Last week, I made two predictions for commodity investors in 2023, if you didn’t read the article, you can do so here.

The first call was for broad upbeat sentiment coming to the mining industry in 2023.

While this prediction seems to be at odds with recession fears in the US and a generally poor economic global outlook…the key point is this, with recession comes lower interest rates.

This could be a very bullish for stocks later in the year.

If this plays out as I outlined last week, you’ll need to reposition your portfolio well ahead of the herd.

As absurd as it may sound right now, I think you should be ready to accept new all-time highs among mining stocks in the second half of 2023.

This will mark a new phase in a secular bull market for the industry.

The second prediction from last week rests on the dire need for more EV battery raw materials.

We know how this played out for lithium stocks in 2022.

With around 300 gigafactories under construction, most car manufacturers are now entirely committed to EV production.

Yet, to date, lithium has been the only beneficiary of this major industry shift.

As I highlighted last week, batteries need more graphite (by weight) than any other raw material, including lithium.

However, deposits for this critical metal are scarce and held mostly within China’s borders.

To date, investment has been fixated on lithium; this has been at the expense of developing mines for virtually all other critical minerals needed in battery production.

For EV manufacturers to have any chance of meeting global demand, the investment will need to go beyond lithium stocks.

It’s why I believe adding stocks leveraged to graphite production (in particular) could offer handsome rewards in 2023.

So, with that, let’s cap off this two-part series on what I believe will be the big themes for 2023…

Prediction #3

While some of the world’s major problems may start to fade in 2023…I’m thinking inflation and rising interest rates, there’s one problem which won’t be solved…energy.

Lack of oil and gas production, depleted US oil reserves, ongoing war in Europe and Russian gas supply threats, and a decade of record-low investment in the fossil fuel industry ensures the world will need to rapidly find alternatives to maintain energy stability.

Unfortunately, renewables won’t be the saviour everyone hopes for.

While I’m bullish on the critical metals needed for this ‘new age’, there’s simply not enough metal reserves available to build the solar panels, batteries, and wind turbines needed to provide massive base load power for the global economy.

It was always wishful thinking…political leaders have a concerning lack of understanding regarding the availability (or lack thereof) for critical metals needed to build a carbon-free future.

Yet, governments have closed the door on fossil fuels…ESG requirements prevent fund managers from investing in the oil, gas, and coal industries.

It means fossil fuels won’t be available when we need them most.

The development of new oil and gas fields need a decade or more of sustained investment to replace depleting reserves, yet the last few years have been among the lowest investment on record in the industry.

So herein lies the only viable solution to the world’s biggest problem.

Ensuring the global economy can meet base load power requirements means we need something far, far greater than any solar, tidal, hydro, or wind power generators could ever achieve.

It brings me to the only achievable alternative for our future energy needs…nuclear.

Love it or loathe it, as an investor, you can’t ignore the potential for uranium in fuelling the nuclear industry.

Governments have either knowingly (or unknowingly) all but guaranteed that at some point in the near future, we’ll need to accept nuclear as our staple source of base load energy.

They’ve signed the death knell for fossil fuels…they’re totally blind to the issue of critical metal supplies.

It means we’re slowly walking into a new nuclear age.

While the 2011 Fukushima nuclear disaster in Japan still hangs large over the industry, the world has never faced the potential for global energy shortages on the scale that’s likely to hit over the coming years.

It comes down to lack of supply.

That’s why I believe nuclear will become a focus in 2023…uranium stocks will, of course, surge if this situation plays out.

Uranium is heating up

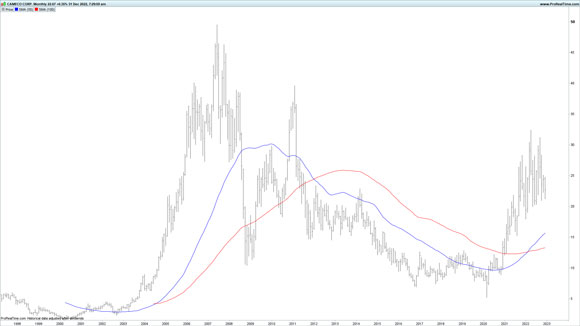

Turning our attention to the world’s largest publicly traded uranium company, Cameco [NYSE:CCJ], shows us that momentum is building in this sector.

CCJ, accounting for around 18% of global supply, has well and truly broken out of its decade-long downturn, suggesting interest is returning to this once very unloved commodity:

|

|

| Source: ProRealTime |

From its all-time low in 2020, the stock topped-out in early 2022…since then, prices have held firm against market turmoil over the last nine months.

CCJ’s price action is typical for the uranium industry at large, including many Australian producers.

Long downtrends that have transpired over a decade or more, followed by a sudden change in momentum in 2021.

Uranium could be in for a multiyear run, meaning investors have years of potential growth by getting into the right companies.

2023 could be a stand-out year for uranium stocks as the full impact of the impending energy crisis starts to unravel.

This brings me to my final forecast…the type of stock to own in 2023.

Prediction #4

Typically, for my own portfolio, I like to focus on late-stage explorers or early producers.

Stocks siting in this part of the mining life cycle offer less risk.

They hold a known ore body, eliminating discovery risk.

With capacity for years of future production, there is no immediate need to replace depleting reserves…the thorn that sits in the backside of every mature mining company.

As I’ve explained to my readers of Diggers and Drillers, late-stage explorers/early producers offer the sweet spot for long-term investment.

But is there any value in adding more speculative stocks to your portfolio in 2023? I’m talking about the early-stage explorers that gain multiples in value within a few short weeks.

Locating a success story among the hundreds of listed small-cap explorers is generally fraught with danger.

At best, it means owning a handful of small caps, which move sideways for years…at worst, when commodity prices drop and the industry turns, it results in losing the bulk of your investment.

80% or 90% losses are certainly not unusual for these types of companies.

But does that mean you should steer clear?

For the most part, yes…but at certain times it does pay to allocate small positions across several small-cap explorers.

Let me explain…

You see, at specific stages in the mining cycle, there is value in allocating risk capital toward the small end of town.

The key is understanding where we are in the investment cycle for mining.

Getting in too early means holding small caps that trend sideways offering little value for investors.

But jumping in too late exposes you to rapid price declines as the secular bull market unwinds.

That’s what we witnessed for crypto and speculative tech stocks last year.

As I discussed last week, I believe 2023 will mark the beginning of a new phase in this mining cycle…a multiyear secular bull market for commodities.

Over the last boom, this was an excellent time to add small explorers to your portfolio.

2023 could very well be the beginning of a new era for small-cap explorers, something I haven’t seen for more than 10 years.

Stay tuned!

One final note

As always, keep a close eye on the charts…technical analysis is your best tool for identifying early strength (or weakness) in particular commodities and mining stocks.

At Diggers and Drillers, we combine technical and fundamental approaches to our stock recommendations…this, I believe, gives us a distinct edge in forecasting and stock selection.

Of course, we’ll have to wait and see how all this plays out…whether I’m right or wrong, I plan to revisit these four predictions at the end of the year.

I’ll leave it there for today.

Until next week, take care.

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia