Fat Tail Daily articles for some time, you know that I don’t believe that it’s an accident that gold is unloved by the general public.

Not just unloved but deeply misunderstood.

By keeping us ignorant, households and businesses will find it increasingly difficult to retain their wealth. A system that has central banks’ lending to the government, which in turn puts the people on the tab to repay will create an enslaved population.

That’s why you pay taxes. Someone has to repay the debt to the central banks! Money doesn’t grow on trees.

Knowing the secrets of gold can help you unshackle your bonds (pun intended), stand in the way of government irresponsibility, and purge the parasite that we know as inflation.

Moreover, you regain your liberty and the ability to build wealth to pass onto generations.

Make gold great again by

making money matter

Last Wednesday, I joined Kerry Stevenson from Making Money Matter and organiser of the Australian Gold Conference, Simon Lawson, the Managing Director of Western Australia-based gold developer Spartan Resources [ASX:SPR] and Hedley Widdup, fund manager at Lion Selection Group [ASX:LSX] to talk about the latest events happening in the gold space.

In the 30-minute chat, we looked at what drove the price of gold higher in recent times, why gold is unloved in Australia, the valuation gap that exists between gold and gold stocks and the factors causing this.

I invite you to listen to this chat and stay tuned to Kerry’s channel as she hosts weekly discussions with key industry figures on matters relating to gold.

Also, this year’s Australian Gold Conference is happening from Monday 26th to Wednesday 28th August at Crown Towers in Barangaroo, Sydney. You can find out more about the event or register to attend by going to this website.

I’m pleased to inform you that I’ll be presenting this year about how to build a precious metals portfolio and the tools I use to give me an edge in selecting gold mining stocks.

Those of you who are already a member of my gold newsletters, The Australian Gold Report and Gold Stock Pro, have already tried it out for yourselves.

It hasn’t been an easy journey given that gold has been rising these three years, but gold stocks have languished. However, the trend has shifted in favour of gold stocks recently and momentum is picking up.

If you haven’t built up a precious metals portfolio yet, now is the time to consider doing so.

Let me guide you in getting started. Consider signing up to The Australian Gold Report and I’ll show you three gold stocks plus a comprehensive guide on buying physical bullion, precious metals ETFs, and more!

Why not join us in making gold great again in Australia?

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report