Two things I’m thinking about today…

1) Let’s go back to April for a moment. Trump tanked the market with his tariffs.

Here we are in June. US stocks are back into the green for the year.

The tariffs still loom over the world…and yet the urgency of the whole discussion is fading. Such is the way of the world.

Here’s another important reason why US stocks have bounced back.

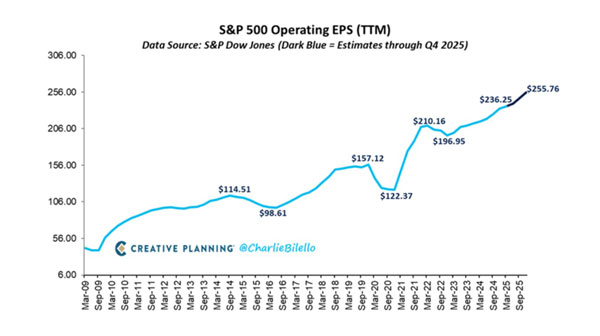

Earnings are still growing!

Here’s the proof…

| |

| Source: Charlie Bilello |

This trend is going to keep on keeping on, at least as far as Wall Street is concerned.

And why not? How long before Trump bullies and blusters enough to get the Fed to drop rates?

Case in point. Trump already put a friendly face in to get through some recent banking regulation.

From Bloomberg:

‘Wall Street is poised to receive a big gift courtesy of the Federal Reserve. The central bank unveiled plans to roll back an important capital rule…

‘The proposal followed by a few weeks the ascent of Michelle Bowman, President Donald Trump’s pick to be the central bank’s new vice chair for supervision. Bowman’s predecessor, Governor Michael Barr, objected to the plan…’

Hmm. Trump has his “pick”…ha!

I find it hard to believe that this was some sort of considered decision about who gets the role.

There is only one criterion with Señor Trump: do what I tell you!

What else…?

Look at this…

From the Financial Times:

‘Federal Reserve vice-chair for financial supervision Michelle Bowman has called for an interest rate cut as soon as July, saying President Donald Trump’s trade war would have a smaller effect on inflation than some economists fear.’

Blah blah. I couldn’t care less about whatever economic mumbo jumbo the Fed pulls out of their arse.

Trump wants lower rates. He’s going to get them – one way or another.

It’s a Wall Street party now.

Don’t forget…there’s still Trump’s tax cuts to come. The markets are getting juiced for another leg up over the next 12 months.

2) It seems to me that the small cap sector on the ASX is starting to heat up nicely.

Case in point is DroneShield ($DRO). This rose over 20% in yesterday’s trade.

This came on the back of a big announcement – my favourite thing in the share market.

In this case, DRO said they have $60 million in orders coming their way. DRO is up 180% for the year.

What a stock. It had a massive run last year. I got my subscribers on that.

This time, I’m peeved to admit, we’re not on this rally. Ah well, you can’t get them all!

However, I mentioned yesterday that Develop Global ($DVP) has had a barnstorming run this year too (+94%).

So has Catalyst Metals ($CYL) from the gold sector (+108%).

These are just three examples.

See what I’m saying? There are stocks going off like firecrackers all over the place.

You can’t get any of them if you’re not watching and not amongst it.

My earnest suggestion is to start taking a high interest in the share market.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day –

US 10-Year Bond Yield

| |

| Source: Tradingview |

US 10-year bond yields have been incredibly tricky to predict over the past year.

Steepening yield curves, tariffs, large deficits, and changing interest rate cut expectations has seen 10-year bond yields remain far more elevated than most expected.

But despite the dog’s breakfast that has made prediction difficult, technical levels continue to be respected.

You can see in the chart above that 10-year yields have been stuck in the range between 3.25-5.00%.

I have to remind you that the chart above is showing yield and not price. Since bond prices move inversely to their yield, you could say the chart above is upside down.

So when the yield is falling the price of the bond is going up.

So in effect the sell zone for yields above, is actually a buy zone for the bonds themselves.

The buy and sell zones shown above have ben very useful for understanding how bonds have been moving.

We recently saw a spike in 10-year bond yields into the sell zone, but once again that area has managed to contain 10-year bond yields.

The yield has dropped from 4.50% to 4.27% in the last couple of weeks and I suspect we will see a rapid move to the point of control of the range at 4.14%.

If the buying continues from there we may see another retest of the buy zone between 3.50-3.7% in the medium term.

A rise in the 10-year bond yield above 4.80-5.0% will switch off the short-term bullish picture for bonds.

Above that level we could see a sharp jump in yields.

So for now, US 10-year bonds are bullish and we should expect rates to drop further in the short-term, but if yields spike above 4.80% all bets are off!

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments