Between 2007 and 2023, iron ore giant Fortescue Metals [ASX:FMG] returned a staggering 4,645%.

Between 2006 and 2023, Mineral Resources [ASX:MIN] returned an incredible 4,689%.

From 2010 and 2023, Northern Star Resources [ASX:NST] returned an amazing 1,348%.

Everybody dreams of investing in a resource company that does something like this.

But how do you do it?

You see, most investors try to do the wrong thing.

And what’s that? They try to chase momentum.

For example…

They see lithium stocks going off like crazy and electric cars all over the news. They chase lithium shares.

They see uranium stocks firing off and learn that artificial intelligence means a gigantic demand for energy. So they chase those too.

They hear about China cornering rare earths and potentially shutting off supply. So they go after that thematic too.

Net result? They never build up expertise in one sector, for starters. They are always chasing short-term performance and the next hot thing.

Admittedly, that’s fine for short term trading.

But you can see from the above examples of Northern Star Resources [ASX:NST], Fortescue Metals Group [ASX:FMG] and Mineral Resources [ASX:MIN] what I’m getting at.

To achieve the truly incredible results in the share market, you need this…

You need to start early and ride a company over a long period of time. And you need discipline to navigate multiple flat and down periods.

Let’s look deeper into this…

Being steps ahead of the crowd

The age-old saying of ‘buy low sell high’ sounds simple. But few get it right because they don’t understand how to implement the principle. To sell high, you have to HANG ON, especially during the tough times. It’s like knowing that a plane can fly but not knowing the dynamics that make it leave the ground.

With resource stock investing, this is especially the case. Many jump on and off resource stocks as they become the flavour of the month, and therefore miss the good companies that rise across different cycles.

Those who make a bonanza and transformed their lives from investments like these would tell you they bought these companies while they were still minnows.

Joining the ranks of these successful investors are those who bought shares in a down cycles with the idea to profit hugely in the recovery.

Before I proceed, I want to clarify this. I’m basing my assumption that this relates to investing in a company with solid mine assets, capable management and a robust financial position. So, stock picking matters.

Every commodity follows a cycle. The price performance of resource companies may fluctuate more wildly than the commodity price because the cycle affects their profitability. Also, sentiment plays a big part in investor demand, further affecting the share price.

During the downcycle, the company’s operating margins will likely decrease, making it less appealing to investors. The share price declines, often below its fair value. It takes much courage to buy or even hold shares in the company.

When the cycle turns around, the operating margins improve. Investors return to these companies and buying momentum may bid the price higher than its fair value. Those who bought in the downcycle enjoy outsized gains, because they paid less to buy these shares.

It’s possible to buy as the cycle turns around to enjoy similar gains. However, they’ll still be a few steps behind those in there during the downcycle. You only confirm a trend exists after the fact. And often the beginning stages of a turnaround can be violent.

Green shoots in the speculative

gold stocks space

Where to look now in the market for this type of play?

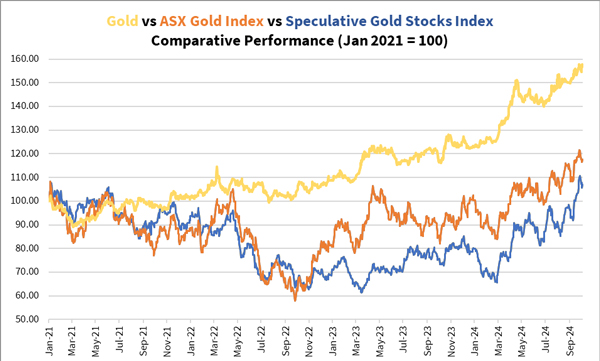

For almost four years, gold explorers and early-stage developers have experienced a brutal bear market.

Despite gold’s solid gains, the rising price of oil in 2022 killed a bull market for gold stocks and brought about the opposite.

The small end of town experienced a decimation of epic proportions. Many are still trading close to their cycle lows.

But you can see below that they’re making a comeback:

| |

| Source: GoldHub Australia |

That figure doesn’t tell you that a few companies have turned the corner and are dragging the index higher.

Those who bought these companies during the bear market are now sitting on significant gains. The share price might only be 15% higher than the price they first paid to buy. However, they had the guts to top up as the price fell.

If I’ve caught your interest and you want to act now, I’ll unveil a special offer in the coming weeks.

And remember the most powerful investing technique in resource investing…buy early and hang on!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments