At time of writing, the share price of Tyro Payments Ltd [ASX:TYR] is up 12.89%, trading at $1.095.

After a steady rise up to $4.53 on 12 February following its IPO, the Tyro share price has been absolutely smashed in the wake of the coronavirus pandemic:

Source: tradingview.com

Today we look at Tyro’s trading update, their cash balance, and the impact of COVID-19 on their business. We then examine the outlook for the Tyro share price in light of its 75% drop in the space of just over a month.

Tyro share price up as market searches for bottom

The Tyro share price was quick out of the blocks this morning, going as high as $1.14 before settling.

The market jumped today as investors gauged the level of central bank policy support and stimulus being rolled out across the globe.

And Tyro caught the wave it seems.

But is this the bottom?

Personally, I highly doubt it.

In the grand scheme of things, this pandemic is still in its infancy, I believe.

Goldman Sachs forecasts a 6% contraction in the Australian economy by the end of the year and 8.5% unemployment by the third quarter.

It really depends on whether or not the central banks and governments throw the kitchen sink at this problem AND the refrigerator for good measure too.

I have a hunch they will — triggering the most aggressive Quantitative Easing measures ever rolled out.

If you are looking for a buffer in this downturn, check out ‘The Coronavirus Portfolio.’ The two-pronged plan to help you deal with the financial implications of COVID-19. Download your free report now.

Tyro’s trading update and cash balance

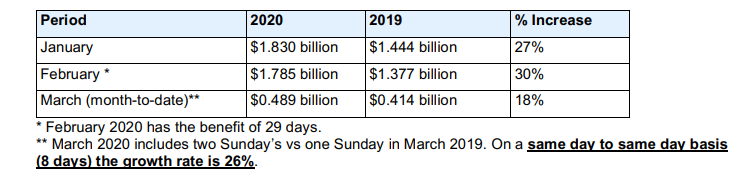

These were the unaudited transaction volume details that Tyro released in a trading update on 8 March:

Source: newswire

It shows that transaction values have yet to fall off.

A good sign?

Well, looking at it one way, people will likely prefer to use card, as cash is viewed as a potential source of infection.

But with the broad sell-off in retail shares going on, you can see the market thinks the sector’s receipts will fall off dramatically in the coming months.

Now for Tyro’s cash balance — will it be able to weather the storm?

As of their most recent half–yearly report released on 20 February, they had $140 million in cash as of December 2019.

Their EBITDA was on a knife-edge though, coming in at $1.5 million. And they posted a loss of $19.2 million for H1FY20.

Consequently, it will be interesting to see their potential cash burn rate in the new environment in their next results.

If they can keep the loss within reasonable parameters, they might not need to go for a capital raise during the downturn.

Outlook for Tyro share price

It’s hard to gauge at this juncture.

The market may continue falling as the number of cases of COVID-19 continues to grow.

In turn, this may drag Tyro’s share price down further.

But with the Australian government considering rolling out $15 billion for small lenders, it is important to remember that Tyro is also a fintech.

And their lending branch may be well suited to capitalise on this additional stimulus in the coming months.

That being said, I think it is important to keep one eye on companies that have significant cash reserves relative to their market cap.

These are the companies that may bounce back the strongest once this is all over.

If you are looking for ways to invest in this environment — be sure to check out our coverage of the two types of assets that may outperform as this all plays out. You can download our Coronavirus Portfolio for free here.

Regards,

Lachlann Tierney,

For Money Morning

Comments