In a sea of red last Thursday, one stock stood out from the crowd.

Check it out:

| |

| Source: Unusual Whales |

As you can see, Nvidia Corp. [NASDAQ:NVDA] shot up 9.4%, while most other major stocks were negative.

That’s a gargantuan move for Nvidia, adding a whopping US$217.7 billion to its valuation in just one day.

That’s like adding almost the value of McDonald’s and Ford combined.

As I type, Nvidia is worth an astounding US$2.55 trillion dollars.

It’s the third most valuable listed company, just behind Apple and the world’s most valuable company, Microsoft.

But get this…

Nvidia is now worth more than the value of every single stock on the Australian stock market combined!

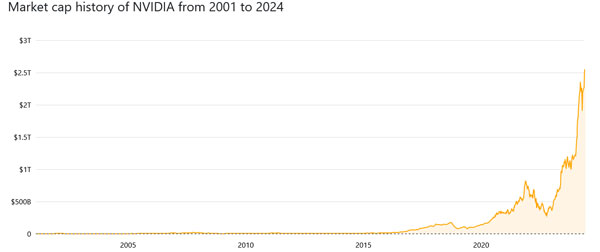

But the really amazing thing about Nvidia is not just the magnitude of its valuation but the speed of its rise too.

At the start of 2020, this was a company worth just US$144 billion. A 17 times gain in less than four years for a stock this big is almost unheard of.

Check it out:

| |

| Source: Companies Market Cap |

Naturally enough, many commentators are now calling it a ‘bubble’.

And an early backer — the legendary George Soros protégé Stanley Druckemiller — recently offloaded some of his Nvidia holdings.

He said on his decision:

‘We did cut that and a lot of other positions in late March. I just need a break. We’ve had a hell of a run. A lot of what we recognized has become recognized by the marketplace now.’

Interestingly, Druckenmiller has rolled part of his profits into the iShares Russel 2000 ETF.

This is an index fund that invests in US small-cap stocks.

Small-cap stocks have lagged the general market all year, and Druckenmiller thinks it’s time for them to play catch up.

Look, if I was in Druckenmiller’s shoes, I can see why he’d play it like this.

He’s made a motza on being early to the AI theme, and as he says himself, ‘he’s not Warren Buffett’.

It’s not his style to stay invested for years.

He picks his moment, places his bets (usually using leverage), cashes in, then moves onto the next idea.

So, personally, I don’t see it as a judgement of the value of the overall AI trend.

When you look at why Nvidia bucked the market trend last Thursday, you can still see strong signs of life in the AI theme.

Let me explain…

Do you want chips with that?

Nvidia’s Q1 results ‘blew the doors off expectations across just about every possible metric’according to Bespoke Investment Group.

The AI giant reported first-quarter revenue of US$26.04 billion, more than triple its revenue one year ago.

Sales in their AI-focused data centre division surged to new records, quintupling year-over-year.

These are all tangible signs that demand for AI computing power isn’t slowing down…yet, at least.

Nvidia CEO Jensen Huang said on the results:

‘The next industrial revolution has begun—companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center—AI factories—to produce a new commodity: artificial intelligence.’

In Jensen’s view, AI, and consequently Nvidia’s microchips, will be the driving force behind everything.Self-driving cars, robotics, drones, TVs, smartphones, computers, factories, trucks — you name it…

What does the total addressable market for ‘everything’ look like!?

That’s basically the reasoning behind Nvidia’s surge.

So, should you be buying Nvidia now?

To be honest, I don’t know.

As Druckenmiller noted, is there anything about Nvidia that’s not priced in right now?

That’s hard to say, and at the very least, you could say it’s priced for perfection right now.

It’s not a stock we hold in the Alpha Tech Trader CORE portfolio.

However, we do hold a number of other stocks that are aligned strongly with the AI theme in general.

The way we see it is Nvidia is best used as a bit of a bellwether stock for AI — a signal rather than an investment.

Right now, it has a quasi-monopolistic hold on one area of the semiconductor market — GPUs.

But this monopoly position may dilute over time.

Interestingly, when you dive deeper into the semiconductor industry, you find that there are a number of monopolistic plays in certain key niches.

Companies are creating crucial products that are even more important —and harder to replicate — than Nvidia’s much-vaunted GPU processing chips.

To give you a few ideas today…

Alternate ways to play the AI theme

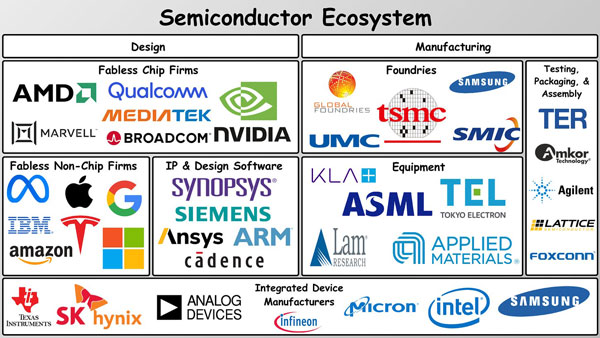

Check out this chart of the overall eco-system:

| |

| Source: Generative Value |

There are a number of subsectors, including design, manufacturing, testing, IP, equipment, and more.

Nvidia itself is a ‘fabless’ chip firm.

The word ‘fabless’ means they don’t actually produce their own chips (though they may design them to certain specifications).

That ‘fabrication’ role is almost exclusively held by two companies.

Taiwan’s TSMC and South Korea’s Samsung account for 71% of the entire foundry market.

They’re the only two companies that make the most advanced microchips.

China is trying hard to develop its capabilities in this sector, but it’s notoriously difficult to get right.

US company Intel is also a potential wild card entrant into the foundry space, with strong financial support from the US government behind it.

Microchip production capacity is a major strategic issue for the world’s superpowers.

Another interesting area of the semiconductor supply chain is lithography.

These are the companies that make the machines that are sold to the foundries that make the chips.

An obscure Dutch company called AMSL is one of the few true monopolies on the planet in this field.

As tech investor Eric Flaningham noted recently:

‘Few people in the world fully understand this technology. The top-end lithography machines have over 100,000 parts. It takes four 747s to ship one to a customer. ASML only makes ~55 of them a year. There’s a reason why these machines cost $200m-$300m a piece.’

Then there are companies like Tokyo Electron, Applied Materials, and Lam Research Corporation, which all create specialist tools essential to the semiconductor supply chain.

Again, all companies you’ve probably never heard of.

I’ve barely touched upon the many moving parts at play here.

My point is that the AI story is a lot bigger than just Nvidia.

With some research, I still think it’s possible to uncover the hidden gems that will ride this multi-year tailwind.

And Nvidia’s recent results prove that…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments