Israel-based semiconductor company Weebit Nano Ltd [ASX:WBT] witnessed a staggering rise in its share price today, climbing by an impressive 14%.

This significant uptick has undoubtedly caught the attention of investors, especially when viewed in contrast to the broader market performance.

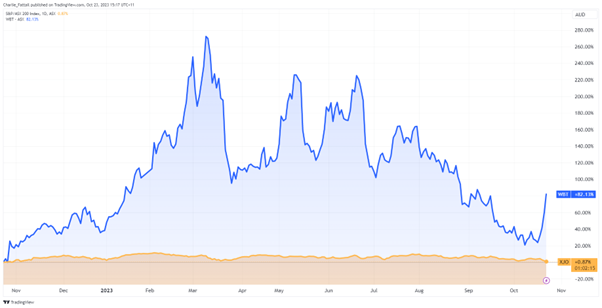

The ASX 200 is currently down by 0.89%, making Weebit Nano’s remarkable rally even more noteworthy against a backdrop of share price losses and rising tensions in Israel.

The company has seen significant volatility this year as hopes of the company’s growth have been weighed down by wider negative sentiment in the highly interest-rate-sensitive tech sector.

But the caution in the broader market was outshone by the latest news that the company has signed its first commercial agreement with DB HiTek, one of the world’s largest semiconductor chip foundries.

Weebit has seen its share price gain 98.48% in the past 12 months, with an impressive 44% coming after the announcement late last week.

Source: TradingView

Weebit licences ReRam to DB HiTek

The commercialisation agreement signed with DB HiTek means that Weebit’s specialised low-voltage, cost-effective ReRam will be available to the foundry’s many customers.

Headquartered in South Korea, DB HiTek is a global top-10 foundry with an annual revenue of over $2 billion.

How much of that vast revenue share Weebit is likely to see remains uncertain, but the company said it has seen ‘increasingly strong demand’ for the product.

Despite the positive news, there have been concerns about the company’s operations.

After the attack by Hamas on Israel, the company assuaged shareholder concerns by saying that it has a ‘proud tradition of not a single day [of work] lost‘ and has continued with remote work.

CEO of Weebit Nano, Coby Hanoch, remained focused on the deal, saying:

‘As one of the world’s largest contract chip manufacturers, DB HiTek’s extensive customer base can gain significant advantage from using Weebit ReRAM in their new product designs, including improvements to retention, endurance, and power consumption. Our collaboration with DB HiTek is commencing immediately, beginning with the transfer of our technology to the company’s production fab.’

Under the technology transfer and qualification agreement, Weebit and DB HiTek will immediately cooperate in transferring Weebit’s embedded ReRAM technology to aDB HiTek production fab and then continue to qualify the technology towards volume production.

Outlook for Weebit

Three major concerns hang over the otherwise extremely positive news from Weebit’s new agreement.

Firstly, there are the operational concerns of a broader conflict in Israel. Israel’s booming tech sector has nearly doubled over the past decade to become its largest sector — constituting 18.1% of its GDP.

Bloomberg reporting earlier this week has highlighted the toll the conflict has already had on many of these tech start-ups that are seeing, on average, approximately 25% of their workforce called up into army reserves or affected by the attacks.

This could be increased if the conflict expands, potentially harming the company or its workforce.

The next concern is around the broader tech industry. With the Magnificent Seven tech stocks (Apple, Amazon, Microsoft, Google, Tesla, Nvidia and Meta) all reporting this week into a weakened market— there could be scope for a wider tech correction if their earnings disappoint.

The final cloud looming over the deal is the uncertainty around the revenue Weebit will expect to earn from the agreement.

The ReRam is a specialised feature that not every chip customer wants or needs.

On a more positive note, the current flash memory market is estimated to be over US$67 billion and rapidly growing, so even a tiny slice of that market could be significant for the company.

That growth will likely be tied to the expansion of Internet of Thing (IoT) devices that favour low-voltage, low-cost chip options.

For now, it looks like investors are happy with the company’s progress.

Whatever comes next, it’s an exciting time for the company and the broader market.

If you think that the ‘Magnificent Seven’ isn’t going to live up to expectations this week, then maybe you need to think about repositioning your portfolio.

They collectively make up approximately 30% of the S&P 500 and have contributed almost 65% if its returns this year.

Defensive positions worth your time

The market has roiled stock investors for the past year — steady ground has been rare.

With things looking uncertain in the stock market, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short-term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and he believes it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive with cash and bonds, you may want to consider making a smart play.

Click here to learn more about what that looks like.

Regards,

Charles Ormond

For Money Morning