Today’s Fat Tail Daily looks around the world…and sees a paradox.

The world appears to be in upheaval…and yet the markets are calm.

Volatility is falling away after its huge spike in April. Now credits spreads in the US are the lowest they’ve been since 1998.

That’s back when my regular TV viewing was The Simpsons and Seinfeld.

US interest rates will likely get cut next month too.

All this is fuel for more fun action in the stock market.

Plenty of people will point out to you that Aussie and US stocks are trading at “nosebleed” valuations.

Indeed, benchmarked against history, they are.

But the world never had a US economy with US$37 trillion in debt before, either. That’s the gorilla in the room.

Trump’s Treasury Secretary, Scott Bessent, knows his boss can bluster and curse and claim whatever he likes.

Bessent has the really hard job. Every day he has to convince the markets that this debt is not a massive financial bomb under the global economy.

So the tricks come out. One is to make it easier for US banks to buy and hold “Treasury” debt. This is de facto monetization of the US deficit because US banks use new money to buy it.

We know the current Fed Chair, Jerome Powell, is going to get the flick one or another. A new Fed chair will have an unspoken mandate – lower interest rates, regardless of the inflation rate, or anything else.

That will get the refinancing costs down…in the short term, anyway.

Now we appear to have another wildcard in play. Could US authorities be doing something to lower volatility?

Michael Howell at CrossBorder Capital seems to think so.

He writes:

“The US Treasury and Fed are deliberately suppressing bond market volatility. This is helping to boost the collateral multiplier, which in turn is driving Global Liquidity higher.”

There is so much money sloshing around the world economy it’s driving stocks, bitcoin and property to new heights.

It’s only natural that investors go “risk on” while this is happening.

Is there another way to see this?

As it happens, yes.

The team at LongWave Capital put out a monthly report that always has a great little bit of market data they’ve unearthed. This month’s was no exception.

They find that…

“Using our numbers, there have been approximately 2,400 IPOs since 1998 on the ASX. The number of IPOs (rather than value) appears to fluctuate in-tune with positive and negative sentiment in the market. Essentially IPO activity is cyclical and pro-cyclical at that.

“We can see in the numbers that IPO activity peaked in 2000 at the end of the first Tech Boom, again in 2006 – 2007 during the China-led mining boom, and then again in 2021. During all three periods, the market was relatively expensive, and the economy was in the midst of an economic boom.”

Here’s this visually…

| |

| Source: LongWave Capital |

Implied in the LongWave observation is we can expect more IPOs to come to market in the following 12-24 months.

It’s a known concern around the ASX that there has been so few IPOs come to the market in the last few years.

That means you and I have another handy guide to the market now. The more IPOs we see, the more we can know that liquidity and sentiment is continuing to improve.

Remember that, if the market keeps climbing, there’s going to be plenty of people warning it’s a bubble or about to crash or at an unsustainable level.

But nobody can know for sure where the market is going, or how high. Japanese stocks reached an epic P/E back in the late 1980s. Why? The Japanese central bank was printing a lot of money.

Could US stocks do something similar? It may not be likely, but its certainly possible.

Think of it like this: if we keep seeing IPOs come to market, stay bullish.

Best Wishes,

Callum Newman,

Australian Small-Cap Investigator and Small-Cap Systems

***

Murray’s Chart of the Day –

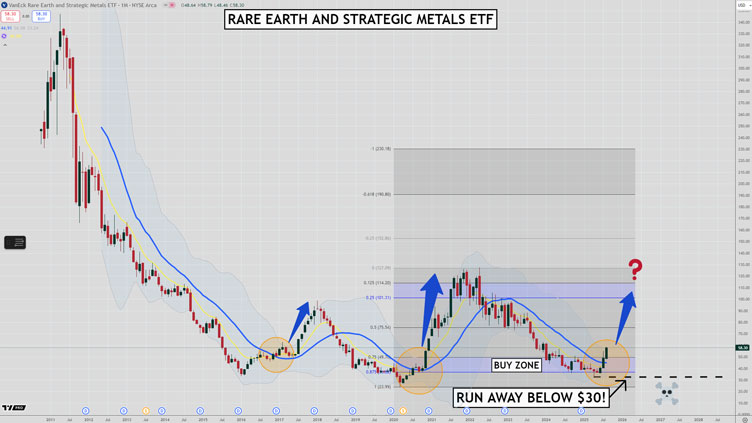

Rare Earths ETF

Source: Tradingview

[Click to open in a new window]

You have been given plenty of warnings over the last few months that there was movement at the station in rare earths and strategic metals.

The Van Eck Rare Earths and Strategic Metals ETF [NYSE:REMX] has been a great proxy of the sector to follow.

It contains many of the worlds largest rare earth and lithium stocks.

In the chart above I have circled the last two times the long-term trend turned up in 2016 and 2020. In both instances a nice rally developed over the next one to two years.

We have the added benefit this time of the rally starting from the buy zone of the previous rally.

Government intervention into rare earths and lithium is sparking renewed interest in the sector. The US is underwriting future production in rare earths and China is intervening in lithium to ease the oversupplied situation.

Markets never move in a straight line, so we should expect volatility ahead which should offer the stragglers a chance to jump into the opportunity at better prices.

My reading of the situation in the ETF shown in the chart above is that any coming shakeouts towards the long-term moving averages should be bought.

But if the price plunges under US$30, I would run away from the position.

If the current rally fails and major support can’t hold I would prefer to get out and wait for the next buy signal.

The upside potential from the current price of US$58.30 is substantial with a first profit target at US$75.00 and then US$101.00.

This ETF can’t be traded in Australia so you would have to be set up to trade offshore to gain access to it.

I am running a crash course this week in trading offshore, so if you are interested in such opportunities make sure you check out the short five video crash course here.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments