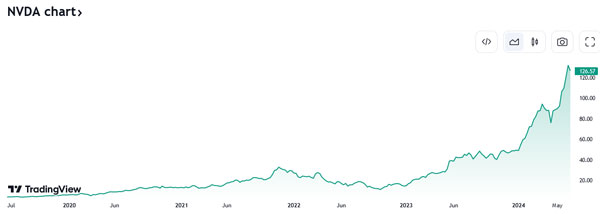

Is Nvidia Corp. [NASDAQ:NVDA] in bubble territory?

And if so, when it pops, what happens to the market?

That’s the question many people are asking these days.

Check out the chart:

| |

| Source: Trading View |

Nvidia just passed Microsoft to become the world’s most valuable listed company.

Such rapid success can bring its own set of unique problems.

Get this…

Apparently, the company is having problems keeping engineers who’ve seen the value of their stock options—a common part of tech sector salary packages—soar.

Some employees are retiring after getting these windfall gains, in some cases, over $10 million worth!

Maybe that’s what’s happening here?

| |

| Source: X.com |

A host of insiders are selling shares to bank some of their windfall gains.

A warning sign?

Perhaps…

Still, the chipmaker remains the hottest property in town.

They continue to beat analyst revenue expectations because their GPU chips are the best in the business for training AI (artificial intelligence) models.

And they’re probably one or two years ahead of their nearest competitors, though that gap will close over time.

Nvidia are pressing home their advantage by building out the AI eco-system as fast as they can.

This is the key point of today’s piece.

Understanding how they’re doing this is why Nvidia manages to beat analyst expectations every quarter.

The longer they can do this, the longer the share price holds up. But if it slows down too soon, look out below!

Let me explain…

The Nvidia flywheel

As it stands, Nvidia trades at a price-sales (P/S) multiple of 40. That’s pretty high.

To give you a comparison, Cisco was trading at a PS ratio of 35 times on 24 March 2000, at the peak of the dot-com boom.

Intel was at 16 times, Qualcomm was at 22 times, and Oracle was at 27 times.

Clearly, Nvidia is in danger territory right now.

But what’s propping up its valuation right now is the pace of revenue growth.

Nvidia is delivering triple digital revenue gains of 208% year over year.

Tech investors pay up for revenue growth. They always have and always will.

The trillion question is: How long can it sustain such amazing revenue growth?

This is where Nvidia’s flywheel strategy comes into play…

A flywheel is a self-perpetuating revenue model where success begets more success.

It’s the ideal sales model because once the flywheel starts turning, the effort required for each incremental sale gets easier.

Nvidia has its own version of this, and it’s what supports the current earnings expansion.

You see, many of Nvidia’s customers are partly owned by Nvidia’s investment arm.

They’ve invested in around 32 start-ups independently or with other AI-aligned firms, like Meta and Amazon.

The investments include participating in a US$1 billion round in Scale AI, Figure’s US$675 million raise, and Paris-based Mistral AI’s US$640 million funding round.

These are all AI companies involved in data, robotics, and specialist generative AI software solutions.

And guess what they all use this newly raised money to buy in large quantities?

Nvidia’s GPU chips of course!

CoreWeave is another big Nvidia investment worth mentioning.

The AI cloud specialist raised US$7.5 billion recently to finance its own expansion ambitions.

They’re building data centres around the world which will help onboard the rest of the world on to AI.

And again, they’re an instant customer of Nvidia too.

Of course, Nvidia isn’t the only big tech company investing up and down the AI ecosystem.

Microsoft, Meta, Amazon, and Google are all at it, too.

But it’s only Nvidia with its ready for sale microchips that has this instant flywheel effect in place.

The other big tech companies are hoping to have a stake in a future world of AI, but they don’t get the immediate revenue sugar hit that Nvidia does.

This flywheel effect is what explains Nvidia’s stunning share price growth versus almost every other AI company.

It helps the revenue figures justify the stock price by telling a story of surging AI demand. But the hidden truth is Nvidia itself is helping drive this demand.

What happens if the flywheel slows down?

That could get messy…

Dot com on repeat

It’s a mug’s game predicting tops for any company and I’m certainly not doing so here.

In fact, as long as the flywheel can turn, the Nvidia share price can keep rising.

But as I look further into the world for signs of widening AI adoption, I can see it’s still not at the inflection point where natural demand can take over.

Indeed, last quarter, several big-name software companies, like Salesforce Inc. [NASDAQ:TEAM], saw their stock prices plummet on signs customers were easing back on spending rather than ramping it up.

And the industry chatter I follow says many C-suite executives – while keen to be seen to be active in the AI race – are a little nervous about committing to expensive solutions too soon in such a fast-changing space.

They want to see some more proof of AI’s benefits before they commit to big IT changes.

In short, the adoption of new AI solutions isn’t going gangbusters…yet, at least.

Will that change?

I’m certain it will, but the timing is the big unknown.

You need to be ready for a number of scenarios.

If the dot com boom is a guide to the future, this is a plausible path to keep in mind:

- Everyone buys Nvidia and other AI infrastructure stock because no good ‘application’ stocks to buy. Like how everyone crammed into ‘networking’ stocks in 1999.

- The flywheel eventually loses momentum as real-life adoption is slower than hoped for. Nvidia misses an earnings estimate, and the stock tanks, bringing the AI sector – and maybe even the entire stock market – with it.

- Everyone loses interest in AI, thinking it is an overblown waste of time but the bulk of the infrastructure needed is now in place.

- The 100-bagger applications start to appear and revolutionise the world.

Of course, history doesn’t always repeat, but it does rhyme. So I think we’ll get some version of this.

The bullish counter to this possibility is that game-changing end-user applications will come much sooner than the dot-com era ones did.

And remember, you’ve got companies like Apple, Meta, Google, and Microsoft, with their billions of daily users pushing hard on AI, too.

There are many moving parts to this story.

But if it does turn out to be a ‘Field of Dreams’ scenario there’ll be a lot of egg on Silicon Valley faces!

Though strangely enough, an AI ‘act 2’ could be the real opportunity for you as an investor.

Watch this space…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments