The Webjet Ltd [ASX:WEB] share price rose on news the government will support the domestic travel sector. We examine what that means for WEB and its stock.

At time of writing, the share price of Webjet Ltd [ASX:WEB] shares are down slightly by less than .7%, trading at $6.04.

As many say, with crisis comes opportunity.

In Webjet’s case however, nothing followed the COVID-19 crisis except a sharp slide for its share price.

A business catering to flight travel will not enjoy a rosy period when international and interstate travel is grounded.

Yet, with Australia’s suppression of COVID transmission, lifting of interstate border restrictions and the rollout of vaccines, the runway is clearing for Webjet’s business and its stock.

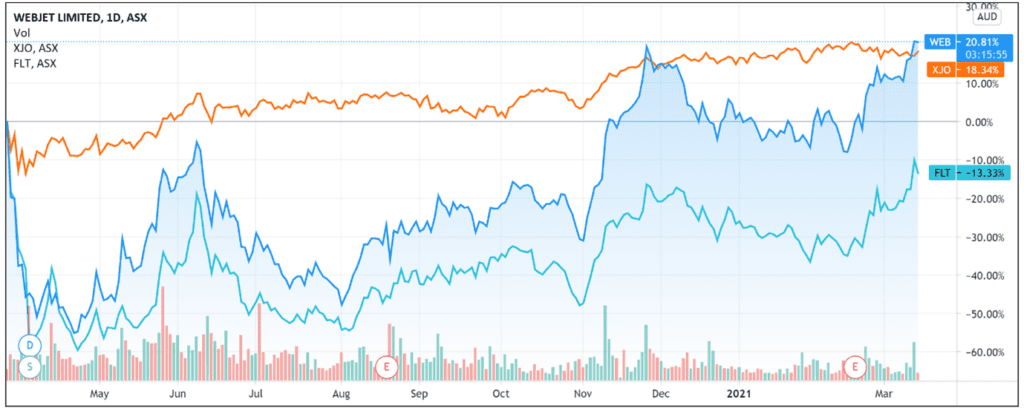

WEB’s share performance of late has seen its shares up 26% over the last month, up 20% YTD and up 51% over the last year.

WEB shares are up 23% on the ASX 200 [XJO] benchmark.

That said, the WEB stock is still trading way down from its late-2018 peak of $16.88 per share.

Federal government’s half-price tickets package

On Thursday, the federal government announced a $1.2 billion support package aimed at the travel sector.

The ailing sector suffered from border restrictions and border closures to international travellers.

The stimulus package includes subsidised plane tickets to incentivise domestic travel.

About 800,000 half-price tickets will be circulated to induce interstate travel to areas dependent on aviation for tourism.

Investors certainly appreciated the news.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Flight Centre Travel Group Ltd [ASX:FLT] shares jumped as much as 10% at one stage on the news.

And Webjet shares rose as high as 7%, trading as high as $6.28 per share.

As covered here back in January, we flagged that Flight Centre could be a viable long-term investment, if you have the patience that is.

Webjet FY2021 half-year results

Webjet’s FY21 half-year results were a sobering read for many investors.

Revenue from ordinary activities decreased by $195.3 million from previous corresponding period. The drop represented a 90% change.

As a result, Webjet reported a net loss attributable to members of $132.2 million, down from a profit of $9 million.

The per cent change was significant enough for Webjet to simply label it ‘large’ in its Appendix 4D release.

Loss per share from July to December of 2020 came to 39 cents compared with earnings per share of 6.6 cents in the previous corresponding period.

However, there was good news.

Webjet OTA reported a profit as the Australian domestic leisure market partially reopened late in 1H21.

According to the company’s release, bookings increased as borders reopened, ‘reflecting strong pent-up demand and Webjet OTA’s highly variable cost base enabled an immediate uplift in profitability.’

Webjet stated it will continue to focus on growing its B2C business ‘organically as leisure travel recovers.’

Speaking to the Australian Financial Review, Webjet Managing Director John Guscic said that its cash position and a cash burn of $4.8 million ‘enables us to withstand any protracted recovery challenges that may fall out.’

RBC Capital Markets analyst Tim Piper told the Australia Financial Review that underlying volumes in Webjet’s business were certainly low.

But Mr Piper did note one positive — Webjet’s online sales site returned to EBITDA-profitability thanks to resumed domestic travel activity.

Webjet’s debt covenant extended

Subsequent to the FY21 half-year results, Webjet reported a successful negotiation to extend its debt covenant waivers from June 2021 to March 2022.

The minimum liquidity requirements of $125 million remained unchanged.

The next covenant test period will be the quarter ending 30 June 2022.

Debt covenants can restrict certain borrower actions that can adversely impact the lender.

Benefits to entering such covenants can include cheaper rates by lenders to compensate the imposed restrictions on the borrower.

Analyst view on Webjet share price outlook

Speaking to Livewire markets about Webjet’s prospects, Monash Investors’ Simon Shields rated the stock a buy.

Mr Shields pointed to the company’s improving cash burn and the market’s seemingly optimistic perception of the stock.

Mr Shields concluded by saying that with travel stocks coming out of a downturn, analysts ‘generally underestimate that consumer response.’

And while he believes the market is starting to anticipate that, it’s not doing it fully enough, and that’s why Webjet shares are a buy in his view.

In contrast, Aberdeen Standard Investments’ Michelle Lopez deemed WEB stock a hold at current levels.

Ms Lopez acknowledged Webjet is a solid business nicely leveraged for the reopening of leisure travel.

However, Ms Lopez thought last year’s diluted equity raise on top of the convertible notes Webjet priced in July all contribute to a ‘share price that’s equivalent to, say, $5, pre-COVID.’

Ms Lopez also cautioned that the market may be underplaying the risk still ahead during the recovery pathway. In her view, ‘there is still a lot of uncertainty about how this plays out.’

Finally, if you’re trading these types of ‘recovery shares’ and you want to arm yourself against uncertainty and understand risk, then this report is a great place to start.

The report includes the insights and technical analysis strategies of our chart guru Murray Dawes.

Highly recommend.

Regards,

Lachlann Tierney

For Money Morning

P.S: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.