In today’s Money Weekend…two P+Ls…listen to the market and yourself…tech stocks under pressure…and more…

I had a great chat this week with a good mate of mine who is a full-time professional trader.

He has thrown his hands up in the air with the current state of the market in the small-cap space and taken off up north.

He has hired a campervan and chucked two windsurfers in the back and is making his way up past Cairns over two weeks to a windsurfing championship. Lucky bugger.

I tell you this not to make you and I jealous, but to say that it is an important part of trading to know when it’s time to down tools and recuperate.

He said something that stuck with me while he was preparing to jump off a rock into a waterhole with a huge waterfall plunging into it.

He said that you have two P+Ls (profit and loss) to manage.

You have to stay aware of your financial P+L but also your personal P+L.

You have to be aware of your state of mind, confidence levels, and how in tune you are with the market. Because when things get out of whack the financial P+L can start heading south at a rapid pace.

We have become accustomed to working harder when the going gets tough but sometimes that’s just dead wrong.

Sometimes downing tools completely and giving yourself time and space to get your mental state back in order is a much better solution than continuing to beat your head against a brick wall when things aren’t going smoothly.

Novice traders will often continue trading long past the warning signs have been given and will trade feverishly until their whole account is drained.

It is only once they are completely released from trading through necessity that they realise just how out of control they have been.

We have zero control over the market. We are just observers. And yet its gyrations can create immense emotional gyrations in us.

It doesn’t matter how many times you tell yourself to become completely objective, you will still feel excited when a stock you hold leaps and terror when it plunges after a bad announcement.

It’s an exciting life trading the markets, but you do get burnt out quickly if you don’t give yourself regular breaks from the action to focus on other things.

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

Listen to the market and yourself

Being in tune with the market involves an understanding that the market moves in cycles. There are periods when you make money hand over fist and others when it is literally impossible to make a dime.

Novice traders will get cocky as a result of the good times and then give it all back plus some when the tough times hit.

The most dangerous market is one that drifts aimlessly for month after month. Despite exercising caution, you will usually end up getting frustrated and trading something to keep busy and soon enough regret it.

After you have gone through a few periods of working extremely hard and still losing money, the prospect of downing tools and jumping into a waterhole instead starts to make more sense.

The trick is getting to know yourself well enough to know when the time is right. You can’t run away at the drop of a hat because then you’d never make any money.

But if you’ve had a string of losses and find yourself deflated and finding it hard to pull the trigger even when you have a great trade, it is time to take stock and consider whether a few days away from the screens could be worthwhile.

I reckon we are in a pretty tough trading environment right now.

Despite the constant uptrend in the ASX 200 which reflects the strength in large-cap banks, resources, and healthcare stocks, the rest of the market has been soggy at best since the start of the year.

Yes, there are pockets that are continuing to trend and if you got on them early enough you are reaping the rewards. Uranium, lithium, rare earths, and iron ore are the standouts.

But when you look at the mid-cap and small-cap space in tech stocks or industrials, there are many stocks trending down.

There has definitely been a shift from the easy pickings that we saw last year when everything was going up.

It is becoming a stock picker’s market rather than a shooting fish in a barrel market.

There are plenty of capital raisings and IPOs happening at the moment so perhaps a lot of money is being siphoned off into those. I’m sure there has been plenty of profit-taking going on as well which has seen many strong stocks tread water.

Toppy techs

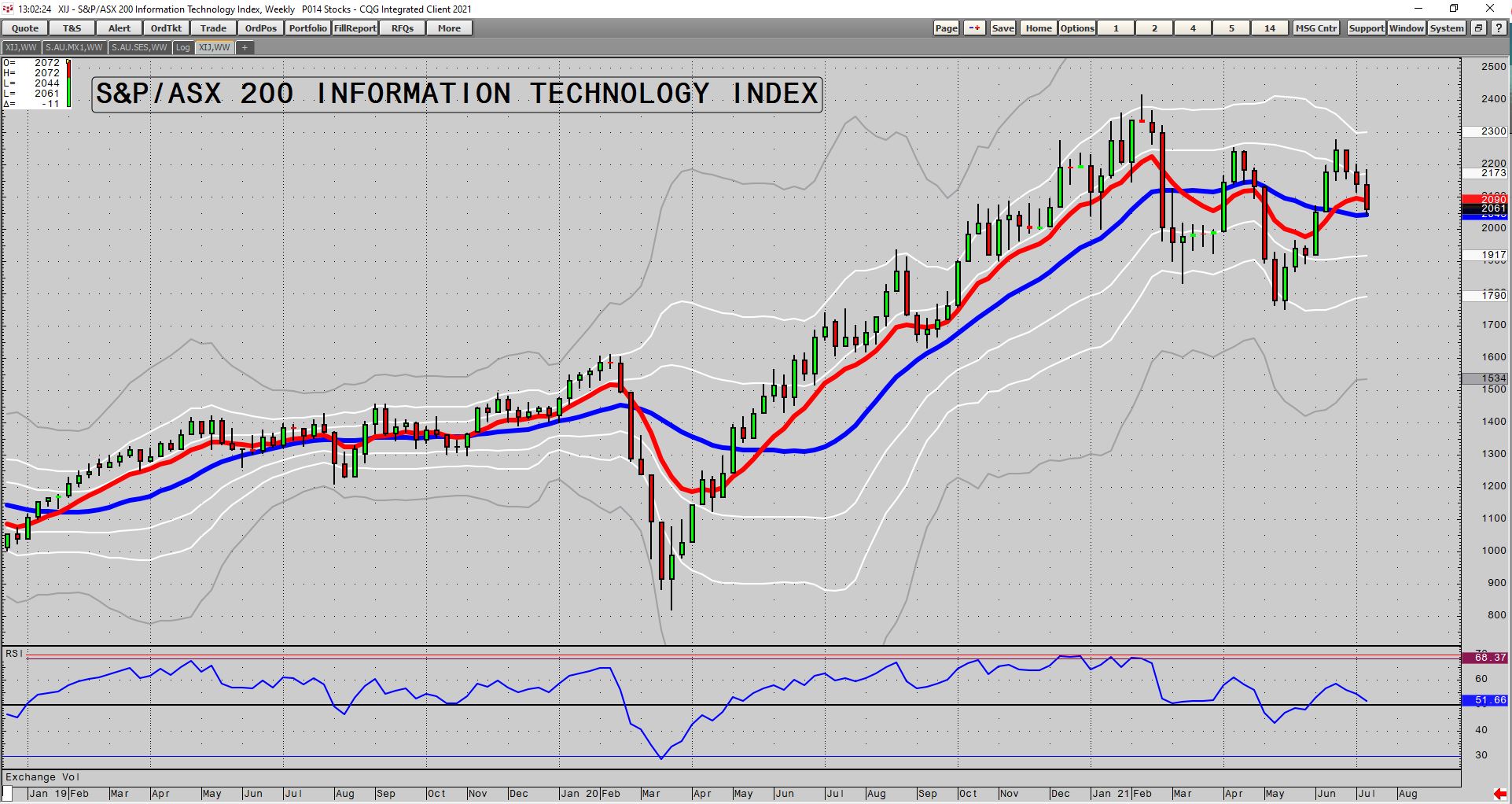

I think the S&P/ASX 200 Information Technology Index [ASX:XIJ] tells the story of the past six months.

Despite the fact the long-term trend is incredibly strong, the last six months has been tracing out what looks like a topping formation to me.

Tech stocks under pressure

|

|

|

Source: CQG Integrated Client |

After peaking in early February there have been two strong bouts of selling, and the last couple of weeks have seen that selling return, with the weakness in BNPL (buy now, pay later) stocks over the past week probably the culprit.

I’d say the risk is to the downside in the immediate future. If prices turn and rally above the peak made on 21 June (2,279), I’ll back off from that view, but until then I will be a bit wary of tech stocks.

There’s no need to fight the market because the only person who ends up punched in the face is you. Better to listen to the market and accept what it is offering at any moment.

There is one sector that I reckon is undervalued and starting to catch a bid. You can find out about it in my ‘Closing Bell’ video below.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.