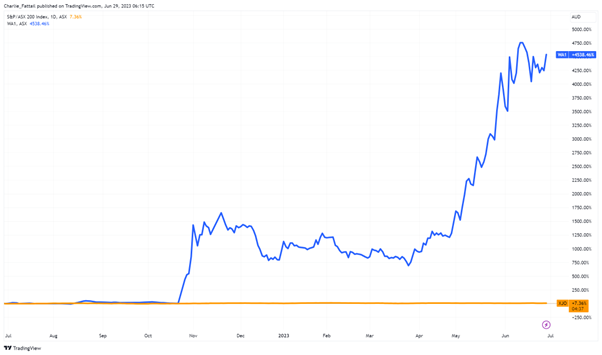

WA1 Resources [ASX:WA1] shares have soared by 7.08%, trading at $6.05 per share today. This comes after further testing at the WA Luni site has extended the footprint of the ‘high-grade’ Neobium enrichment that was discovered in 2022.

The site, which has been subject to vigorous testing since its discovery, has the potential to be a globally significant resource. Investors have taken notice with the shares of the company up a whopping 4,072.69% in the past 12 months.

What has got investors excited, and what does today’s news mean for the company?

Source: TradingView

WA1 on the radar

What some have described as a ‘company maker’, WA1’s Niobium discovery was announced today by a further ‘400m in multiple directions with new significant intersections,’ according to the company’s Managing Director, Paul Savich. He went on to say:

‘Along with the promising early-stage mineralogical assessment released previously, this drilling continues to establish the outstanding potential and global quality of this critical metal discovery.’

The WA site known as Luni is part of the West Arunta Project, located approximately 700 kilometres northwest of Alice Springs. The site is 100% owned by WA1, which currently has two RC diamond drilling rigs testing the site — with the latest results looking extremely positive.

Highlights of the most recent two tests include:

| Latest Tests Results | Early June Results |

| · LURC23-045 from 43m: 41m at 2.4% NB2O5

· LURC23-021 from 90m: 18m at 2.2% NB2O5

| · LURC23-015 from 79m: 10m at 8.3% NB2O5 Within overall interval from 78m of 42m @ 2.7% NB2O5

|

| · LURC23-020 from 34m: 13m at 1.4% NB2O5

| · LURC23-016 from 80m: 8m at 3.0% NB2O5 Within overall interval of 40m at 1.1% NB2O5

|

| · LURC23-019 from 72m: 24m at 1.1% NB2O5

| · LURC23-026 from 35m: 40m at 3.1 NB2O5 Within overall interval of 97m at 1.7% NB2O5 |

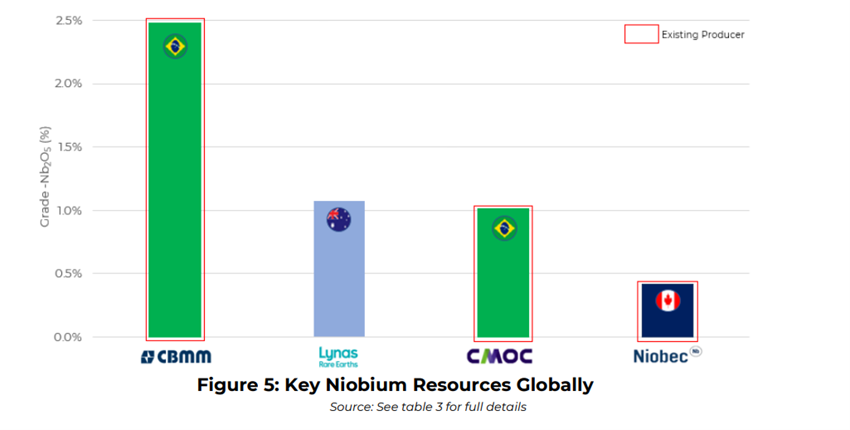

While the samples shown are highlights of the testing — some of these are exceptional for the resource which can see mining from approximately 0.7%, provided the mineralogy is suitable.

Many potential global resources are often tripped up at this point, as Niobium is often mixed with complex metallurgy which makes it uneconomical to extract, WA1 has previously reported that the mineralogy is considered ‘conventional’.

As the company has yet to give an estimate of the total resource (promising MRE in six months), some back-of-the-envelope calculations would already show that the find is approximately 20Mt. This puts it on the scale of a globally strategic find. Ongoing step-out drilling could see these numbers double as investors eagerly await assay results.

Source: WA1

Currently, only five resources globally have grades exceeding 0.7%. The results out of WA1 are showing a promising average of approximately 1-2%. This could be huge for the company.

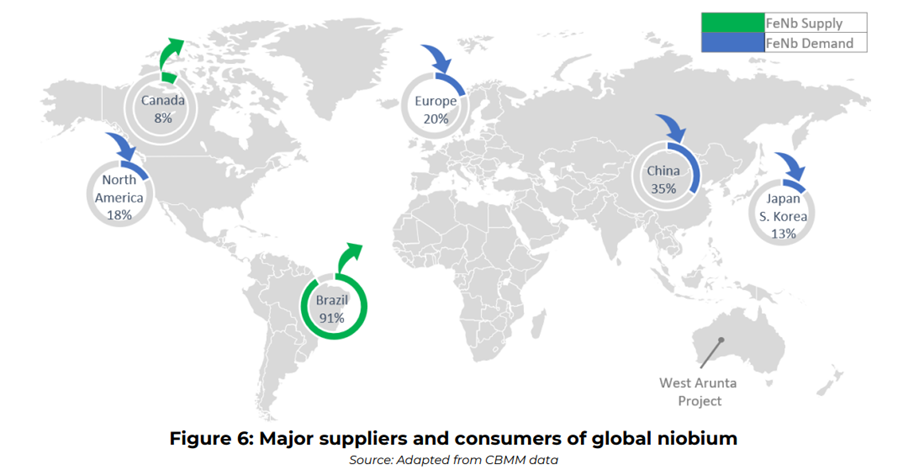

With Niobium production split between a handful of producers, the find in WA could put Australia on the map for this critical resource.

What this means for WA1 and Niobium

Niobium is a metal with unique properties. It makes it essential as the world transitions to a low-carbon economy. The predominant application for Niobium is as a micro-alloying element in high-strength, low-alloy steel (HSLA) applications. These include oil and gas infrastructure, automotive, battery, wind turbines, and premium stainless-steel products.

The global Niobium market is approximately 100kt/pa with around 85% of it being sourced from one mine (Araxa Mine) in Brazil owned by CBMM.

Source: WA1 Resources

Currently, Niobium sells for approximately US$30,000–45,000 a ton depending on purity. Meaning the potential for WA1 to sell into a market with growing demand through net-zero policies and extremely tight supply could have huge impacts on this junior miner.

What else is critical for the world’s move towards net zero but is tight on supply?

There’s something that we take for granted, which is in every piece of electrical product and is critical for power generation and transmission…copper.

Without copper, the world’s attempts to electrify, and the current power generation regimes would fall apart overnight. Yet, we are seeing falling supply and plummeting quality.

Where there is a lack of supply comes great opportunity.

Three copper mining stocks to watch in 2023

Want to know more about copper mining stocks worth watching in 2023?

If you subscribe to Fat Tail Commodities, you could instantly download the most recent copper stock report from our resident geologist and commodities expert, James Cooper — all for free.

In James’ latest report, you will get instant access to three of his latest top stock picks for the copper industry. James will also uncover information that every copper investor should know.

Learn about the looming copper supply crisis and how you can position yourself to take advantage of changes that are already happening.

To be ahead of the curve and gain access to all the latest news, click here to see our three copper mining stocks to watch in 2023.

Regards,

Fat Tail Commodities

Comments