What a week it’s been for a couple of high-flyers.

Firstly, Sir Richard Branson’s vision of space tourism has succumbed to the gravity of economic reality.

Dreams borne from the days of easy money have turned into a nightmare for investors.

|

|

| Source: Barron’s |

As reported (emphasis added):

‘Investors have cooled on Virgin Galactic stock…In July 2021, around the time of the Branson flight, shares traded north of $50 apiece. They have dropped more than 90% since then amid a series of delays to the start of commercial service caused by a series of technical and regulatory challenges.’

July 2021 was a time of peak market euphoria.

Robinhood traders. The Reddit crowd. Meme stocks.

In the heady times, pesky issues like ‘technical and regulatory’ challenges, cash burn, and commercial reality are ignored. But there comes a time when you run out of ‘bigger fools’, and these once-discounted issues suddenly get counted by a more analytical marketplace.

The news was even worse for investors in Virgin Orbit — a spin-off from Virgin Galactic.

From The Guardian, 24 May 2023 (emphasis added):

‘Virgin Orbit, the satellite launch company founded by British billionaire Richard Branson, will permanently cease operations, just months after a major mission failure.

‘The California-based firm, which had already filed for Chapter 11 bankruptcy protection in the United States in early April, has auctioned off its main assets, recovering just over $36m. That figure is barely 1% of the value the company reached in late 2021 on Wall Street when it was valued at $3.5 billion.’

The fates of Virgin Galactic and Virgin Orbit come as no surprise.

In the 13 May 2020 issue of The Rum Rebellion, I wrote:

‘“History never repeats itself. Man always does.”

Voltaire

‘The tentative Post-Second World War recovery morphed into another period of optimism.

‘Rising fortunes — generated from a manufacturing boom — made people believe anything was possible. Horizons are expanded.

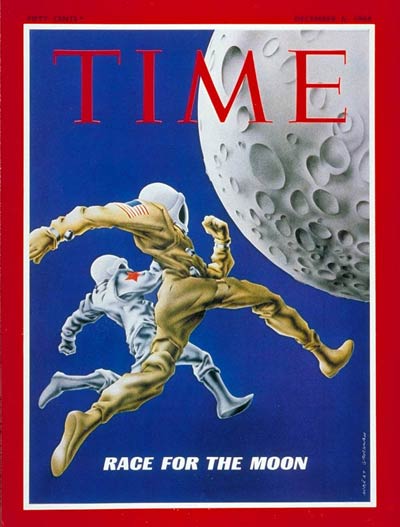

‘The peak in social mood was captured by the Time Magazine cover of 6 December 1968…the Moon beckoned.

|

|

| Source: Time Magazine |

‘Then along came the unsettling 1970s.

‘The gold standard was abandoned. Oil shocks. High inflation. Rising interest rates. An economy in the grips of stagflation…high inflation and high unemployment and stagnant growth. People were more concerned with what was happening on Earth, not the Moon.

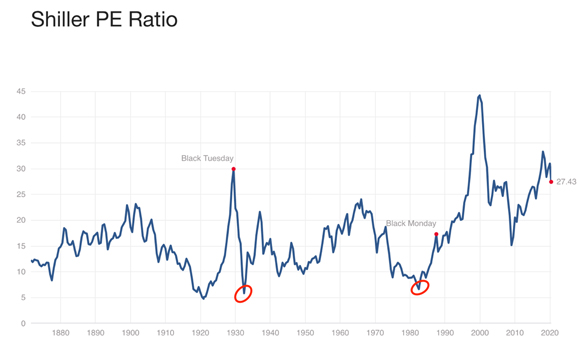

‘The gloomy social mood at that time was reflected in a PE ratio that came within a whisker of the low reached in 1932.

|

|

| Source: Multipl |

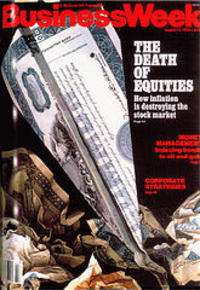

‘The cover of the August 1979 edition of Business Week magazine, reflected the rather sombre and downcast mood of that period.

‘The share market was dead.

|

|

| Source: Business Week |

‘Since the lows of early 1980, social mood has been — for the most part — on the up.

‘There have been episodes when investor confidence has been shaken — 1987 crash, dotcom bust and GFC.

‘On each occasion, the US Federal Reserve (the Fed) has led the central banker efforts to restore faith (and optimism) in markets.

‘Such has been the “success” of these concerted efforts, there’s now an overwhelming belief in the ability of the Fed to insulate us from any serious or prolonged downturn.

‘The Fed has our backs.

‘And when confidence is high and money (appears to be) abundant, well…anything is possible.

‘The cover of Time Magazine on 29 July 2019…déjà vu…

|

|

| Source: Time Magazine |

‘The latest cover — a homage to the 1968 edition — is reflective of social mood…the logos of SpaceX (Elon Musk) and Blue Origin (Jeff Bezos) feature prominently.

‘Both men have been hailed as visionaries and amassed serious personal fortunes (on paper) courtesy of the Fed’s easy money programmes and investors buying into the vision.

‘When social mood is high and money is flowing freely, flights of fantasy can be entertained.

‘But when things start to unravel on Mother Earth, gravity takes over.

‘As announced in Reuters on 12 May 2020 (emphasis added):

‘“Billionaire Richard Branson’s Virgin Group said on Monday that it may sell up to 25 million shares of space tourism company Virgin Galactic Holdings Inc to raise funds amid the COVID-19 pandemic.

‘“The company said it intends to use the proceeds to support its portfolio of global leisure, holiday and travel businesses that have been affected by the impact of the coronavirus.

‘“The company (Virgin Galactic), which aims to offer the first commercial space flight later this year, said in April it would keep running as a critical infrastructure business during the pandemic.”

‘Periods of peak optimism are fertile ground for grand visions.

‘Society — financiers and investors and consumers — get swept up in the mood of the day.

‘But then the bubble bursts.

‘Credit-funded spending patterns change.’

As economic conditions in the US continue to deteriorate, I expect the grand visions of Musk and Bezos to be put on the back burner.

Cash flows from their various businesses are going to be needed here on Earth…shoring up the share prices of Tesla and Amazon.

From the penthouse to the jailhouse

While investors in Virgin Orbit and Virgin Galactic have lost money, a former darling of the tech set has (finally) lost her freedom.

|

|

| Source: Insider |

Theranos is another case of investors ‘buying the dream and ignoring pesky issues like…does this actually work’.

In the spirit of ‘you learn far more from your mistakes than you do your successes’, on 10 May 2018, I wrote an email to our three daughters regarding the spectacular rise and even more spectacular fall of Theranos.

Here’s an edited version…

‘Hello girls

‘Not sure if you’ve been following the Theranos saga in the US.

‘For a bit of background, Theranos was the biotech start-up founded in 2004, by 19-year-old entrepreneur, Elizabeth Holmes.

‘Theranos was founded on good intentions. Holmes wanted to “democratise healthcare” by making it possible to diagnose a variety of illnesses from a simple, low-cost blood test.

‘Early detection could save lives…a noble concept.

‘There was one small problem…her Professors at Stanford University said, “it was not possible”.

‘Perhaps they were wrong. Perhaps there was a way for science and technology to evolve to the stage when a few drops of blood could replace more extensive (and expensive) testing regimes.

‘Holmes certainly didn’t lack self-belief.

‘In 2011, she convinced former US Secretary of State, George Schulz, to join the company’s board…which also included Henry Kissinger.

‘In 2013, the pharmaceutical giant Walgreens entered into a partnership to place Theranos blood sampling centres in its stores. A major coup.

‘In 2015, Forbes magazine named Elizabeth Holmes as the world’s youngest self-made billionaire…at the time, Theranos was valued at US$9 billion.

‘Elizabeth Holmes was being hailed as the next Steve Jobs.

‘But it was all a fraud.

‘In 2016, serious questions were being asked about the accuracy of the results from the blood tests.

‘There’s your first lesson.

‘Never promise something you cannot deliver…eventually you’ll be found out.

‘But you already know this…which is why I’ll get to the real reason for this email.

‘This was the CNBC headline from 4 May 2018…

|

|

| Source: CNBC |

‘Walmart heirs, DeVos (a family member of the of Amway founder)…these are seriously wealthy families. How did they fall for this fraud?

‘But it gets better (or worse, depending upon your perspective) as a lesson in how even the best, brightest and richest can be duped.

‘Lesson number two.

‘Even those with the resources, the contacts and the privilege to access the very best inside information, can get it horribly wrong.

‘There is never anything “sure” about a “sure bet”.

‘People lie. Markets change. Social mood can turn. Governments can change legislation.

‘There’s a host of reasons as to why that “guaranteed” winner becomes a loser.

‘Expecting the unexpected is why I spend time analysing risk.

‘What can go wrong?

‘Where are the traps?

‘What’s the downside?

‘What’s fair value?

‘If we do this reasonably well, then the upside will take care of itself.

‘Which brings us to Lesson Three.

‘To quote from Kerry Packer “never, ever bet the house”.

‘The amounts lost by the high-profile investors, are — by normal standards — a “fortune”.

‘But when measured against their personal wealth, it’s a small change.

‘Murdoch’s loss of US$125 million is less than 1% of his US$16 billion net worth.

‘DeVos is worth US$5 billion…her loss is around 2% of her net worth.

‘The Walton family’s combined wealth is over US$100 billion…to them, US$150 million is a rounding error.

‘Carlos Slim is worth US$57 billion…what’s a mere US$30 million when you’ve amassed wealth of that magnitude?

‘And that’s the lesson…never invest more than you can afford to lose.

Don’t bet the house.‘Far better to suffer a flesh wound, than to risk an amputation.

‘The final lesson. The importance of keeping it simple.

‘Having “been there and done that”, I learnt the hard way about “hot tips”.

‘There are far too many variables to factor into the risk equation…including the potential for fraudulent behaviour.

‘How do you weigh this up in advance…especially when the smart money (the ones who you’d think would be in the know) has bought into the concept?

‘Experiences like that of Theranos…are why I decided long ago to “keep it simple”.

‘Assessing market risk (as opposed to individual company risk) is an easier task.

‘A lot of broking analysts and professional managers do a pretty lousy job at analysing companies, so what makes me think I’ll be any better?

‘I’ve learnt my limitations…the hard way.

‘The “simple” approach — investing in the index — is boring and far less rewarding when compared with a concentrated investment in a genuine success story…like an Apple, Google, Microsoft et al.

‘That’s the trade-off we have to accept — boredom v excitement and index performance v individual stock performance.

‘We must not jeopardise (our) long-term vision by investing more than we can afford to lose in “once-in-a-lifetime” opportunities and “hot tips”.

‘If they come off, that’s a bonus. But if they don’t, then at least we’ve minimised the cost of the lesson and more importantly, the damage.

‘That’s how the rich minimise their mistakes…a lesson well worth remembering.

‘Love,

‘Dad’

With the lessons of over-promise and under-delivery fresh in our mind…

Beware the hype around AI

The current hype around investing in anything remotely connected to Artificial Intelligence (AI) is destined to create more losers than winners.

FOMO — fear of missing out — is pushing the Nasdaq Index to a level that fundamentals do not warrant.

Dreams are being bought, but — like the Space Race and Theranos — reality is what’s going to be sold and sold and sold…until prices are a fraction of what they are today.

I sincerely hope the lessons of what happens to over-hyped high-flyers are of value to you and your family.

Until next week.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia