At time of writing the Tyro Payments Ltd [ASX:TYR] share price is trading at $2.92, up 1.56%.

The nation’s fifth-largest provider of EFTPOS machines recently copped a lot of backlash over a major outage to its service.

Source: Optuma

Tyro Payments and the problems

Tyro is the nation’s largest provider of EFTPOS machines outside of the Big Four banks.

The company was recently forced to notify ASIC, the Australian Securities and Investment Commission, of a terminal connectivity issue.

The outage affected 15% of its terminals and less than 5% of customers.

With many small businesses around the country relying on Tyro’s EFTPOS machines to collect payment, a lot of users were left unimpressed by the outage and turning to social media to vent their frustrations.

In response to the outage the company is now collecting and repairing impacted terminals and claims 70% of Tyro’s merchants were unaffected by the outage.

At time of writing the company held a market cap of $1.47 billion and made a $19 million loss in February 2020.

Tyro and the future

With the company only being listed in December 2019, it’s been a turbulent start to life on the All Ords [ASX:XAO], taking into account the COVID-19 pandemic.

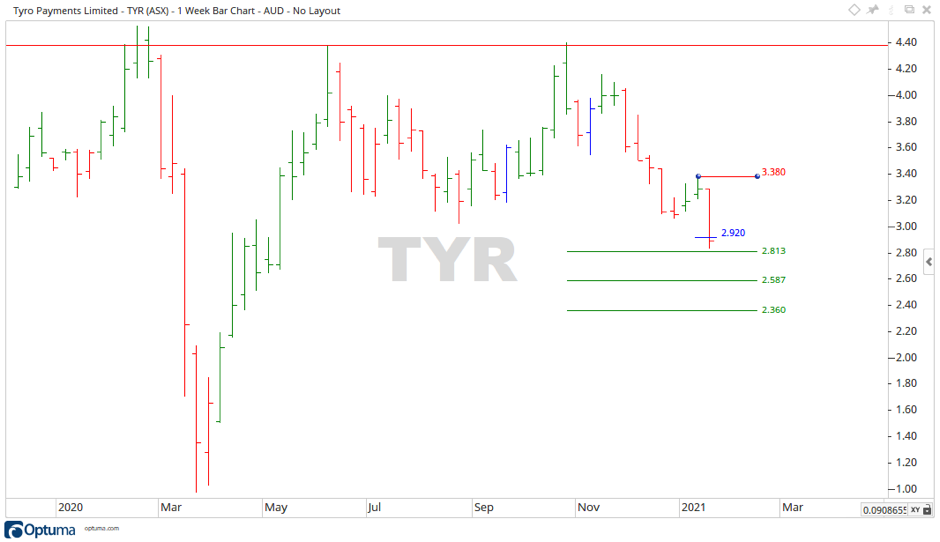

Looking at the weekly chart:

Source: Optuma

The price fell into the March low before rebounding.

Moving up to a high of $4.40, throughout the year this level proved unbreakable as it was tested on more than one occasion, creating a double top.

With the price now falling away, it may be set to fall further on the back of the recent outages.

Should this be the case, then the levels of $2.58 and $2.56 may be enough to halt the fall.

Should the price turn to the upside, then the level of $3.38 may provide future resistance.

Tyro payments, while being the fifth-largest provider of EFTPOS terminals in the country, may be in a position of pushing water uphill at this stage.

More people than ever appear to be shopping online, using their credit cards or BNPL services such as Afterpay Ltd [ASX:APT], which naturally excludes the use of an EFTPOS terminal.

Personally, I think with the country and economy overall still not in a good place, there may be less money going through small businesses, which means less fees through Tyro terminals.

At this point in time Tyro would not be one that I would put on a watchlist.

We’ve previously discussed how TYR’s potential to morph into a fintech could spur its growth.

If you are looking for more exciting fintechs, you can get the names of three potential future stars, right here.

Regards,

Carl Wittkopp,

For Money Morning