True North Copper [ASX:TNC] has impressed investors with an exceptional first hole at Vero Resource in North West QLD.

TNC reported high-grade mineralisation from the company’s first drill hole as part of its diamond drilling program at its wholly owned Mount Oxide Project.

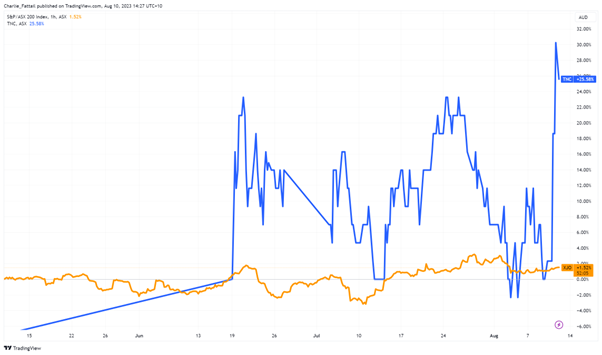

Shares of the company have surged by 25% today, trading at 27.5 cents per share, as investors digest the early results from True North’s first significant on-ground exploration of the site.

The junior miner is a fresh face on the ASX, only beginning trading in mid-June this year after merging with Duke Exploration, who acquired TNC.

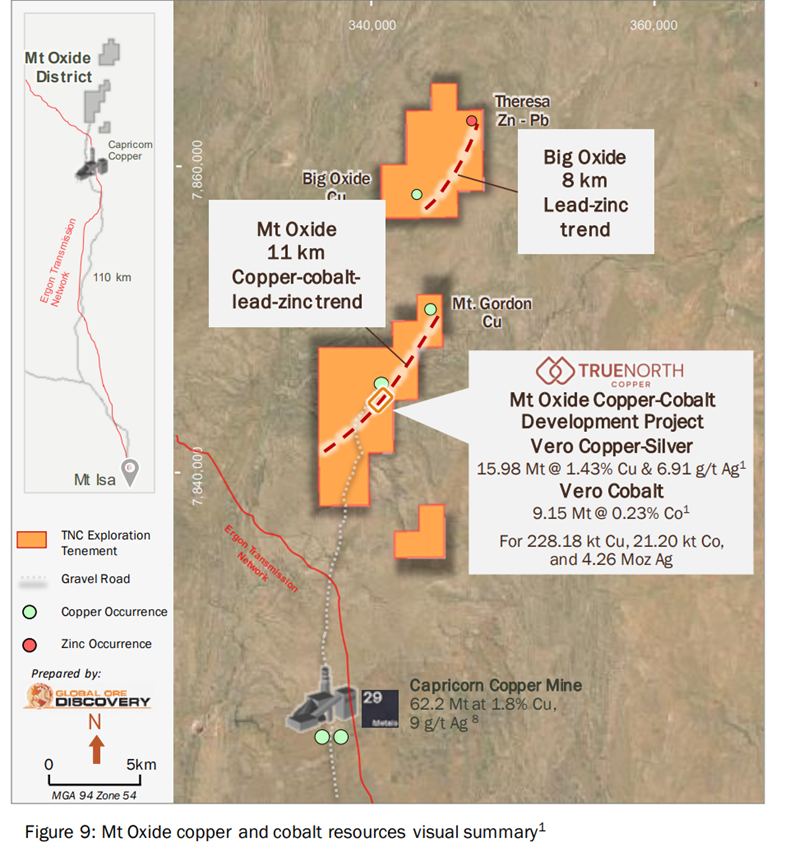

The newly merged company has several copper, cobalt, gold, and silver projects across QLD, with a combined resource base of 326kt of copper, 23kt of cobalt, 87.4koz of gold, and 4.3Moz ounces of silver.

Source: TradingView (Three month chart)

TNC drill exploration results

TNC has announced solid results from its first hole drilled in its exploration of its newly acquired Vero Resource at its Mt Oxide Project in QLD.

The first intersect recorded showed 66.5m at 4.95% Cu in the first hole, with further drilling continuing throughout the second half of this year.

The first drill hole in the initial diamond drilling program returned some phenomenal results.

Early results include some width estimates, but the highlights include the following:

- 50m (48.00m) at 4.95% Cu, 32.7 g/t Ag and 685 ppm Co from 234.00m

- 20.60m (15.47m) @ 10.51% Cu, 63. g/t Ag and 1,149 ppm Co from 234.60m

- 8.55m (5.62m) @ 6.03% Cu, 51.6 g/t Ag and 98 ppm Co from 290.15m

- 00m (8.19m) at 3.06% Cu, 34.2 g/t Ag and 682 ppm Co from 357.50m

- 4.00m (2.93m) @ 6.00% Cu, 63.7 g/t Ag and 544 ppm Co from 357.50m

- 55m (8.55m) at 6.16% Cu, 45.9 g/t Ag and 140 ppm Co from 172.50mx

- 2.80m (2.80m) @ 14.74%Cu, 102.5 g/t Ag and 54 ppm Co from 178.25m

The exploration at the Vero Resource is the first large-scale drill program undertaken there since 2012.

In early June this year, TNC acquired Mt Oxide from Perilya [ASX:PEM] for $45 million, including a deferred payment of $15 million for two years.

The company was able to fund this after Duke’s acquisition of TNC included a significant raise.

As part of the offer, the company completed an underwritten capital raise with priority for Duke shareholders, which raised $37.3 million at $0.25 per share.

The proceeds of the raise funded the company’s acquisition of the Mt Oxide Project and the new round of exploration.

True North Copper’s Managing Director, Marty Costello said today:

‘This is a tremendous outcome from the first hole of our initial diamond drilling program at Vero. These drill results are simply stunning, not only returning superb grades but also showcasing the ever-expanding nature of the Vero high-grade ore body. With every drill hole, we are increasing our confidence and expanding the extent of the resource.’

Outlook for TNC

The outlook for this junior miner is a reasonably rosy one. The company’s diverse assets and staggered project timelines should allow it to piggyback off other projects to fund the expansion of projects like Mt Oxide.

For example, at the end of July this year, the company announced that it had commenced copper sulphate production at its Cloncurry Project in QLD and holds an offtake agreement with Kanins International.

The development of these various projects through the second half of the year should put the company in good stead for growth,

The timing is also encouraging, considering the price of copper and other precious metals have yet to have their breakout moment this year.

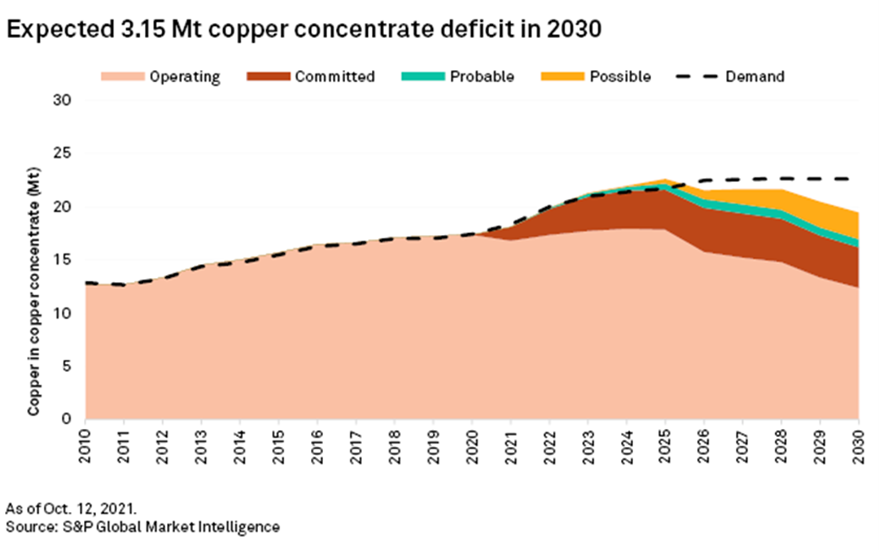

Source: S&P Global Market Intelligence

Signs point towards supply shortfalls affecting the copper market by 2026, as previous underinvestment will eventually bite the market and push prices.

Over 200 copper mines are expected to run out before 2035 and some of the largest mines are seeing their reserves dwindle. Many of these larger open-pit mines will eventually be forced to shift to expensive underground mining.

While prices still see short-term weakness, the future will undoubtedly be copper shades of red.

The main issue will be this — where do we find it all?

The red draught and what to do about it

Reimagining our transport, power generation, and transmission is a huge task.

All of these are extremely copper-heavy.

A new EV requires, on average, 80 kilograms of copper.

This means that we will need a lot of red metal, and more exploration will be required to restock supplies.

If you subscribe to Fat Tail Commodities, you will have access to resources expert, James Cooper’s, most recent expert briefing on the subject — all for free.

James will give you expert analysis of the copper industry. He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

To find out more about investing in the ‘red draught’ and click here today.

Regards,

Fat Tail Commodities

Comments