Here are three things I’m thinking about today…

1. Our first trade war victims are getting flushed out.

We don’t have to look far to see the first one. It’s oil!

This got clobbered after OPEC decided to increase production. That begins now. Those extra barrels will now hit the market just as demand is set to go down. Here’s why you care.

The Wall Street Journal reports:

“In the biggest oil field in the U.S., dismayed frackers are starting to reconsider their drilling plans because they anticipate demand for their product to weaken—in part as a result of Trump’s erratic shifts on trade.”

Let’s check in on how Trump’s making the American oil industry “great again”.

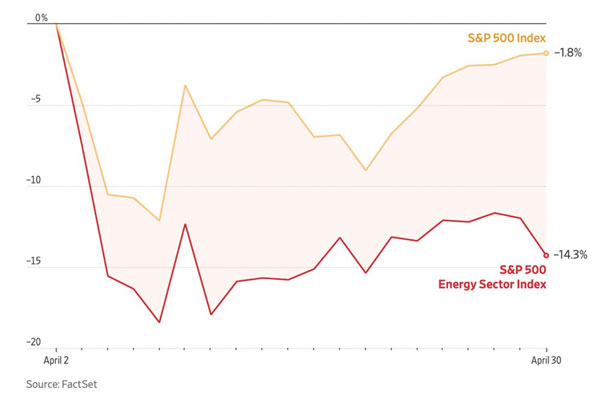

Hmm. US energy firms are getting slaughtered alongside the oil price. Check it out…

| |

| Source: Wall Street Journal |

The other week I said the US could have low gasoline prices or a roaring oil industry.

Trump promised both, despite them being polar opposites.

Then again, he’s never been one to let the facts get in the way of the story.

Hmm.

All this is a good thing for the rest of us.

Lower oil prices go straight to consumers as extra dollars.

They also help lower inflation.

That takes down interest rates. That should bolster the outlook for the share market over the year.

There is one caveat to this. Trump is going hard on Iran. A flare up in the Middle East could reverse the oil price quick smart.

2. Now I present the next victim…

Reliance Worldwide (RWC) is a construction supplies company on the ASX. It’s a decent presence in the USA. The catch? 48% of their material is sourced from outside America.

RWC put out a market update this morning.

Tariffs are going to cost them at least $25-30 million in restructuring and expenses. They’re now scrambling to source their inventory from anywhere but China.

Plus, the outlook is sinking too. They write…

“A full year trading outlook for FY25 was provided in RWC’s interim earnings announcement released on 18 February 2025.

“Since then, economic conditions in the US have deteriorated, due mainly to the uncertainty surrounding the introduction of higher tariffs between the US and its trading partners.

“This has contributed to declining consumer confidence and reduced demand.”

Watch the stock to see how much it declines. RWC is already down since last September.

I’m guessing most of this was the market jumping ship once it became likely Trump would get in.

However, it’s one thing to expect a 10-20% tariff on Chinese imports. They’re currently 145%.

The US housing market is also “frozen”, according to reports, thanks to high mortgage rates and expensive prices.

So, not much to bolster RWC for the moment. It will likely grind along for a long while now.

There are a lot of traps like this out there now.

Also consider…

3. …This chart from Firetrail on the ASX outlook

They say…

“Earnings risk is starting to rise.

“Research from Goldman Sachs shows that to hit FY 2025 consensus earnings, the average ASX 200 Industrial would need to deliver its strongest second half earnings skew in two decades.

“This suggests the market could see a wave of earnings cuts in the upcoming “confession season” ahead of August results.”

| |

| Source: Firetrail |

Point being: make sure you know your stock, or you could get whacked if they disappoint.

Remember, too, all this is more applicable to the Top 200.

There is still plenty of opportunity in the small sector of the market. Good buying too.

Here’s shrewd fund manager Matthew Kidman appearing in the Australian Financial Review today…

“So we’ve started to churn some of these large caps out over the past few weeks, which had served us well defensively … but now we’re thinking it’s better to get back on the bike we ride normally and take on more risk.”

The article says he’s been buying back into the market, and plans to keep going. Sounds smart to me, as long as you keep the usual risks in the share market in mind.

As Buffett says, “Be fearful when other people are greedy, and greedy when others are fearful.”

Indeed, the great man from Omaha announced his retirement over the weekend. What an epic ride.

Hopefully, he lives to 100 and beyond to see Berkshire keep fruiting.

Regards,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day

– Australian Dollar – Monthly Chart

| |

| Source: Tradingview |

With Trumps policies causing an exodus from the US dollar, the Australian dollar is starting to look promising for more upside.

The recent collapse in the Australian dollar saw it plummet into a major buy zone between 58-62 cents.

The recovery has been swift as the US dollar turned down sharply during the tariff tantrum.

If the Aussie can hold these levels until the end of this month that will confirm a monthly buy pivot from a major buy zone.

That could increase the odds of more upside ahead for the Aussie dollar in coming months.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments