The Volt Resources Ltd [ASX:VRC] has joined the European Raw Materials Alliance (ERMA), sending the VRC share price higher.

At the time of writing, VRC share price was up 6%.

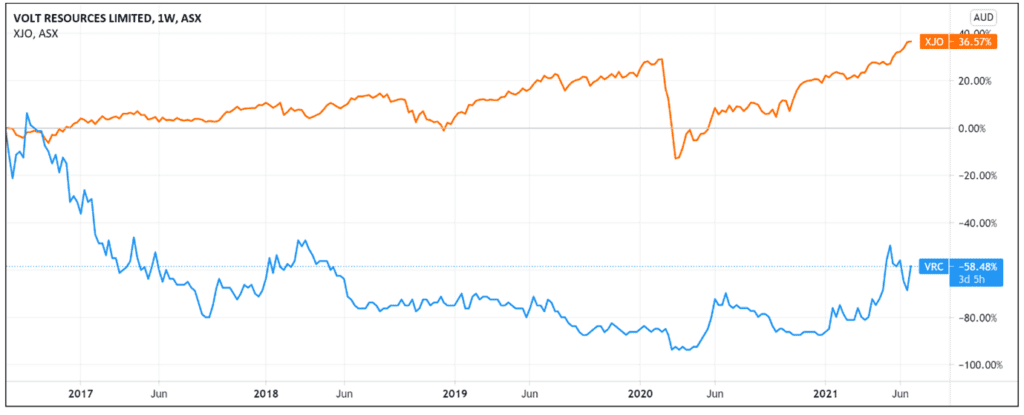

While the graphite explorer has underperformed the ASX 200 benchmark over the last five years, it is starting to make up ground this year amid interest in lithium stocks.

Year to date, the VRC stock is up 230%.

Let’s examine the details of today’s announcement and how joining ERMA impacts VRC’s outlook.

Volt Resources joins EU raw materials alliance

VRC — both a graphite producer and a gold explorer — has joined the European Raw Materials Alliance, launched by the European Union Commission in September 2020.

Essentially, ERMA brings together organisations, both private and public, covering the entire raw materials value chain.

Fellow emerging ASX lithium stock Argosy Minerals Ltd [ASX:AGY] joined the alliance earlier this year.

To date, ERMA’s network includes over 130 companies and several national authorities, ministries, and NGOs.

Why join ERMA?

Volt described ERMA’s strategic scope as identifying investment cases to ‘build capacities across raw materials value chains.’

What does this mean in practice?

What’s most likely to interest VRC’s shareholders would be ERMA’s ‘investment matchmaking’ service through its Raw Materials Investment Platform.

This matchmaking process includes financing sources like grants, equity, and loans.

This investment matchmaking process sounds interesting, but investors will likely wonder how practical the benefits will be.

Is Volt’s joining largely symbolic, or can the network have a concrete commercial impact for the firm?

Outlook for VRC shares

The European Union imports about 98% of rare earths from China while Chile alone meets around 75% of the region’s lithium needs.

ERMA was set up in part to diffuse this concentrated reliance.

As the European Institute of Innovation and Technology (EIT) RawMaterials CEO Bernd Schafer said last year, ERMA’s ‘most important task is to secure raw materials supply in Europe by identifying investment opportunities for sustainable and socially responsible access to raw materials in Europe.’

The sustainability emphasis of the European lithium market has contributed to the rise of stocks like Vulcan Energy Resources Ltd [ASX:VUL], which aims to launch a carbon neutral lithium project in Germany.

Vulcan is part of ERMA’s partner network.

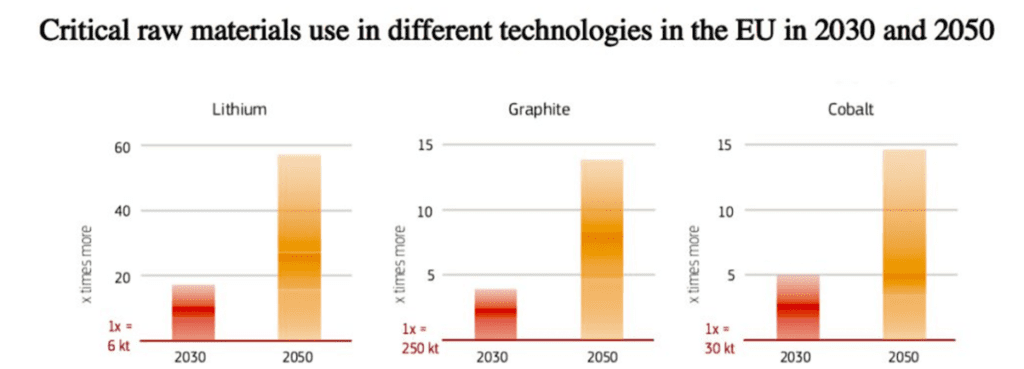

As the above chart shows, Europe’s use of critical materials like graphite and lithium are expected to rise and, with that, the need to diversify the sources of these raw materials.

In that sense, bullish VRC investors will be buoyed by Volt’s 70% interest in the Zavalievsky graphite business, which includes a graphite mine and processing facilities 230 kilometres north of Ukraine’s main port of Odessa.

VRC said Zavalievsky has production capacity of up to 30,000 tonnes of graphite concentrate per year.

In 2014, the mine was the eighth-largest producer of natural flake graphite in the world, but recent graphite oversupply and reduced product sales during COVID restrictions last year saw the business operating ‘well below nameplate capacity’.

Shareholders will likely bank on Volt improving the mine’s performance while fine-tuning its environmental impact as global demand for EVs rises.

Bullish investors will also likely note the recent performance of another graphite and natural flake producer, Syrah Resources Ltd [ASX:SYR].

SYR shares are up 50% over the last month.

As we’ve covered recently, stocks serving the lithium battery industry are thriving at the moment.

There is certainly emerging recognition that the lithium battery and electric vehicle sector is a potential growth market.

So if you want further reading on investment opportunities in the lithium sector, then our free report on lithium stocks is a great place to start.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here