How are you enjoying the madness?

I’ve never seen commodity markets flying around so rapidly. It’s chaos out there.

But within the madness, there has to be some opportunities brewing.

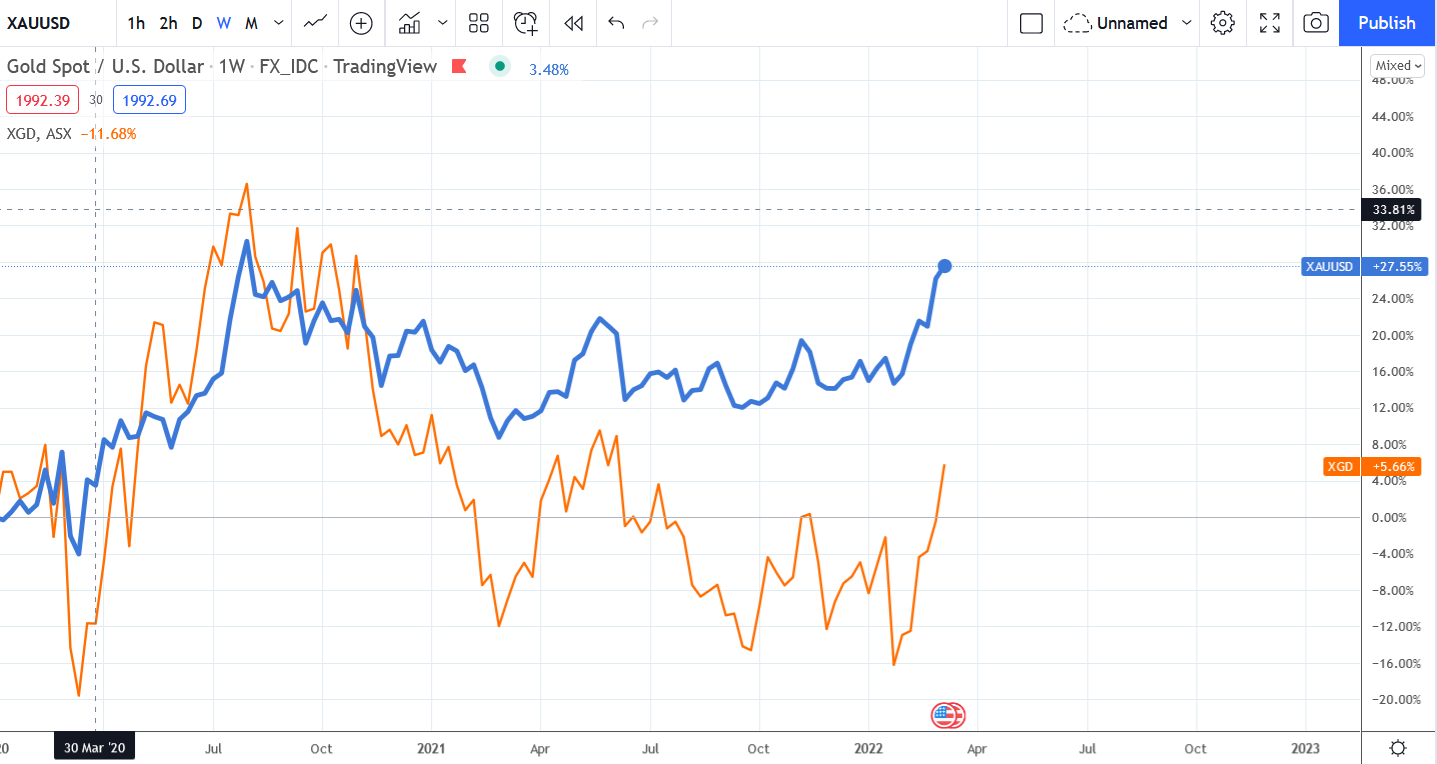

The largest disconnect that I can see out there is the gap opening up between the gold price and gold stocks on the ASX.

I have been calling for higher gold prices (with all the other gold bugs) for ages and have been following gold closely in my ‘Closing Bell’ videos (below this article).

My view was that the buying should return once gold broke out above US$1,880, which was the midpoint or ‘point of control’ (POC) of the correction over the last couple of years.

That has certainly been the case, with gold flying once it got above the POC, racing straight to the all-time high of US$2,075 before meeting some stiff resistance.

Gold probably needs to do some more work before it’s ready to break out above the all-time high, but conditions are ripe for that to happen sometime this year and possibly within the next few months.

But major investors don’t seem to be that convinced of such an outcome because there isn’t much impulsive buying going on in gold stocks, despite the rapid increase in the gold price over the last couple of months.

Perhaps there’s a concern that the buying is on the back of geopolitical tensions which often end up reversing once the tension subsides.

We’re also on the verge of a rising interest rate cycle, and rising real rates often make life difficult for gold.

But with inflation hitting 7.9% in the US and the heightened volatility in markets probably giving the Fed cold feet to chase down inflation rapidly, my guess is that inflation is going to remain elevated for a long time.

Negative real rates at the long end of the yield curve will be with us for years, so there isn’t much of an opportunity cost in holding gold.

Will central banks turn to gold?

We also have the wild card of how central banks around the world will react to the events over the past month.

With the Russian central bank cut off from their foreign reserves by US sanctions, you have to ask whether it will become imperative for other nations to start building up their gold reserves, so they aren’t at the mercy of such actions in future.

For the traditional enemies of the US, I would say that is a no-brainer.

With many Russian banks cut off from SWIFT, there could also be a hastening of moves to find ways to lessen the grip of the US dollar on nations.

If a breakout to new all-time highs was to happen on the back of central bank buying, then strap yourself in for a massive run in gold.

But that’s all conjecture, of course.

The technical situation for gold is obviously looking strong right now, but I always get nervous when a market retests an all-time high and gets rejected — the infamous ‘double top’ that can mark a major high before a serious correction.

So I’m a little wary that we could see gold correct further after tapping the all-time high again, but the thing that interests me is the gap that has opened up between gold and gold stocks.

Gold stocks will play catch up

A quick look at a chart of the gold price compared to the S&P/ASX Gold Index [ASX:XGD] since the start of 2020 shows the situation quite clearly:

|

|

| Source: Tradingview.com |

The chart above is heavily weighted to the large-cap gold stocks. The fact is the smaller-cap gold stocks have been seriously pummelled over the past year, so the size of the lag for them is much larger than it looks in the chart above.

Oil prices are surging higher so there’s a case to be made that gold producer margins could be under pressure from rising costs.

But gold has rallied $200 an ounce over the past couple of months, which should more than cover rising fuel costs for miners.

If gold keeps rallying, the lag will start looking ridiculous, and I reckon gold stocks will stage a sharp rally if that’s the case.

There are a few gold stocks that haven’t really turned up at all, and they are probably suffering from company-specific issues, but a rising tide lifts all boats, so I reckon it’s time to start sniffing around for a bargain.

I give you a few goldies to consider in the ‘Closing Bell’ video below, but be sure to also check out my friend and colleague Brian Chu’s take on gold at the moment. He’s got five niche gold stocks for you to check out, and he should know because he’s invested most of his family’s money into gold stocks for years and has been shooting the lights out.

Regards,

|

Murray Dawes,

For The Daily Reckoning Australia Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.