Today, we continue with our top trends for 2022 as part of our ongoing series, “Our Top Nine Investment Trends to Watch in 2022”

In this series we are going to cover our top 9 investment ideas:

1. The great lithium disconnect

2. Decarbonisation — green switch activated

3. The future of payments

4. Quantum computing and Moore’s Law on steroids

5. Connected devices and memory

6. Decentralised finance — an ‘Amazon-in-1994’ moment

7. The influential ‘I’s

8. Watch out for gold

9. Stocks – Mind the lofty valuations

If you’re interested in dowload all 9 Trends in one document to read at your leisure, simply enter your email below and have them sent directly to your inbox.

And this time, we’re talking about…

Trend #4 Quantum computing and Moore’s Law on steroids

‘In less than ten years quantum computers will begin to outperform everyday computers, leading to breakthroughs in artificial intelligence, the discovery of new pharmaceuticals and beyond. The very fast computing power given by quantum computers has the potential to disrupt traditional businesses and challenge our cyber-security. Businesses need to be ready for a quantum future because it’s coming.’

– Jeremy O’Brien, 2016

Let’s talk about quantum computing by tackling a roundabout puzzle.

You’re hosting a Christmas dinner and need to seat 10 fussy relatives. Only one optimal seating arrangement works out of all the possible permutations.

How many combinations must be sifted to arrive at the optimal arrangement?

Answer: over 3.6 million.

Over 3.6 million combinations to compute just to seat 10 family members around some Christmas rotisserie chicken.

In this familial microcosm lies a wider problem.

Most current supercomputers don’t have the working memory to hold countless combinations inherent in problems more pressing than a Christmas seating plan.

But combinatorial optimisation is not an academic curiosity.

Optimisation is a professional hassle for many industries.

A logistics firm delivering to dozens of cities, for instance, seeks the optimal route to save time and fuel.

A super fund wants to balance risks of their large investment portfolios.

And a pharma company desires to simulate the action of molecules in pursuit of a drug breakthrough.

Our current computers struggle to cope with these problems.

In a way, our computers must themselves be optimised.

Quantum mechanics provides the means.

As technology giant IBM explains:

‘Quantum computers can create vast multidimensional spaces in which to represent very large problems. Classical supercomputers cannot do this.

‘Algorithms that employ quantum wave interference are then used to find solutions in this space, and translate them back into forms we can use and understand.’

Quantum computing is also faster.

Finding an item in a list of one trillion, where each item takes one microsecond to check, would take a classical computer about a week.

A quantum computer would take about a second.

Quantum computing is another leg up in computing’s evolution.

And one of the many emerging applications of quantum computing collides with a trend we discussed earlier — EVs and their lithium-ion batteries.

Giant automaker Mercedes-Benz, for instance, has recently partnered with IBM to use quantum computing to assist with the development of EV technology.

As Newsweek reported:

‘What could have taken decades to research can be done in a few years. Within a 2 to 3 year timeframe and about 300,000 tracked drivers as data points, IBM and Mercedes-Benz are working to understand the complex chemistry inside of a lithium-ion battery in order to shorten development times for improvements.

‘In addition to the research on batteries, Riel says that the use of quantum computing can also speed up the research into new kinds of materials that can be used to build cars. Running simulations that look at how those prospective materials interact with chemical catalysts, such as corrosion, can cut development times by years.’

The revolutionary potential of quantum technology isn’t lost on investors.

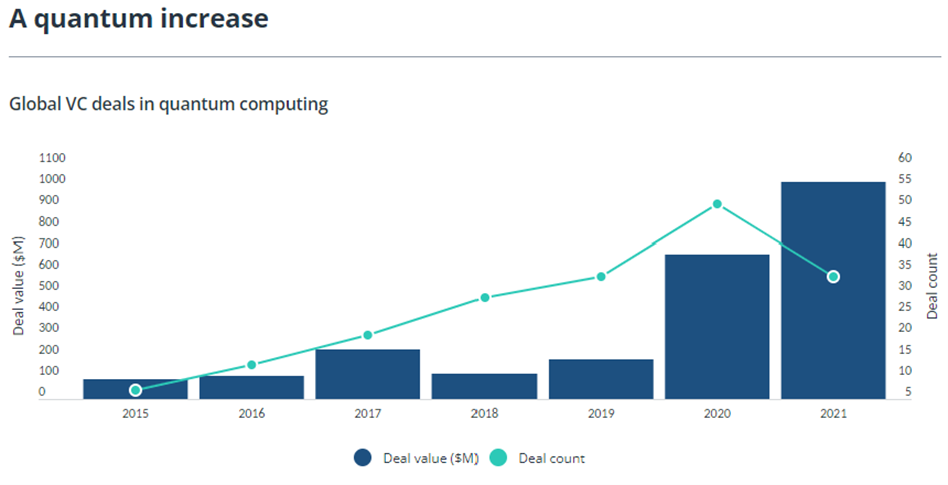

In 2020, investors spent US$557.5 million on 28 venture deals for quantum computing firms in North America — more than three times the amount invested in 2019.

In July 2021, one private company, PsiQuantum alone raised over US$450 million to build a commercially viable quantum computer.

And according to PitchBook Data, global venture capital investment in quantum computing reached US$1.02 billion in 2021 — more than was poured into the industry during the previous three years combined.

Source: PitchBook Data

Quantum computing, chips, and ‘Moore’s Law on steroids’

Developments in quantum computing parallel progress with integrated circuits.

As Peter Diamandis and Steven Kotler wrote in their book Abundance: The Future is Faster than You Think:

‘In 2023 the average thousand-dollar laptop will have the same computing power as a human brain (roughly 1016 cycles per second). Twenty-five years after that, that same average laptop will have the power of all the human brains currently on Earth.

‘More critically, it’s not just integrated circuits that are progressing at this rate.

‘In the 1990s, Ray Kurzweil, the director of engineering at Google and Peter’s cofounding partner in Singularity University, discovered that once a technology becomes digital—that is, once it can be programmed in the ones and zeroes of computer code—it hops on the back of Moore’s Law and begins accelerating exponentially.

‘In simple terms, we use our new computers to design even faster new computers, and this creates a positive feedback loop that further accelerates our acceleration—what Kurzweil calls the “Law of Accelerating Returns.”

‘The technologies now accelerating at this rate include some of the most potent innovations we have yet dreamed up: quantum computers, artificial intelligence, robotics, nanotechnology, biotechnology, material science, networks, sensors, 3-D printing, augmented reality, virtual reality, blockchain, and more.’

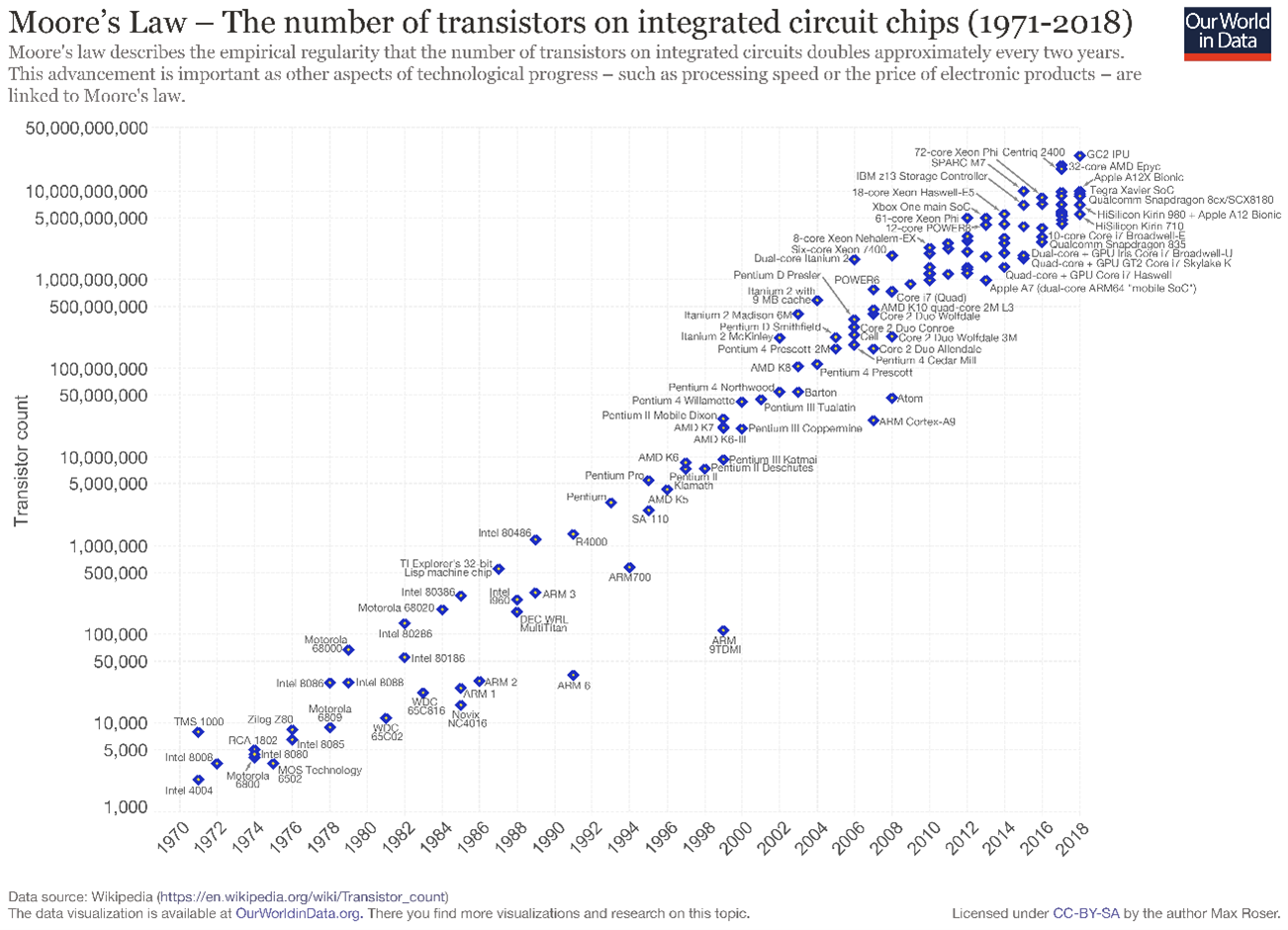

One of the key laws underpinning the technological revolution of the last 30 years is Moore’s Law.

In 1965, Intel founder Gordon Moore noticed a pattern: the number of transistors on an integrated circuit was doubling every 18 months. Meaning that every year and a half, computers became twice as powerful.

Source: Our World in Data

MIT Technology Review noted that the most important technological breakthroughs we now take for granted ‘almost without exception, are possible only because of the computation advances described by Moore’s Law.’

But over the past few years, Moore’s Law has slowed.

Integrated circuits improve via shrinking the space between transistors, permitting us to pack more of them onto a chip.

In 1971, channel distance — the distance between transistors — was 10,000 nanometers. By 2000, it was about 100 nanometers. Today, it’s closer to just five.

Such a microscopic distance hinders the electrons ability to calculate. Shrinking this distance inches us closer to the hard physical limit of transistor growth.

In 2020, MIT Technology Review ran a story on the ‘gradual decline’ of Moore’s Law, noting that numerous ‘prominent scientists have declared Moore’s Law dead in recent years’. Even the CEO of giant chipmaker Nvidia agreed.

Again, however, quantum computing offers hope.

Peter Diamandis and Steven Kotler write in Abundance: The Future is Faster than You Think:

‘Kurzweil’s point is that every time an exponential technology reaches the end of its usefulness, another arises to take its place. And so it is with transistors. Right now, there are a half-dozen solutions to the end of Moore’s Law.

‘Alternative uses of materials are being explored, such as replacing silicon circuits with carbon nanotubes for faster switching and better heat dissipation. Novel designs are also in the works, including three-dimensional integrated circuits, which geometrically increase the available surface area.

‘There are also specialized chips that have limited functionality, but incredible speed. Apple’s recent A12 Bionic, for example, only runs AI applications, but does so at a blistering nine trillion operations a second.

‘Yet all of these solutions pale in comparison to quantum computing. In 2002, Geordie Rose, the founder of an early quantum computer company D-Wave, came up with the quantum version of Moore’s Law, what’s now known as Rose’s Law. The idea is similar: The number of qubits in a quantum computer doubles every year. Yet Rose’s Law has been described as “Moore’s Law on steroids,” because qubits in superposition have way more power than binary bits in transistors.’

A bit about us — Fat Tail Investment Research

While themes and trends can come and go, one thing that doesn’t go out of fashion in the investing world is insightful analysis.

Information is the crucial ingredient in markets.

But information alone isn’t enough.

It’s the rational analysis of the information that separates a sound idea from a weak one.

Here at Fat Tail, our editors pride themselves on providing valuable insight by applying their industry experience and knowledge.

At Fat Tail, we value differences.

Disagreement isn’t censured but encouraged.

And we find our readers appreciate the range of thought and ideas of our editors.

At Fat Tail, we have bulls, we have bears, we have crypto advocates, and gold bugs.

At the heart of it, though, we have a team dedicated to the free exchange of ideas. Reason trumps agenda here.