In today’s Money Weekend…not that Evergrande…where’s my money!…the risks are rising…and more…

The troubles in the Chinese property market as a result of government clampdowns on property developers are starting to cause some serious havoc.

As Lachlann Tierney pointed out a few days ago, Evergrande’s stock and bond prices have been in free fall this year.

|

|

|

Source: CQG Integrated Client |

We may be close to the endgame because they have suspended trading in their bonds. Apparently, it is only for a day or so, but my guess is it will be extended beyond that and perhaps indefinitely.

Evergrande is huge. They own 2% of all Chinese real estate. There is US$300 billion of debt on the line. They are the largest high-yield dollar bond issuer in China, according to Bank of America. They account for 16% of outstanding notes.

The default rate on junk dollar bonds would spike from 3% to 14% in one hit. Ouch.

Chinese banks will obviously come under pressure with the smaller banks hardest hit. The prospect of contagion is very real in a situation like this, so it begs the question when Xi will step in to soften the blow.

They have created this situation with their ‘three red lines’ policy, so this can’t be an unexpected outcome.

China implemented its ‘three red lines’ policy aimed at curbing leverage and risk in the property development sector.

Developers began to be assessed against three criteria:

- Their liability-to-asset ratio must be less than 70%

- Their net gearing ratio must be less than 100%; and

- Their cash-to-short-term debt ratio must be more than 1

If the developers failed to meet any of these ‘three red lines’, regulators would place limits on the extent to which they could grow debt. Not meeting all three, for example, means no growth in debt is allowed.

There are around 10 other developers in a similar situation to Evergrande and their share prices have also been plummeting. In one trading session a couple of days ago, Guangzhou R&F Properties fell 12%, Greentown China dropped 11%, Sunac China lost 11%, Agile Group down 9%, Fantasia Holdings fell 8.5%, and Country Garden sank 8%.

Evergrande faces US$669 million in coupon payments this financial year, including US$83.5 million due 23 September for a dollar note. My guess is that one doesn’t get paid.

Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here

Where’s my money!

Irate investors have gathered up their pitchforks and are currently holding management hostage in their offices. Things are on the edge of going nuclear, so grab your popcorn and get ready for some fireworks.

A cascading liquidity crisis is a distinct possibility and Chinese banks are preparing for such an outcome by hoarding yuan at the highest cost in four years, according to zerohedge.com.

The Chinese property bubble has been blowing up for many years. Whether this is the straw that breaks the camel’s back remains to be seen. Intervention to ward off social unrest is always high on the agenda for the Chinese leadership.

I guess it is a case of who blinks first.

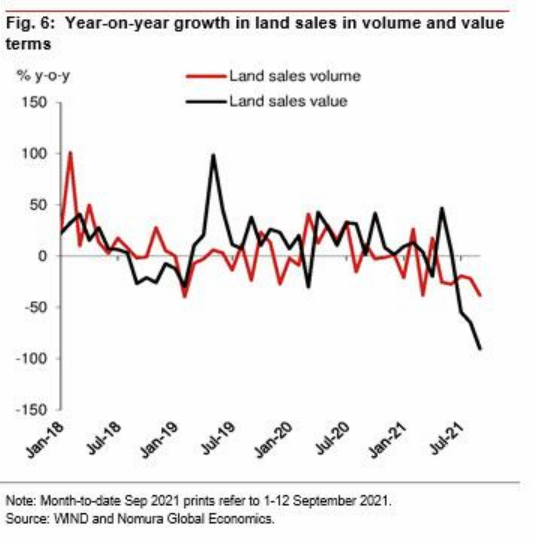

New land sales crashed by 90% in August, which can’t be a good sign. Yikes.

Land sales plummet

|

|

|

Source: Zerohedge.com |

Evergrande has more than 700 projects across 223 cities. With construction grinding to a halt and with the prospect of a coming fire sale, it is no wonder commodities like iron ore are taking fright.

Iron ore in free fall

|

|

|

Source: Tradingview.com |

But there may be more selling coming across various commodities if future construction in China falls off a cliff. Steel and cement production may have peaked for now.

Whether the contagion spreads beyond China is hard to answer. We have to wait and see how the Evergrande implosion plays out and whether they get bailed out. If they are allowed to fall over, it is similar to a Lehman moment for China and perhaps global banks will be caught up in the fallout.

If Chinese growth implodes, which is a possibility with the property sector making up about 25% of China’s growth, there could be flow-on effects to the rest of the world.

We’ve been through moments like this many times over the past few decades and without fail, once the you-know-what hits the fan, the government and central bankers step in to bail everyone out.

But before that moment arrives, there is often heightened volatility in equity markets.

The risks are rising

There are a few other things that have me wondering whether we are getting closer to a correction.

Triple witching hour hits tonight in the US. That’s when September futures and options expire.

I have noticed in the past that major reversals in the indices often occur within a few weeks of triple witching hour. I have also noticed that prices often spike sharply into the expiry date.

My guess is that the banks spike prices into expiry to ensure as many sold puts as possible expire worthless. That may be a conspiracy theory, of course, but that’s what I reckon is going on.

Prices then often retreat soon after expiry is out of the way.

We are also heading closer to a possible tapering of US Fed asset purchases and will learn more next week at the FOMC meeting.

My guess is that US bond yields are at risk of spiking higher on the back of tapering. I also reckon a huge stimulus bill from the government could put upward pressure on rates as well.

That doesn’t bode well for gold or high-priced tech stocks.

We have seen this play out before.

So there is a lot on the market’s plate as we head towards the end of the year. Might be a good time to pull up stumps and go fishing.

Check out my Closing Bell video below where I explain why I think we may be getting close to a correction in stocks. I also have a look at the Australian dollar, gold, gas, and oil.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.