In today’s Money Morning…a landmark deal…crypto youth and a new wealth generation…you’d be foolish to ignore it…and more…

Dear Reader,

Every decade has its fair share of defining trends.

Products, services, or entire industries that help shape societies’ overall focus or interest. Helping shape the zeitgeist of any given period.

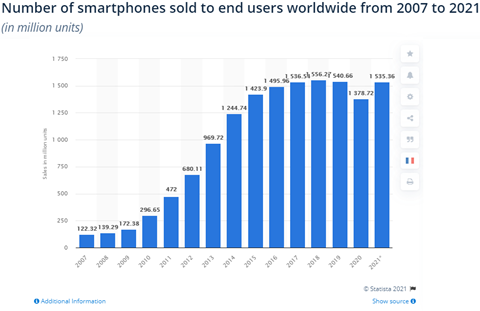

For example, one of the last decade’s (the 2010s) biggest megatrends was the smartphone. A device that is now so ingrained in our everyday lives, that it is hard to imagine life without them.

Just take a look at the rapid adoption throughout the past 10 or so years:

|

|

|

Source: Statista |

A fantastic chart that really puts into perspective one of the 2010’s most important industries. And keep in mind, this is just one example.

After all, most decades don’t just have one definitive megatrend. They have multiple, some of which may be easily recognisable, and some of which may be more subtle.

Which begs the question, what might be some of this decade’s (the 2020s) key megatrends?

Well, while no one can be certain of what the future will bring, we can make some reasonably educated guesses. And today I want to tell you about two burgeoning megatrends that have just collided in a big way…

A landmark deal

Late last week, a professional e-sports team, known simply as TSM, signed a US$210 million deal to change its name. Teaming up with a Hong Kong-based cryptocurrency exchange — FTX — to officially become: TSM FTX.

The biggest single deal in terms of value that the e-sports industry has ever seen!

So, why should you care?

Well, you should care because this, I suspect, is a moment that people will look back on one day. The point where two rapidly growing industries meshed together to further propel both.

But perhaps I’m getting ahead of myself.

After all, you may be wondering just what the hell ‘e-sports’ even is. Because while cryptocurrencies have entered the mainstream vernacular, e-sports is still somewhat fringe.

To put it simply, e-sports is just competitive video gaming.

A pastime that, just like regular sports, revolves around people playing and watching others compete. Just digitally…

And when most people hear about e-sports for the first time, they usually scoff. Because until you see it for yourself, it is hard to imagine why anyone would want to watch someone else play a video game. Let alone cheer for them like a typical sports fan.

But I can assure you that it is very real, and quickly becoming a formidable megatrend. One that certainly won’t replace traditional sports but will likely become a new tangent of it.

Granted, it is still a relatively young industry. But it is growing fast!

Which brings us back to the US$210 million deal between TSM and FTX. Because this sponsorship is larger than most naming-rights deals we’ve seen in even traditional sports. The kind of money that you’d typically see a company splurge to plaster their brand over a stadium or arena.

For context, Disney spent AU$70 million to change Docklands Stadium to Marvel Stadium. An eight-year deal that was finalised back in 2018.

FTX has spent almost four times as much on this 10-year agreement with TSM. Which will skyrocket the organisation’s value to new heights.

After all, TSM was already the leading e-sports team prior to this deal. Valued at US$410 million last year. So, this latest deal will certainly cement their dominance.

And while this is still only a fraction of worth compared to some of the larger traditional sporting franchises, it is impressive. Especially when you consider the fact that TSM was only founded in 2009. Starting out as a simple website resource at first, and only entering professional video gaming in 2011.

So, they’ve certainly come a long way in the span of one decade already.

But I suspect the next 10 years will be even more impressive…

Crypto youth and a new wealth generation

The bigger story here, though, aside from the rise of e-sports, is the conflux with cryptocurrency.

Because when you think about it, investing isn’t usually an industry that is known for sponsoring sports. Albeit that is changing, gradually.

Last year, for instance, online trading and investment brands inked 28 deals across a range of sports. Spending roughly US$51.96 million on sponsorship deals.

A drop in the ocean compared to most sporting deals, and just a fraction of FTX’s US$210 million commitment.

Which no doubt begs the question, why would FTX choose e-sports for this deal?

Well, to be clear, this isn’t the only deal FTX has made in the sports world. Earlier this year they spent US$135 million for the naming rights to Miami’s basketball team’s (Miami Heat) home court.

So, e-sports clearly aren’t their only focus.

But the fact that they spent more on the TSM deal is telling.

Because as you’d expect, e-sports fans are typically on the younger side. People who typically aren’t all that engaged with the idea of investing or growing their wealth. And yet, cryptocurrencies — with their digitally native roots — have managed to capture this demographic’s attention.

Sometimes for the better, and sometimes for the worse.

The point is that they’re making it accessible.

As FTX’s CEO Sam Bankman-Fried puts it:

‘Taking a huge industry and then reimagining it in a digital age: that’s sort of what e-sports are to sports, and it’s sort of what crypto is to investing and to finance.’

A distinction that is incredibly simple, but also incredibly important. Because while both e-sports and crypto are still young, so too are their biggest fans. Kids that are going to grow up alongside these two sectors and turn them into gargantuan industries.

And while you don’t necessarily have to ‘get it’ or like it, you’d be foolish to ignore it.

Mark my words, both e-sports and crypto are destined for big things over the coming years. And this latest deal between TSM and FTX is a sign of what is to come.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.