Mainstream media is once again floundering to understand whether house prices will rise or fall in the face of rising inflation and rising lending rates.

|

|

|

Source: ABC News |

No doubt it’s causing a few issues when it comes to building costs.

Demand has increased 35% on the back of ‘home builder’ grants.

Manufactured supply chain shortages have made it nigh on impossible to get the materials needed to meet Australian building standards.

I spoke to a mate of mine today who’s been building houses for more than 40 years.

He’s struggling to finish projects that were due for completion months ago. And not only that — he can’t get any staff!

He lost some of his best workers due to the vaccine mandates.

After posting three job adverts, he’s not had one response. Not one!

‘Australia is a lazy country’, he tells me.

It was more beneficial to sit at home and collect the pandemic payments on offer during the lockdown than turn up for a day’s labour.

Now the lockdowns have passed, however, it seems no one needs to work for a living.

Reminds me of an article I read earlier this week:

‘Man retires at 35 after investing just $8k in cryptocurrency shiba inu’

‘The former supermarket warehouse manager named Rob has been able to retire at the age of 35, after investing in the popular meme coin.

‘The dad told Fortune how he started trading cryptocurrencies in a bid to build a better future for his partner and son, The Sun reports.

‘He became interested in shiba inu which was launched in August 2020, after reading the coin’s 28-page white paper when he first came across it…the coin’s value raised Rob’s earnings to over $US1 million ($A1.3 million), according to documents reviewed by Fortune.

‘It comes as last week another trader became a millionaire and was even able to buy a house by investing in shiba inu.’

I can tell you now, there are more than a few first home buyers floating around that have fattened their budgets cashing in winnings on crypto.

I’ve assisted a few to purchase myself — and they have budgets well in excess of $1 million.

The ultimate winners of technological innovation are always the existing landowners.

This is where the money soaks up in the end.

After all, land is the only thing that provides us with all the things we need.

We live on it, work on it, sleep on it, everything around us is made from it, and we derive all our food and sustenance from it.

And location matters!

Well-located land is short in available supply.

The more a buyer has, the more they will spend bidding up the price of the best locations their budget can afford.

If you owned just three well-located property investments over the last couple of years, likely you would have made more in ‘capital gains’ than you would’ve been able to ‘earn’ as a labourer in the last six years!

I’ve seen ordinary suburban homes increase by $300K in a matter of 3–4 months this year.

Prices have skyrocketed.

And I can assure you now — the boom will continue.

At least in the regions that are attracting the COVID migrants.

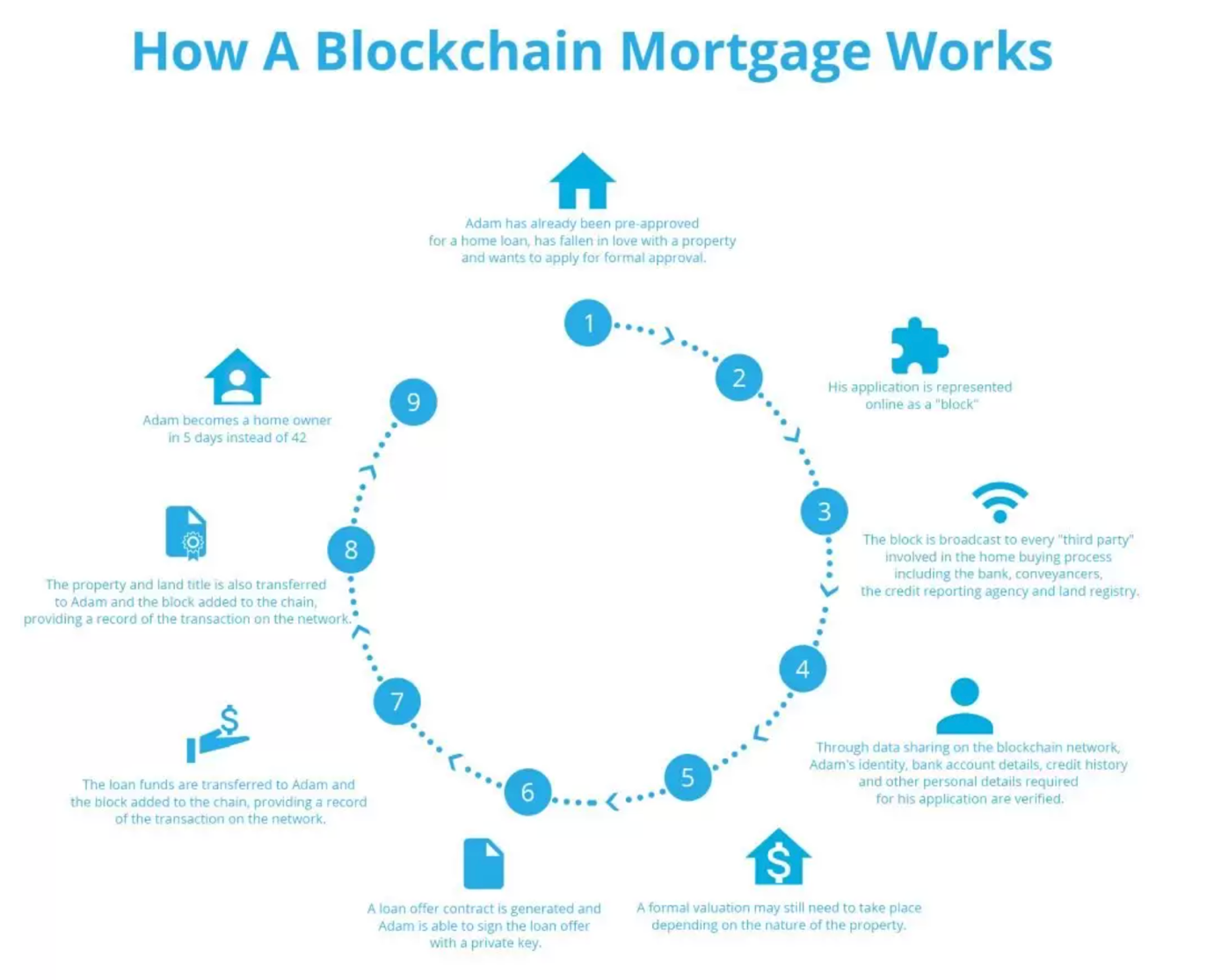

No doubt about it — blockchain is changing the real estate landscape — and feeding into worker shortages.

Before long, it will also change the way mortgages are issued too.

The technology will allow approvals to be done in real time. No more waiting for weeks for an archaic banking system to check your credentials.

Blockchain would not only allow your loan to be generated automatically — it would also transfer and register ownership of the property upon purchase instantly.

|

|

|

Source: homeloanexperts.com.au |

We’re in for one of the biggest real estate booms in history — one that a slight shift in interest rate payments or serviceability rates is not going to impact significantly.

At least not yet!

Until next time,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.