Vocus Group Ltd [ASX:VOC] agreed to a scheme implementation deed with a consortium consisting of Macquarie Infrastructure and Real Assets (MIRA) and Aware Super.

While S&P/ASX 200 tech stocks like Afterpay Ltd [ASX:APT] and Xero Ltd [ASX:XRO] fell today in early trading, Vocus shares jumped as much as 8.7%.

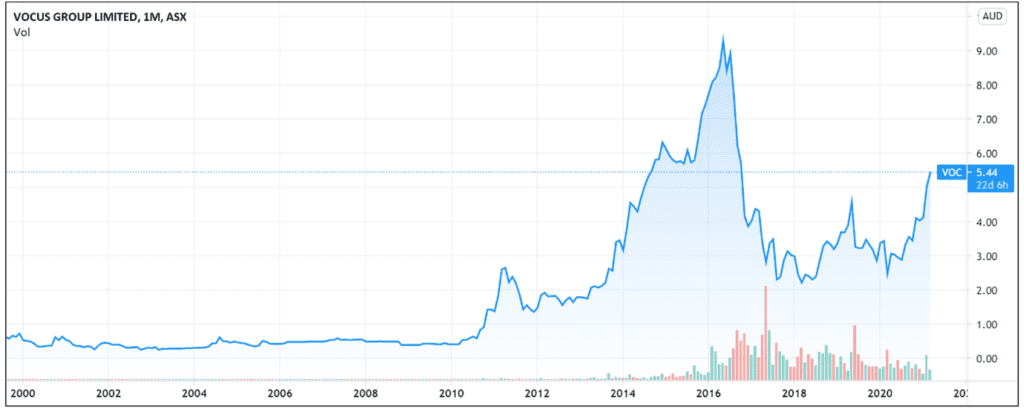

Today’s ASX announcement saw the Vocus share price at one point trade at $5.450 — a 52-week high.

At time of writing, Vocus was trading at $5.435 per share.

Let’s take a closer look at the deed’s details.

Vocus enters scheme implementation deed

Fibre network services provider Vocus today announced its entering a scheme implementation deed (SID) under which a consortium agreed to acquire 100% of Vocus’ share capital for $5.50 per share.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

Here are the other highlights.

The scheme values ‘Vocus’ equity at $3,501 million and implies an enterprise value of $4,599 million on a fully diluted basis.’

This entails that the company’s EV/EBITDA multiple will be 12.0x for the 12 months ending 31 December 2020.

The scheme consideration of $5.50 per share also represents a 25.6% premium to Vocus’ closing price of $4.38 per share on February 2021.

Vocus’ board unanimously recommended that Vocus shareholders vote in favour of the scheme subject to an independent expert concluding the scheme serves the best interests of company shareholders.

This deal comes after Vocus considered an IPO of its Vocus New Zealand arm, whose proceeds would reduce debt and be reinvested in Vocus’ core business.

However, the company’s board decided against the IPO after ‘overwhelmingly positive’ feedback from shareholders regarding MIRA’s indicative offers, according to Vocus Group Chairman Bob Mansfield.

While the company cited ‘strong interest from investors’ for a potential IPO of Vocus New Zealand, the SID arrangement ensures that Vocus cannot pursue the IPO so long as the SID remains in effect.

Finally, Vocus shareholders are expected to vote on the scheme in June 2021 with implementation slated for July 2021.

What did Vocus management say?

Vocus Group Managing Director and CEO Kevin Russell commented that this deal ‘clearly validates the company’s strong operational and financial performance, and recognises that we are executing the strategy that we set out in 2018. Fibre is the critical infrastructure of the modern economy and this arrangement endorses our view that Vocus’ secure, Australian-operated fibre network is key to our momentum in market.’

In turn, Vocus Chairman Bob Mansfield stated:

‘The Vocus Board is unanimous in our view that this offer is in the best interests of Vocus shareholders.

‘Feedback from shareholders in recent weeks on the indicative offer of $5.50 originally received from MIRA has been overwhelmingly positive and there is a broad recognition that this is a very fair value for Vocus shareholders.’

Additionally, each director confirmed their intention to vote any shares held or controlled in favour of the scheme.

What now for the Vocus share price?

As the Australian Financial Review reported, today’s ASX announcement caps off ‘years of financial buyer interest in Vocus.’

The company fielded offers from the likes of AGL Energy, EQT and Affinity Equity Partners but ‘bidders had walked away after what they saw in the data room.’

To strengthen its appeal, Vocus had to strengthen its financial position.

For instance, while revenue growth is slow, Vocus has drastically cut its losses.

In 2017 it recorded a loss of -$1.46 billion but the very next year profit after income tax was a positive $61 million.

FY20 did see profit after income tax back in the red at -$0.18 billion.

Nonetheless, Vocus updated its FY21 guidance and now expects its Vocus Network Services to have recurring revenue growth of 8% (up from 5%).

The outlook for Vocus Group’s underlying EBITDA did remain unchanged at $382 million to $397 million.

In its latest first-half FY21 release Russell stated, ‘We can confidently say that our three-year turnaround program is complete ahead of schedule, and the company is now moving into a new stage of investment and growth.’

Today’s announcement follows the acquisition of all issued capital in fellow fibre-based telecommunications company OptiComm Ltd [ASX:OPC] by Uniti Group back in November.

It also follows ‘keen investor interest in Australian telecommunications sector assets’, with the Australian Financial Review reporting that a ‘bunch of funds’ are also lining up for ‘Telstra and Optus’ mobile phone towers portfolios.’

As we’ve covered previously, Vocus fibre infrastructure can attract customers both in the enterprise and wholesale market.

If you enjoyed this look at Vocus, be sure to stay up to date with the latest investment news, trends and opportunities by subscribing to Money Morning. Click here to learn more

Our publication is a fantastic place to start on your investment journey — we talk about the big trends driving the most innovative stocks on the ASX.

Regards,

Lachlann Tierney

For Money Morning

P.S: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here