Today, we continue with our top trends for 2022 as part of our ongoing series, “Our Top Nine Investment Trends to Watch in 2022”.

In this series we are going to cover our top 9 investment ideas:

1. The great lithium disconnect

2. Decarbonisation — green switch activated

3. The future of payments

4. Quantum computing and Moore’s Law on steroids

5. Connected devices and memory

6. Decentralised finance — an ‘Amazon-in-1994’ moment

7. The influential ‘I’s

8. Watch out for gold

9. Stocks – Mind the lofty valuations

If you’re interested in dowload all 9 Trends in one document to read at your leisure, simply enter your email below and have them sent directly to your inbox.

And this time, we’re talking about…

Trend #6 Decentralised finance — an ‘Amazon-in-1994’ moment

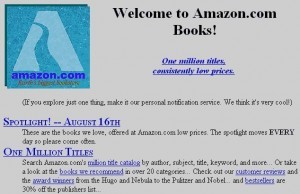

When he walked away from a lucrative investment banking job and started up Amazon in his garage in 1994, Jeff Bezos said:

‘I knew that when I was 80, I was not going to regret having tried this. I was not going to regret trying to participate in this thing called the internet that I thought was going to be a really big deal. I knew that if I failed, I wouldn’t regret that.’

Bezos spotted very early on that the internet was an exponential trend.

Source: Pew Research

He explained:

‘I came across the fact that Web usage was growing at 2,300 percent per year. I’d never seen or heard of anything that grew that fast, and the idea of building an online bookstore with millions of titles — was very exciting to me.’

Bezos knew the power of exponentiality.

That’s the key point…

As renowned futurist Ray Kurzweil once put it:

‘Our intuition about the future is linear. But the reality of information technology is exponential, and that makes a profound difference. If I take 30 steps linearly, I get to 30. If I take 30 steps exponentially, I get to a billion.’

As Ryan Dinse, editor of Exponential Stock Investor points out, we can apply the same exponential principles to investing.

Which is why finding exponential trends early can result in significant returns.

So what’s this got to do with decentralised finance (DeFi)?

Ryan believes the DeFi industry appears to be one such exponential trend.

It’s grown from almost nothing to an US$80 billion industry in around three years.

think it’ll be an US$800 billion industry just one year from now.

Matthew Roszak, co-founder of the DeFi platform Vesper Finance, told Markets Insider recently:

‘Right now, we’re sitting at a DeFi market cap of about $80 billion. My sense is that a year from now it will add a zero.’

Remember, the global finance industry is a US$22.5 trillion behemoth — compared to that, US$80 billion, even US$800 billion, is a drop in the ocean.

The point is this…

While Amazon made a fortune disrupting ‘bricks-and-mortar’ retail, it’s nothing compared to the enormity of the opportunity at hand for DeFi disruptors.

The internet’s power and impact is relevant when discussing DeFi’s potential.

As Coinbase co-founder Fred Ehrsam noted in 2021, DeFi is the ‘internet of money’.

Ehrsam believes in 40 years the idea of an open, global network for value transfer will seem obvious as DeFi becomes the primary financial system of the world.

He writes:

‘DeFi, like the internet, will likely make financial services cheaper, faster, secure, personalized, and more. If YouTube grew the breadth of video content by orders of magnitude because it was free and easy for anyone to both create and use videos, what will DeFi do for financial products as it similarly allows anyone to create and use anything at near-zero cost?’

Vitalik Buterin, co-founder of Ethereum:

‘I believe that DeFi will create a new, easy-to-use and globally accessible financial system for the world. For example, applications like stablecoins are some of the most valuable innovations to come out of DeFi so far. They allow anyone in the world to benefit from the censorship resistance, self-sovereignty, and instant global accessibility of cryptocurrency while having the purchasing power stability of the dollar—or, if the dollar ever stops being stable, they enable people to quickly move their funds into another asset that does a better job of maintaining stability’

But what’s so special about decentralised finance?

As a PwC report on DeFi explained, what makes decentralised unique is the idea of using blockchain to create a market that is ‘permissionless and open to anyone’.

DeFi obviates the need for centralised intermediaries — which can speed up transactions and cut costs.

And its decentralised nature also democratises innovation. Many smart and engaged people across the world can now experiment on DeFi projects in the hope of improving the financial industry.

As Coinbase co-founder Fred Ehrsam said, DeFi is a ‘truth hiding in plain sight today’.

But watch out for DeFi in 2022 and beyond as it potentially makes a bigger, disruptive splash.

Now, finding stocks set to benefit from a convergence of megatrends is a huge part of Ryan’s Exponential Stock Investor service.

So if you want to find out more, click here.

A bit about us — Fat Tail Investment Research

While themes and trends can come and go, one thing that doesn’t go out of fashion in the investing world is insightful analysis.

Information is the crucial ingredient in markets.

But information alone isn’t enough.

It’s the rational analysis of the information that separates a sound idea from a weak one.

Here at Fat Tail, our editors pride themselves on providing valuable insight by applying their industry experience and knowledge.

At Fat Tail, we value differences.

Disagreement isn’t censured but encouraged.

And we find our readers appreciate the range of thought and ideas of our editors.

At Fat Tail, we have bulls, we have bears, we have crypto advocates, and gold bugs.

At the heart of it, though, we have a team dedicated to the free exchange of ideas. Reason trumps agenda here.