In today’s Money Weekend…tapering taper…will the Fed blink?…blood from a stone…and much more…

Conditions for trading markets move in cycles. You have to work out whether it’s a time of feast or famine, then trade accordingly.

We have been through a long period of feasting while the Fed pumped the markets back up. Now we are entering a fallow period while markets try to work out how the Fed is going to respond to the fact inflation is shooting higher, with no sign of slowing down.

The investment banks are starting to say that the risk of an accelerated taper is increasing.

Goldman Sachs is saying they could double the pace of taper and be finished by next March, instead of June. They think the Fed may announce an accelerated taper in December.

Then they can butter the market up for the coming interest rate rises, which will start around the middle of next year.

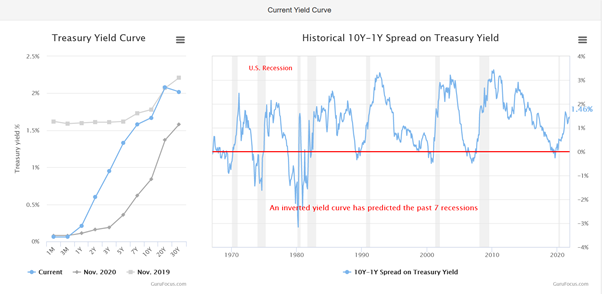

The US yield curve is starting to react, with the short end rising rapidly and the long end also rising, but not as fast.

That means the yield curve is rising and flattening across the board.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Yield curve on the move

|

|

|

Source: Gurufocus.com |

I don’t think many people understand just how important the US yield curve is.

Nearly every asset market around the world is priced in relation to the US yield curve.

Since the Fed last attacked inflation in the early ‘80s with the Volcker interest rate shock, we have been in a generation-long environment of falling interest rates. Anyone under the age of 50 or so doesn’t know anything other than falling rates and rising asset prices.

With CPI inflation in the US currently headlining at 6.2% and expected to stay elevated for the foreseeable future, the interest rate on the US 10-year bond yield of around 1.6% seems incredibly low and could shoot a lot higher quickly if the market really takes fright.

Will the Fed blink?

The first sign of the Fed blinking in the face of the rapidly changing market conditions will be if they announce that they are accelerating the pace of taper.

That’s when we will know for sure that they are starting to get worried that they are falling behind inflation and need to start acting to rein it in.

The market is already racing ahead of Fed announcements and is ratcheting up the number of interest rate rises expected next year.

It is no wonder that many stock prices seem to be aimlessly drifting at the moment.

The fact that we are only weeks away from the end of the year could be part of the problem. Many investors have had a good year and would be more interested in ensuring they keep the great gains they have rather than rolling the dice on new trades.

The uncertainty we face as a result of the changing inflation environment lends itself to profit-taking rather than risk-taking.

Blood from a stone

When stocks start drifting, a trader needs to keep their wits about them because it’s easy to fall into the trap of trying too hard to find profit-making opportunities.

Soon enough, you’re knee-deep in mediocre trades, and they act like quicksand — slowly sucking you under.

There is nothing worse than having a bunch of crappy trades on your books and then being caught out by a sharp swan dive in the market. The lack of conviction that you had with the trades to begin with adds to the pain of each loss.

Having the attitude that you can’t draw blood from a stone is the right one.

Turn your attention to other things, and let the market tell you when it is time to start trading again.

Sometimes sitting on your hands and doing nothing at all is great trading.

We are taught from a young age that productivity is based on working hard towards our goals at all times.

But trading isn’t like a normal career. You can’t study trading for a few years and then know how to do it. You can’t work harder than last month, and then make more money than last month as a result.

That doesn’t mean you can trade without any effort. Much to the contrary.

You have to work extremely hard to make any inroads at all, and often you can work intensely hard and end up with an old boot on the end of your fishing line.

The market isn’t obligated in any way to give you a cent.

You have to be present when the market is ready to give you a good win. But that involves navigating many different market environments and making sure you keep your losses to a minimum when the market is being stingy.

I reckon the next few months of trading has more of a chance of seeing large downside volatility than strong rallies. As I was writing this article, the ASX 200 has been steadily selling off and is now down over 100 points around the middle of the day.

That doesn’t mean it won’t be up 100 points on Monday, but I reckon it’s a sign that making money trading as the end of the year approaches is going to be tricky.

Tread carefully and consider paying more attention to your eggnog than the markets. They will still be there tomorrow.

Watch my Closing Bell video below where I outline why I think the ASX 200 is at risk of further downside in the immediate future.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.