Honestly, if you’d pitched 2020 as a movie idea a year ago, you’d have been laughed out of the room.

‘Too far-fetched’, the movie moguls would tell you.

And yet the real-life drama that is the year 2020 rolls on…

We got the latest instalment late last week.

Just as traders and investors were winding down for the week, news came through that President Donald Trump had contracted COVID-19 and was off to hospital.

Markets reacted swiftly, sharply, and mostly down.

It’s to this backdrop we start the trading week today.

No doubt, it’ll be an interesting week…

As I said in last Monday’s update, US election years are usually volatile for markets. This one is no different. Maybe, just a few added twists.

But I’ll let others predict the manic market’s minute-by-minute moves.

Instead, I want to look at a hidden opportunity playing out in slow motion — so slow in fact, I think many people are missing it in the fast-paced noise of 2020.

Let me explain more…

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Time to beat the market

Before the late Trump drama, the talk of the town — the big end, at least — last week was news that Vanguard was pulling their product from the big super funds.

It appears to be the first step in strategy to sell their wares direct to investors themselves. This could be stiff competition for the low-cost industry funds.

As the AFR reported:

‘The world’s second biggest asset manager, Vanguard, is gearing up to disrupt Australia’s big superannuation funds by announcing it will return tens of billions of dollars it now invests on behalf of their members and instead compete for the money directly.

‘The $8.9 trillion investment manager, described as the “Amazon of financial services” for its disruption of Wall Street incumbents, will cease managing bespoke investments for Australia’s superannuation funds as it prepares for a disruptive second push into superannuation and seeks to manage retirement nest eggs directly with potentially lower fees.’

What happens next will be interesting…

Vanguard’s business model is pretty simple.

They pioneered ultra-low cost, index fund investing.

As index fund managers, they’re not trying to beat the market. They’re just trying to match it. Because of this simple method, they can afford to charge really low management fees.

And punters love it…

I remember when I was a financial advisor, selling the idea of an index fund to a client was the easiest thing in the world.

‘So, you’re telling me Ryan, I’ll save heaps on fees and probably get a better performance? Where do I sign…?!’

Even the world’s most famous stock picker has extolled the benefits of index investing.

Warren Buffett once said:

‘A low-cost index fund is the most sensible equity investment for the great majority of investors. By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals.’

Who can argue with that?

Well (ahem), today I’m going to.

You see, I believe there’s never been a more important time for investors to try and beat the index.

To go for ‘alpha’ as it’s known to market pros.

In fact, I’ll go further than that.

I think the surging popularity of index funds is actually creating the most exciting stock picking opportunities I’ve seen in decades.

Let me explain why…

Tomorrow’s blue chips

Index funds have had a very good innings over the past few decades.

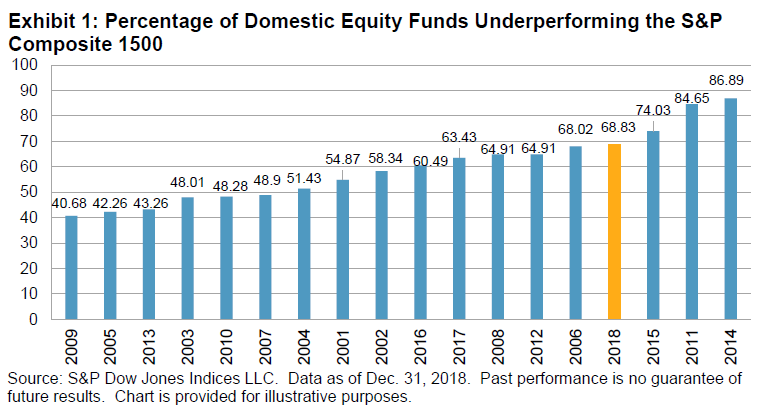

The fact is most active funds underperform the market, so index investing isn’t just cheaper, but often makes better returns too:

|

|

|

Source: CNBC |

But that’s at the fund manager level. I still think there’s a chance for ordinary investors — you and me — to beat the index.

You see, we can invest where bigger funds find it hard.

That’s the world of small-cap stocks.

And in a world that’s changing fast, I don’t think the index edge will be as good as it once was over the next decade.

I think in a wide array of sectors, tomorrow’s large companies will likely be today’s small challengers. Which means index funds will have to chop and change their holdings a lot more than they have in the past.

Tech will be at the heart of this movement. But technology by itself doesn’t offer protection.

As strange as it might sound, there are no guarantees that the Apples and Amazons of today will be the top dogs of tomorrow.

The history of the stock market is full of fallen giants. Think Kodak, GE, IBM, and Lehman Brothers, for example.

And here in Australia, how certain can you be that the Big Four banks — companies that dominate our index right now — will even around in 10 years?

If that sounds like hyperbole, check out the chart for Germany’s Deutsche Bank or even AMP here at home.

In fact, I’d say it’s almost a certainty that the big companies of tomorrow will be companies you mightn’t even have heard of yet!

Consider the well-known story of Afterpay.

It only got added to the ASX100 index back in mid-2019 when it was already a 10-bagger. And it isn’t in the ASX 20 yet despite banging on the door.

The point is an index fund investor would’ve missed the share price growth from $2.58 in 2015 to $80 today.

Now I’m certainly not saying finding such picks is easy.

But what I can say is that opportunities like that are out there and index funds are by their very nature the last to know about them.

Then there’s the fact that as index investing becomes more popular, it actually destroys the efficiency it’s built upon.

Think about it for a second…

As more investors shift from active to passive funds, there’s a decline in resources dedicated to determining what each security is worth, which could lead to greater and more common deviations from fair value.

In other words, in a world of index funds, the careful stock picker has more opportunity than ever!

There’s alpha in energy

My colleague and editor of the excellent Australian Small-Cap Investigator service, Ryan Clarkson-Ledward, wrote on Friday about the exciting lithium sector.

Energy is another part of the world going through some huge changes right now. 100 years of oil dominance is coming to an end.

Who might the next BP or Shell be?

Might it turn out to be some small-cap lithium miner?

I’d wager there are several small stocks in lithium, in battery technology, and in renewables that will find their way into index funds over the next few years or so.

Which means if you can find them now, they could be absolute game changers for your portfolio.

In a world of constant change, there will only be more opportunities like this.

Isn’t that search worth at least some part of your portfolio?

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.