Solomon Lew’s Premier Investments [ASX:PMV] is the centre of market attention this week for all the wrong reasons.

The retail conglomerate has fired John Cheston, the long-serving CEO of its popular kids’ stationery brand Smiggle. It cited ‘serious misconduct and a serious breach of his employment terms’ but gave no other details.

This decision comes just days after leaked budgeting and sales documents highlighted Premier’s fashion brands’ challenges.

The shock firing also comes three months after Mr Cheston agreed to become the CEO of rival jewellery retailer Lovisa in June next year.

The sudden departure marks the end of Cheston’s decade-long tenure at Smiggle, where he had been a key figure in the brand’s growth and expansion.

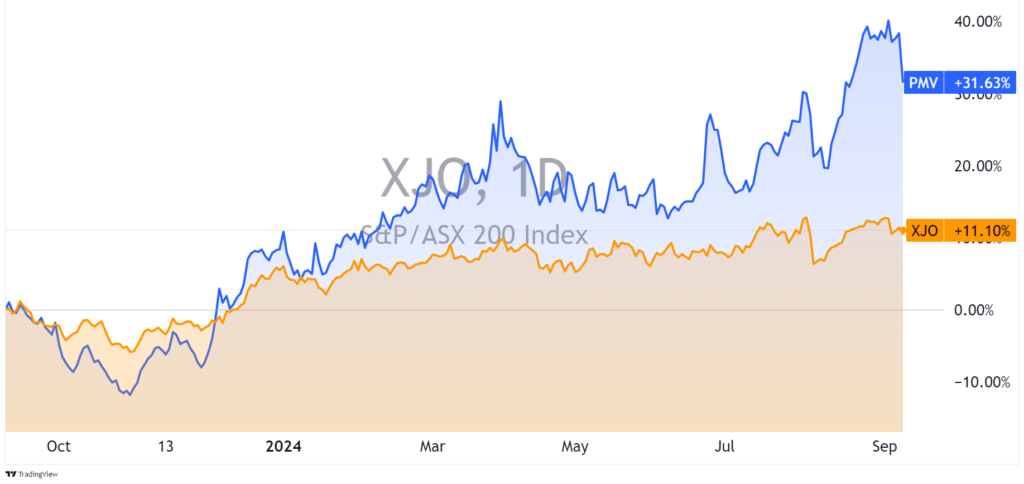

Investors have been spooked by the news, with Premier Investments’ share price falling sharply from its recent high and cutting into a good portion of the company’s growth over the past year.

Premier’s shares fell as much as 8% yesterday before pairing gains. This afternoon, they are currently trading at $33.64 per share.

Source: TradingView

Strategic Shakeup at Premier

Premier investments have faced a challenging few years of trading amidst the cost-of-living crisis. To address this, Premier has made a series of large strategic shifts, the biggest of which is the 2025 demerger of Smiggle and Peter Alexander.

However, during this time, Mr Lew has lost key execs, often poached by rival retail billionaire Brett Blundy at BBRC.

Mr Blundy first snagged former Premier chief executive Mark McInnes, a veteran of Solomon Lew’s empire with a decade at the top job.

It seemed the veteran had tipped the Smiggle CEO as one of the folks he wanted to help expand BBRC into a new growth phase.

While Mr Blundy’s empire schemed for bigger things, it appears Mr Lew is on the back foot. Then, in June, retail giant Myer announced expansion plans to purchase Premier’s major fashion brands.

Mr Lew owns a 31% stake in Myer, which has also suffered sales setbacks but is moving in a new direction under fresh CEO Olivia Wirth.

The deal would be the largest shakeup of Solomon Lew’s retail empire in nearly two decades. Seeing it sell its major fashion brands — Just Jeans, Jay Jays, and others.

As part of the due diligence for this sale, sales and marketing documents were shared. These were then leaked over the weekend. Reportedly exposing the problems these brands face.

The documents show that all of Premier’s major brands have suffered falling sales and are millions behind their projected targets.

In response to the article, Premier released a trading update clarifying its position. And (now suspiciously close to that leak) also fired Mr Cheston.

The trading update showed expected total sales for its retail division of $1.6 billion for 2024, down from $1.64 last year.

This guidance will hardly give confidence to investors who were hoping for growth.

But will the leak affect Myer’s willingness to continue with the deal? And how should investors think about Premier moving forward?

Premier Investments Outlook

It’s no surprise that retail has had a tough few years. The leak confirmed what many had already suspected about Premier’s apparel brands. However, the size of the falls was somewhat shocking.

According to the leaked documents, the 2H24 sales were:

- Portmans saw a 10% fall in sales to $68 million.

- Jacqui E recorded an 8.3% fall in sales to $33.3 million.

- Just Jeans saw a 0.4% drop in sales to $136.32 million.

- Jay Jays posted a 4.8% fall in sales to $69.2 million.

Compare that to their already poor performance in 1H24 below:

Source: Premier Investments 1H24 Report

You can imagine the board’s thoughts. Now faced with replacing a key executive while navigating slowing sales across its other names.

This will make Smiggle’s next CEO appointment a key issue for investor confidence. It could also determine the success of next year’s demerger.

For those brands that remain. These fashion brands will likely make up most of the $800 million in goodwill and brand value on Premier’s books.

If these documents’ figures are accurate, we will likely see future impairment and writedowns if these trading conditions continue. That is, of course, if the sale to Myer isn’t completed earlier.

Ms Wirth, the former Qantas loyalty chief, was appointed CEO of Myer in March. She has already outlined ambitious expansion plans for the retailer. And Premier’s apparel brands appear to be at the heart of them.

This will mean she will look past any short-term weakness here to pick up brands that she has said hold the ‘bare bones’ of brand pedigree and long-term success.

The sale to Myer could also be an easy exit for Premier Investments. If it goes through, it could see Premier Investments return to its roots as a listed investment company.

It would also have some serious capital to look for opportunities elsewhere. Until that happens, the challenge of replacing Smiggle’s CEO should be on shareholders’ minds.

The timing of this controversy is poor as consumers grapple with cost-of-living pressures which will see them continue to spend less.

Long-term retail trends also point to increasing competition from online players such as Cettire. However, those concerns will be less important in the immediate future as investors seek security.

From here, Premier will need to convince its shareholders it can drive long-term value creation with or without these brands.

It will also have to address concerns about leadership stability as Mr Lew continues to ruffle feathers in the retail landscape.

The success of this strategy could determine whether Premier Investment can hold its throne as a major retail player or face a period of prolonged uncertainty.

Is this the time to invest in retail?

Premier Investments is not the only one being hurt by the Australian retail market.

But we think investors should be looking at the broader economic picture.

Australia is grappling with persistent inflationary pressures and a weak economy.

While other economies look to stabilise, we face the dual challenges of rising costs and constrained consumer spending.

But it’s no surprise, look at your own costs. Petrol is up almost 8%, power bills are jumping almost 20%, and groceries are up nearly 30%.

We could be facing an extended period of significant weakness in the economy.

Investors need to consider how to position themselves in these challenging times.

We have created a free guide that could help you navigate this turbulence with your portfolio and savings intact.

Click here to learn how to access our free guide — your investment strategy may depend on it.

Comments