Trading in Vulcan Energy Resources Ltd [ASX:VUL] share price is on hold pending VUL’s full response to short seller J Capital’s report.

J Capital, who often shorts stocks, today released a negative report on VUL, arguing the lithium developer made ‘highly optimistic assumptions’ regarding its flagship Zero Carbon Lithium Project in Germany.

After releasing a brief update regarding J Capital’s report, VUL entered a trading halt, seeking to release a longer response before 29 October.

What does J Capital allege?

Vulcan, god of empty promises.

That’s how J Capital started its short sell report on Vulcan Energy.

In essence, the activist short seller alleges Vulcan acted deceptively when it promoted its zero carbon lithium mine in the Upper Rhine Valley.

‘They have based highly optimistic assumptions for the project on work done by small consultancies that were owned by management and acquired by Vulcan,’ wrote J Capital.

JCAP also took aim at Vulcan’s goals to use geothermal power to extract ‘green’ lithium.

As J Capital argued:

‘Our research shows that the project may never actually get under way: the costs are higher than the company claims, output will be lower, the environmental impact is brutal enough that public outcry will block permits, as has happened before in the area, and the quality of the lithium resource is low. Many experts agree with us that this project is a non-starter.’

JCAP’s report also alleges Vulcan misled investors by releasing an optimistic Pre-Feasibility Study (PFS), with key assumptions provided by consulting companies owned by management.

JCAP thinks VUL’s management is ‘low-balling the costs and overstating the quality of its resource.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Vulcan offers initial response

Vulcan released a short but trenchant response before entering a trading halt.

VUL thinks JCAP’s report makes ‘a large number of inaccurate statements and assertions’.

Emphasising J Capital’s history as a short seller (a position where one profits from a declining share price), VUL said ‘it is clear the report is merely an attempt to profit from shorting Vulcan.’

Vulcan signed off by affirming its credentials, noting it is a team of 80 personnel ‘with globally unique experience in geothermal energy project development and direct lithium extraction.’

While strong, VUL’s response did not delve into the details of J Capital’s report.

Investors seeking answers on JCAP’s assertions will likely have to wait for VUL’s more thorough response later this week.

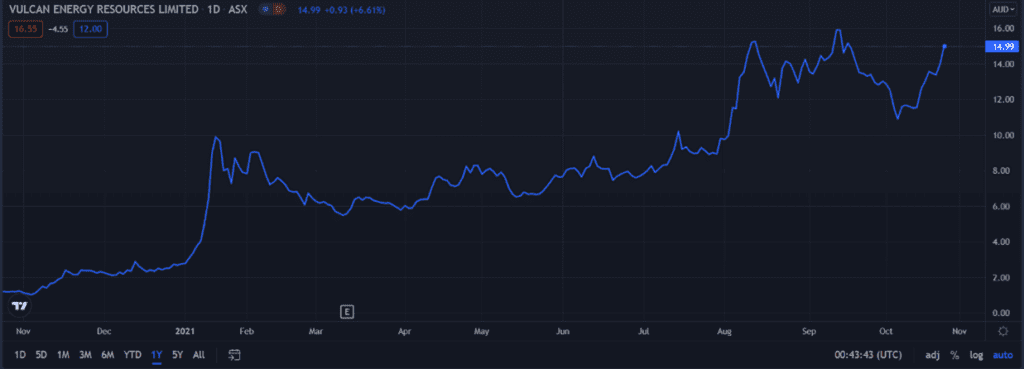

Now, apart from the growing adoption of Electric Vehicles (EVs) and the rising political action against climate change, the recent run-up in VUL’s share price may also have had something to do with the record low interest rates helping inflate asset prices as investors chased yields.

But while VUL’s attention is set to be redirected to answering queries raised by J Capital in the near term, I think it’s worthwhile paying attention to this low interest rate environment we find ourselves in.

While CPI figures from the US are worrying many about looming inflation, our Reserve Bank is holding steadfast to its targets.

RBA’s Philip Lowe maintains that the bank will not raise the cash rate until inflation and wage growth are sustainably in the 2–3% range, not forecast to happen until 2023 or 2024.

But this has big implications few are talking about, which are compounded by a falling iron ore price.

With depressed iron ore prices set to hit our terms of trade, the RBA may yet keep rates low for a while longer.

To find out what this could mean for your investment portfolio, please read the latest dispatch from our editorial director Greg Canavan.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here